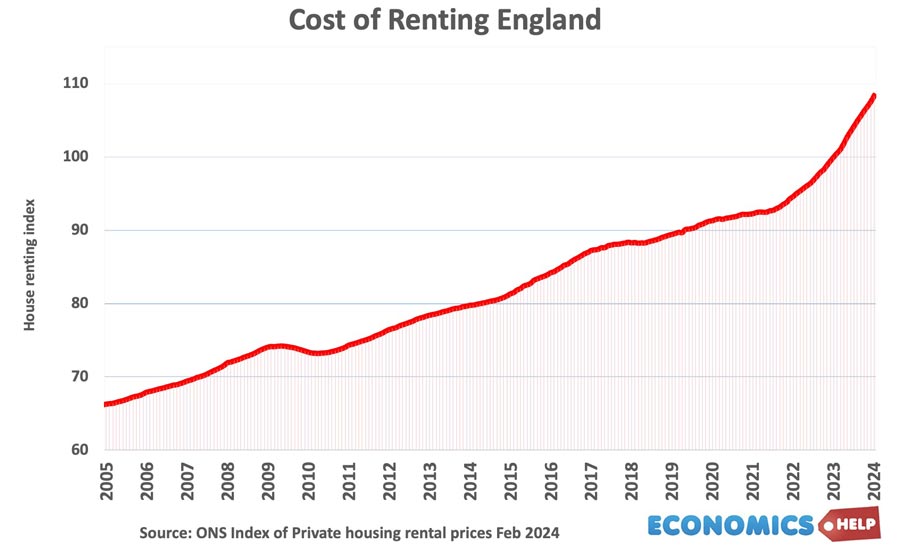

First time buyers have seen Mortgage payments as a share of income rise significantly in the past 2 years, increasing the cost of buying a house. However, the private rented market has been even more problematic. In the past four years, rents have risen 20%, pushing tenants to spend a higher share of income on renting. For those wondering whether to buy or rent, how does it compare financially?

The the cost of buying an average home is currently in the region of £265,000. If there is a deposit of £20,000, the mortgage would be £245,000. Assuming a fixed interest rate of 5%, the initial monthly payments would be £1,313, giving a total cost over 30 years of £473,377. Of which £245,000 is capital repayment and £228,477 is interest payments.

However, there are more upfront costs to include. This includes Solicitors, mortgage arrangement fees, survey and search costs. Buying white goods and furniture. Stamp duy is possible, though in this example, first time buyers wouldn’t pay. But, you’re still looking at possibly £6,000 upfront.

The other downside of owning a property is maintenance repairs, roof, guttering, boilers, decorating. It all adds up, this could be an average of £1-£2,000 a year forever. If we spend £1,500 a year for 30 years, that increases the cost by £45,000. Though don’t forget inflation will increase maintenance costs over time.

As a very rough rule of thumb, buying a £265,000 house is going to cost over half a million pounds over the next 30 years. But, the crucial thing is after 30 years, you are left only with insurance and maintenance costs.

By contrast, how does renting compare? The current average rent in England is £1,327 a month or £15,924 a year. It’s rather similar to the mortgage cost for an average home, except you don’t have the upfront costs of buying and ongoing maintenance costs. In the short-term at least, renting is marginally cheaper than buying. Though don’t forget Housing markets are highly regional. For example, currently buying is more expensive in London, but cheaper in the northeast and Scotland. This probably explains why house prices are rising more in these areas than the south-east

Of course, with renting you don’t have the uncertainty of interest rates changing. If interest rates fall to 4%, the monthly mortgage falls to £1,170 with a total 30 year cost of £421,080. On the other hand, if interest rates rose to 6%, the cost rises to £1,469 a month and the total mortgage cost rises to £528,804. However, this is definitely not the end of the story, there are two factors which tilt the balance heavily against renting in the long-term.

Rent Inflation

In the past 19 years, rents in England have risen by 65%, 3.4% a year. This is quite close to the average inflation rate. If we assume rents rise by 3.4% a year, it means in 10 years time, you will be paying £1,792 a month. In 20 years time, you will be paying £2,504 a month. The really scary thing is that in 50 years time, you would be paying £6,829 a month. Now, we hope earnings and pensions will also be rising by at least the rate of inflation. But, this is the difference after 30 years, mortgage payments end, but rent payments keep rising. After 50 years of paying monthly rent, which rises with inflation, you will have paid a total of £2,023,946.33, which is around £1.5 million more than the cost of buying. Of course, these figures rest on many assumptions which could change. Perhaps with a house you will end up spending £60,000 on an extension, £20,000 for solar panels. But, the longer you live, the bigger the total cost of renting.

How cost of renting depends on rate of rent inflation

This shows annual cost. For monthly rent/12.

| Year number | 1% | 3.40% | 5% |

| 1 | 15,924 | 15,924 | 15,924 |

| 2 | 16,083 | 16,465 | 16,720 |

| 3 | 16,244 | 17,025 | 17,556 |

| 4 | 16,407 | 17,604 | 18,434 |

| 5 | 16,571 | 18,203 | 19,356 |

| 6 | 16,736 | 18,822 | 20,324 |

| 7 | 16,904 | 19,461 | 21,340 |

| 8 | 17,073 | 20,123 | 22,407 |

| 9 | 17,243 | 20,807 | 23,527 |

| 10 | 17,416 | 21,515 | 24,703 |

| 11 | 17,590 | 22,246 | 25,939 |

| 12 | 17,766 | 23,003 | 27,235 |

| 13 | 17,944 | 23,785 | 28,597 |

| 14 | 18,123 | 24,593 | 30,027 |

| 15 | 18,304 | 25,430 | 31,528 |

| 16 | 18,487 | 26,294 | 33,105 |

| 17 | 18,672 | 27,188 | 34,760 |

| 18 | 18,859 | 28,113 | 36,498 |

| 19 | 19,047 | 29,068 | 38,323 |

| 20 | 19,238 | 30,057 | 40,239 |

| 21 | 19,430 | 31,079 | 42,251 |

| 22 | 19,625 | 32,135 | 44,364 |

| 23 | 19,821 | 33,228 | 46,582 |

| 24 | 20,019 | 34,358 | 48,911 |

| 25 | 20,219 | 35,526 | 51,356 |

| 26 | 20,421 | 36,734 | 53,924 |

| 27 | 20,626 | 37,983 | 56,621 |

| 28 | 20,832 | 39,274 | 59,452 |

| 29 | 21,040 | 40,609 | 62,424 |

| 30 | 21,251 | 41,990 | 65,545 |

| 31 | 21,463 | 43,418 | 68,823 |

| 32 | 21,678 | 44,894 | 72,264 |

| 33 | 21,895 | 46,420 | 75,877 |

| 34 | 22,114 | 47,999 | 79,671 |

| 35 | 22,335 | 49,631 | 83,654 |

| 36 | 22,558 | 51,318 | 87,837 |

| 37 | 22,784 | 53,063 | 92,229 |

| 38 | 23,011 | 54,867 | 96,840 |

| 39 | 23,242 | 56,733 | 101,682 |

| 40 | 23,474 | 58,662 | 106,766 |

| 41 | 23,709 | 60,656 | 112,105 |

| 42 | 23,946 | 62,718 | 117,710 |

| 43 | 24,185 | 64,851 | 123,596 |

| 44 | 24,427 | 67,056 | 129,775 |

| 45 | 24,671 | 69,336 | 136,264 |

| 46 | 24,918 | 71,693 | 143,077 |

| 47 | 25,167 | 74,131 | 150,231 |

| 48 | 25,419 | 76,651 | 157,743 |

| 49 | 25,673 | 79,257 | 165,630 |

| 50 | 25,930 | 81,952 | 173,911 |

| Total cost over 50 years | £1,026,512 | £2,023,946 | £3,333,657 |

Rent inflation of 3.4% is a reasonable assumption. Though in the past four years, rent has risen by an average of 5% a year. If rents were to rise by 5% a year, the total cost over 50 years is £3.3 million. If rents rose 5% a year, and you live another 60 years, the total cost rises to £5.6 million. That sounds silly, but that is the effect of compounded rate rises.

I would like to think rent growth of 3% a year is a better guide than 5%. But, in the short-term at least, there are reasons to be worried about the private rented sector.. The UK population is rising rapidly, buy to let landlords are selling, and the number of social housing has been squeeezed. Even if more houses were to be built, it’s not clear how many would end in private rented sector to limit rent rises.

In the short-term, buying a house is expensive, you need a big deposit, you have large mortgage payments and then you have extra buying costs. But, the mortgage amount is then fixed. When I bought a house in 2005, my monthly mortgage payments were £950, it was close to 40% of my monthly income. It was more than the £700 a month I was paying rent. On the pre-crisis day, I got a self-certification mortgage with help of a parental deposit. I had a lodger who paid £300 a month (some of the time). But it was too much so I switched to an interest-only mortgage for 4 years. However, the monthly cost of that first mortgage is now £450 a month. Interest rates were lower, and I started paying extra back.

Now, I was lucky in that in 2007, interest rates fell to 0.5% and this made a mortgage much cheaper. If it had been the late 1980s and interest rates rose to around 10%, it would have been a very different situation. Later we’ll look at whether there is a chance of high interest rates returning. But first, there are other considerations. Renting has various advantages.

It gives flexibility and freedom to move around Repairing a house is not your responsibility or cost. Buying and selling a house can be a tortuous process.

However, renting has also has many disadvantages. Your landlord might want to sell, and you have to leave. Repairing a house is not your responsibility, but it means, things may not be repaired properly and you are at the mercy of your landlord.

There is less sense of ownership and you can’t always make changes to property or garden.

Renting itself can be a tortuous process with intense competition faced in recent years.

Buying a house also has other advantages. Since 1980 nominal house prices have risen 1,100%, that’s an extra £242,000. A lot of this is due to inflation, but in real terms house prices have still risen nearly 100% since 1980. This is capital gains, you don’t get when you rent. When you are 80, you could sell to fund a retirement home. Given house price to incomes are really stretched and many are on the edge of affordability, there may be a limit to how much real house prices increase in the future. But, if the past is any guide, there will be considerable increase in nominal prices in the coming decades. That’s another benefit of buying.

Interest Rates to Rise

The thing that can really hurt the decision to buy a house would be an unexpectedly large increase in interest rates. If we go back to our example, if interest rates were to increase to 8%, monthly repayments would rise to £1,798 and the total cost £647,180. But, at least for the foreseeable future, interest rates are likely to go down rather than up. A very rough consensus is for interest rates to settle around 4%. But don’t forget the long-run trend has been for falling interest rates. If you look at a country like Japan, with its advanced demographics, interest rates have been very low. Though Japan is one of the few countries, which has seen a sustained fall in house prices from the bubble years of the late 1980s.

Another thing about mortgage costs is that you aren’t necessarily tied to waiting 30 years to pay off the mortgage. When I got a mortgage in 2005, I took out the longest possible term 43 years, and for the first few years only paid interest only mortgage. But, in recent years, I have been trying to overpay the mortgage. Rather than invest in pension or savings, I use any savings to repay my mortgage. This significantly reduces the overall cost and I plan to pay it off several years early to save considerably on interest payments. This reflects the really important thing about buying a house. The first few years are really hard, you have all the expenses of setting up a home, and mortgage payments can be a big share of income. But, assuming constant interest rates, mortgage payments as a share of income should start to fall.

Related

My thoughts are…

The decision to buy a house would be an unexpectedly large increase in interest rates. If we go back to our example, if interest rates were to increase to 8%, monthly repayments would rise to £1,798 and the total cost £647,180. But, at least for the foreseeable future, interest rates are likely to go down rather than up.