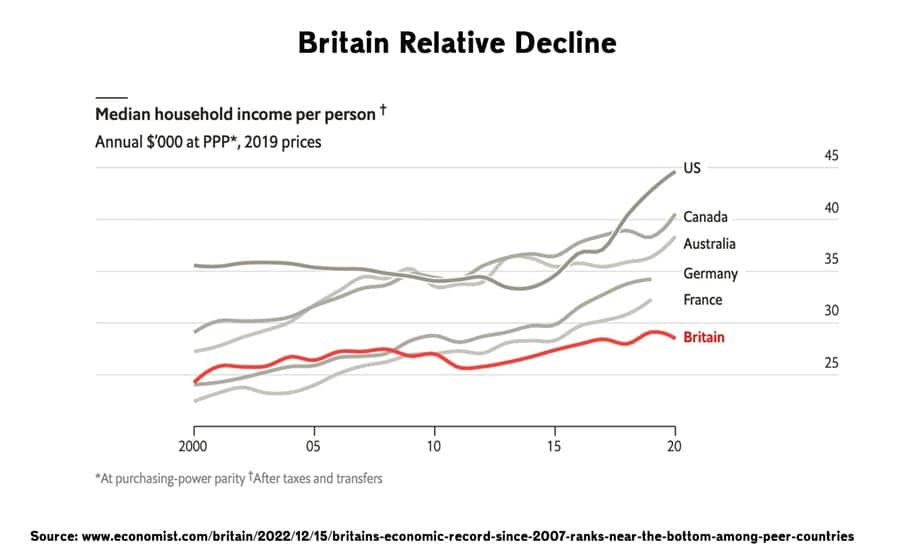

The UK economy has undergone a real battering in the past 15 years. For decades, the UK grew around 2% a year, but per capita incomes are now barely increasing.

It’s not just about a global downturn, the UK has fallen further behind similar economies like France and Germany on key metrics like income and wage growth. Productivity growth has been very low. Therefore it becomes easy to paint a picture of an economy in decline, a country in retreat. However amidst all the gloom and pessimism, there are seven reasons to hope things could get better.

- Catch up potential

Firstly, if the UK could catch up lost ground with similar economies like Australia, France and Germany, it could mean an extra £8,000 income per household. An extra £100bn in tax revenue. If the UK could regain that past relative performance, it would be transformative and the economy would look very different. The UK managed productivity growth of 2% in the post-war period, but since 2007, there has been a big loss in potential output. The problem is that this very low growth has caused something of a downward spiral, low growth is one of the factors making firms reluctant to invest. But, the good thing is, this means that in theory, the UK has catch up potential.

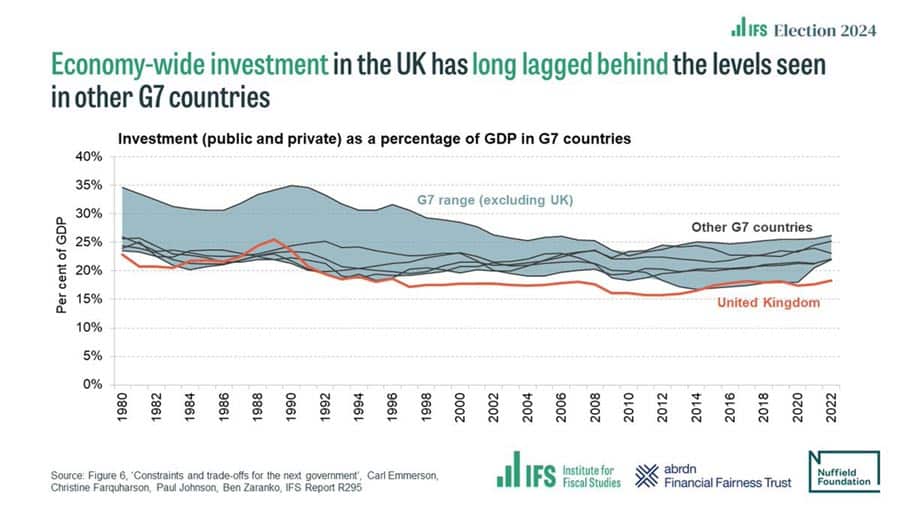

A good example is that in the post-financial crisis, the UK had the lowest business investment in the G7. The UK has seen one of the poorest growth in capital intensity. In fact,a lot of UK growth has been based on people working longer hours. It has led the UK to have a very poor take up of automation – robot intensity lags major economies – well below the global average However, this means if robot intensity increases, there are productivity gains to be made. 2023, saw strong growth as firms start to catch up.

- The UK is good at some things

If we watch news or youtube videos, it’s easy to be overwhelmed by negative stories. The UK steel industry is closing down, the car industry is in retreat. We have the most expensive electricity. But, what you might not hear about so much is that the UK is actually quite good at some industries. In 2022, the UK TV and film industry received over £5.4 billion in inward in investment. The TV/film industry is projected to rise to £8bn by 2026. Other strong exports include pharmaceuticals, financial services, video games, education and scientific instruments.

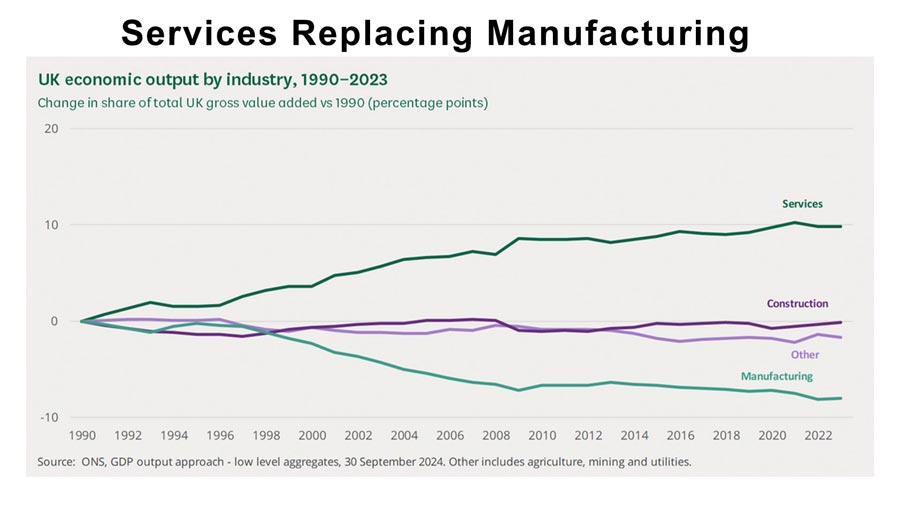

UK manufacturing has been in relative decline since 1900, but the decline in manufacturing is being offset by a rise in service sector indutries. The UK is never going to be able to compete with China in making goods. But exports from the service sector don’t have to be inferior to the manufacturing sector. The secret of the modern economy is to specialise what you are good at, not what you think you should do. In 2023, the UK rejected a proposal to build a film studio in Marlow Buckinghamshire because of NIMBY pressure. But the UK gets more revenue from media exports than it does steel and coal.

- Planning Reform will help growth

The economist asked a group of economists who specialise in growth, what policy would make the biggest improvement to economic growth. The overwhelming winner was planning reform to make it easier to build things where they are needed. In the past 40 years, the UK has fallen behind. There has been a decline in built up areas per capita. If you want to increase growth, planning reform is likely to make a big difference. It may not be popular, the people of Marlow didn’t want a film studio in their backyard, but it does increase GDP. The French economy has innumerable problems – high debt, bloated public sector, excessive regulation, and perennial strikes. But, despite all these things which are supposed to hobble an economy, it is good at building things. This kind of compensates for other problems. Real planning reform could help the UK economy.

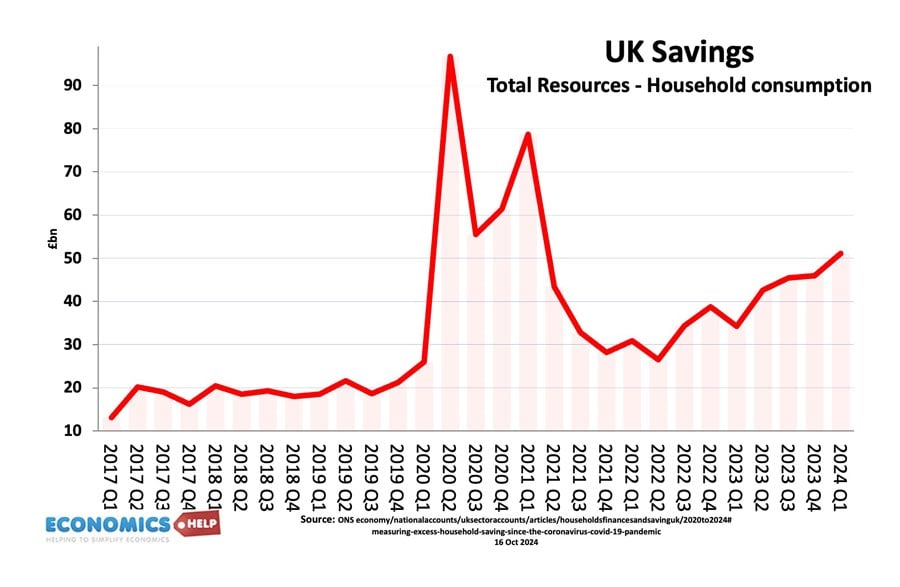

- Household savings have risen

Traditionally the UK has been a low saving economy. Borrow more, run down savings and spend. But, since the pandemic, this habit has been reversed, with consumers saving much more. This may partially reflect an ageing population, people saving for retirement, but that doesn’t explain such a rapid growth in savings. What it means is that if confidence returns, many households have the capacity to spend more, leading to higher economic growth and that virtuous circle of rising investment. With inflation falling to 1.7%, there is increasing room to cut interest rates, this should increase consumer spending, which in turn could increase investment.

- Don’t believe everything you see

I learnt pretty early on in my Youtube career, that negative titles tend to do about 10 times better than ordinary titles. But, this does create a financial incentive for all types of media to concentrate on the negative story. Now, in the case of the UK you don’t need to do much spinning to provide negative facts. But, at the same time, it is important to be aware of that fact that although many things are bad, the dismal prospects can be over-estimated. We hear of job closures, but not new job openings. In fact UK unemployment is near all time low.

- External shocks were hard

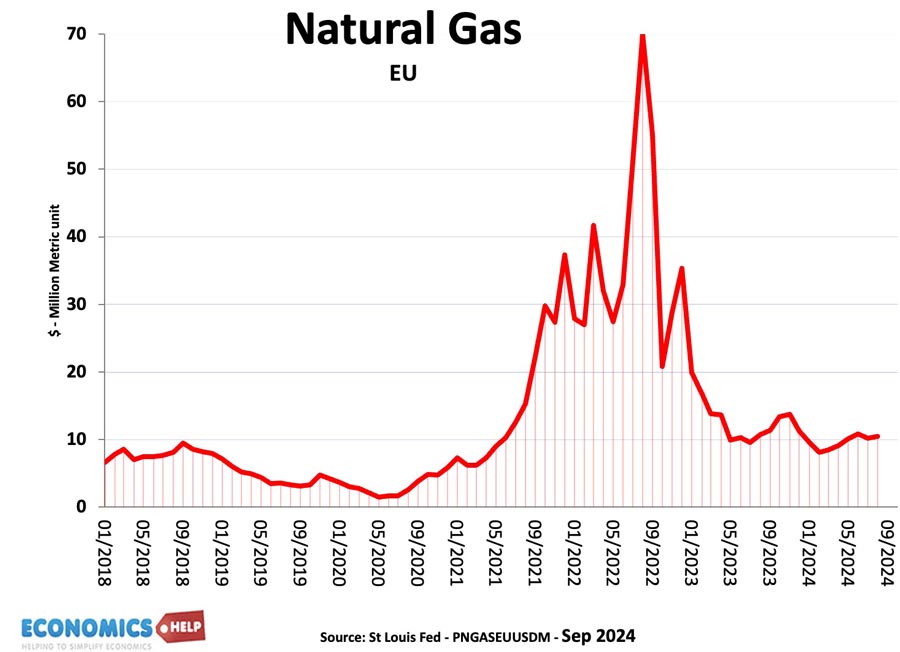

The Covid lockdown combined with the rise in oil and gas prices in 2022, really hit the UK economy hard because we are so reliant on gas for electricity. It caused the UK to have the highest electricity price in Europe. And it was this cost-push inflation which really killed living standards and economic growth, It caused higher prices and lower output, and this scarred consumers. If we don’t get any more shocks like this, it will help the economy. Becoming less reliant on gas would help in the long term.

- Less Self-inflicted Crisis

The UK has also had a few self-inflicted crises in recent decades. Austerity in the 2010s, leaving the EU in 2021, and Truss’s mini-budget of 2023. Brexit was a big shock to UK’s trade with Europe and the uncertainty definitely held back investment. Although tariff barriers and lack of competition will remain, at least the uncertainty of Brexit is over. The Truss mini-budget was relatively minor in terms of long-term damage, but it did highlight a frequent flip-flopping of policy and tax, which created uncertainty for business. This might be different in the future.

So these are reasons for optimism. But, how convincing are these arguments? A lot of these points rest on the assumption that since things were so bad in the past, they will be better in the future, but that is not very concrete more wishful thinking.

When an economy gets stuck in a downward spiral, sometimes it can bounce back. But other times the negative spiral can feed on itself. There’s no law economies need to keep growing. Venezuela lost 90% of its GDP over 20 years. The optimistic scenario also rests on the assumption we won’t get more major external shocks and we will get a good competent government. But, again, that is very hopeful and could easily be dashed. Also, this optimistic approach ignores many long-term problems such as short-termism, demographic changes, falling birth rates and an ageing population.

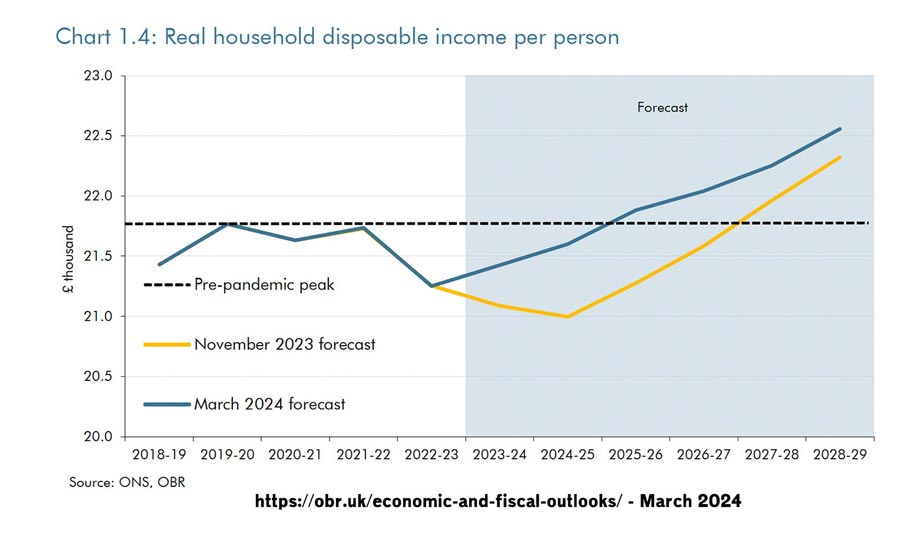

Real household incomes are still forecast to grow only slowly.

External sources