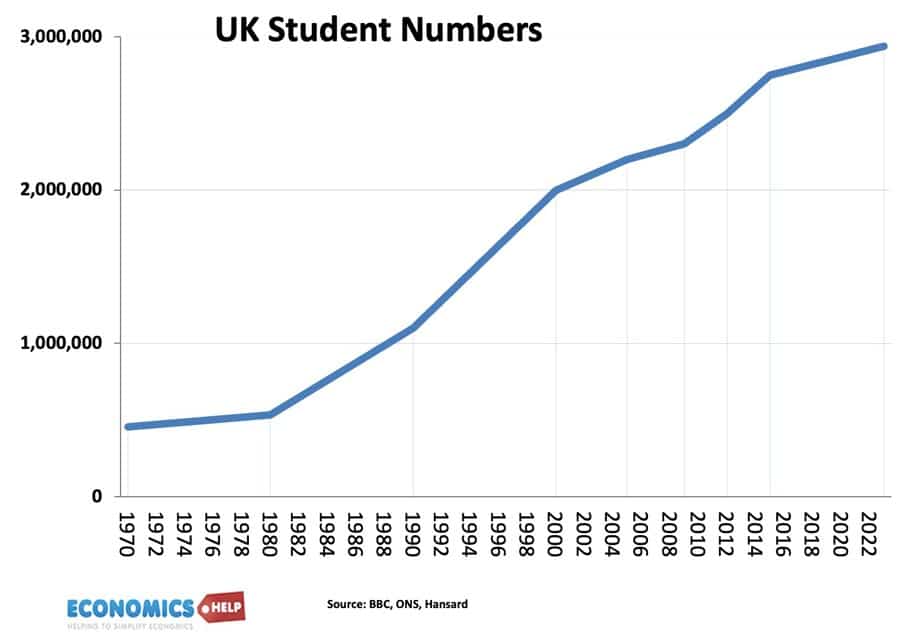

In 1999, Tony Blair made a pledge that 50% of young adults would go into higher education by the next century. And this is one government promise that has actually been achieved, Student numbers have risen, UCAS applications almost doubled.

Students are told a degree is a passport to success, higher salary and cultural enrichment. But in an era of rising student debt and falling graduate wage premiums, does going to university make financial sense anymore?

Firstly, with tuition fees rising, it’s going to get more expensive. 3 years of tuition could easily set you back £28,500 and then an average £18,000 on rent. It’s no surprise that the average student loan debt in England is £45,000 and with the rise in rent costs and tuition fees, this is only going to get worse. Not only that, but recent changes to the student loan system mean more graduates will have to start paying back early. The IFS calculate in the old system just 49% ever paid back. In the future, it will be 79%. Good for government finances, but graduates face an additional marginal tax rate of 9% on income over £25,000. Even a modest starting salary of £30,000,will attract marginal tax rates of 37%.

Income Premium

But, we are told this debt and cost is all worth it because graduates will earn more over their lifetime. In 2020, the IFS calculated that over a lifetime male graduates will be around £130,000 better off. For women, this is £100,000. However, there are two things. Firstly, the IFS also state around 20% of students would be better off financially if they had not gone to university. The average figures are also skewed by 10% of graduates who massively benefit – around half a million extra earnings. The second caveat is that since 2020, there are signs that the graduate premium is declining. The ONS state that the real median wage premium of a graduate in 2023 was just £6,500 a decrease of £1,500 from 2022. This decline is supported by research which shows the graduate premium is starting to decline since previous birth cohorts. For women the graduate premium has fallen from 48% for 1969-74 birth cohort to 15% for 1989-94 birth cohort. The decline in male graduate premium from 29% to 18% is less pronounced but still visible.

What difference does a degree make?

Also, when looking at the graduate premium it is important to take into account factors which would affect salary apart from degree, such as socio-economic status and parental wealth. For those born in 1970, the true graduate premium at 26 years old was 19%, but this has dropped to 8% for the 1990 cohort.

An interesting comparison is the average graduate wage compared to national minimum wage. In 1999, the average starting salary of a graduate was almost double that of a minimum wage job. In 2023, the graduate premium is only 30% higher. A major factor is the significant increase in the national minimum wage, which has been a boon to low-paid sectors. For example, whilst median wages have stagnated since 2010, bar workers have seen a 65% increase in real wages since 1998. From April 2025, a mininum wage job of 40 hours a week would give a salary of £488 a week or £25,396. It’s a wage which ironically will now trigger student loan repayments. But, whilst low paid jobs have seen a real increase, there has been a stagnation in salaries amongst more traditional graduate jobs.

By the way this is not to criticise the national minimum wage, it has been one of the most successful economic policies of the past 20 years. If you took away the minimum wage it wouldn’t mean more real wage growth for graduates.

The number of students has nearly doubled since 1994. 400,000 to 758,000 in 2023. But whilst student numbers rise there is an increasing problem of under-employment of graduates. 21% who graduated before 1992 were over-educated but those who graduated after 2007, it rises to a third. With 33% of graduates working in non-graduate roles

Variations in Degree Premium

But, going back to the graduate premium, it is worth bearing in mind there is a large variation depending on degree, university and location. Stem Subjects see a wage premium of 60%. These are the best-performing degrees in terms of high salary, computing, law, business and management, maths and economics. But, for non-stem and non-law finance degrees, the nominal wage premium is just 20%. London still remains the top location for graduates, with a regional premium of 40%. But in the north and midlands, the wage premium has fallen by up to 20%. And here graduates are more than twice as likely to be under-employed. Basically for non-Russell-Group, non-stem students from poorer regions, going to university might be an expensive mistake.

And, don’t forget these nominal wage premiums ignore the cost of repaying student loans and other factors which explain wage differential.

Alternatives to degree

Whilst the UK has been successful in encouraging students to go to university, there has been a long tradition of undervaluing vocational skill training, which has left the UK with labour shortages in areas like bricklayers, builders, plumbers, and electricians. We want to build 1.5 million houses, but don’t have the workers. Yet, these skilled trades give the prospect of very good salaries. I was really interested that Paul Johnson, the outgoing head of the IFS reported that his 24-year-old son was in a position to bjuy a house in London, – not due to a loan from his parents, but because he didn’t go to university but got an apprenticeship aged 18. These years of work enabled him to build up savings, gain work experience and not be saddled with debt.

Leave at 18?

A really interesting question is which is better leave school at 18 and start working straight away or go to university. If I was an 18 year-old and my only goal was financial security, I would be tempted to train as a plumber or a roofer. Live with my parents for a few yeasr, save for a deposit and after an apprenticeship set up my own self-employment business. If you earn £1,800 a month, and have subsidised rent with parents, if you were frugal, you could easily save £800 a month. Aged 21, when your friends left university with £50,000 debt, you could have £30,000 in savings. But, any kind of skilled tradesperson gives scope for much better than minimum wage jobs. In Oxford, I have been quoted £90 an hour for a plumber, £60 for an electrician. But, if I wanted to get a good income, I would set up as a gutter repair man. Over the past 3 years, I’ve spent £2,000 to tradesman who did terrible jobs and ripped me off. In the New Year, I will pay £1,500 to a company which looks reputable. He said for 2 people, it would be less than a days work. Take off tax and costs, and you’re still looking at the £500 a day. Do a 4-day week and in theory £8,000 a month. They are booked 3 months in advance, suggesting a real shortage. Oxford is high living costs and other regions, will definitely be cheaper, but even my parents in Yorkshire find great difficulty in employing tradespeople to do jobs. There’s no shortage of work, and as a result, it’s pushing up wages. In an era of job insecurity, the one realy growth area of jobs is in installation, servicing. Think heat pump installer, solar panel installer, plumber. I don’t think AI will be able to unblock your toilet just yet. I recently published a video about Gen Z and difficult work prospects, I was interested in this comment about a student who gave up university and trained to be a car-mechanic. You might not get $100,000 a year in the UK, but the average hourly rate of £39 an hour is quite good.

Non-monetary benefits of a degree

Now, the other side of the coin, is that there are many factors other than monetary benefits. I actually really enjoyed studying economics and I’ve had an enjoyable career writing economic books, making youtube videos. By the way for writing a book on economics, I got paid £5,000 flat no commission. But, when you consider the time taken to write it, it’s only a bit above the minimum wage. Publishers know there are plenty of economics graduates who would jump at the chance to write a book. a low pay. At least I got a job before the generation when they will get AI to write it for free. Would I really prefer being a roofer to an economist? Probably not, even if a roofer got paid more. I don’t like the cold for a start. So young people have to weigh up many considerations. But, it is really important to know that academic achievement and a degree is not a silver bullet to success. If you are not enthused by the idea of studying for three years, be very careful of choosing a low-value degree which could leave you with high debt, higher marginal tax and not necessarily the super-well paying job you might have hoped for. Some schools are like gravy trains for university. Getting people into university helps their rankings and prestige, but not all students are served by going to university, especially now it is so expensive.

Related