London can be a great place to live, with a strong economy, a wealth of high-paying jobs, and a rich legacy of art, sport and culture. It’s become a melting pot of world cultures and is the top European city for tourist visits. Symbols of London are instantly recognisable. Yet, at the same time, its economic success and wealth has come at a high cost both to the rest of the UK economy and quite often, to Londoners themselves. London has become a victim of its own success with an influx of wealth and people driving up property prices to make buying or renting a nightmare for ordinary workers.

In the early 1980s, London’s economy was still in a different era. The former docklands, which closed in 1969, sat empty and desolate. Fleet Street unions were still influential in the printing of newspapers and house prices were still affordable for working families. But, the 1980s saw a revolution in the structure of the UK economy, The finance sector was deregulated and billions of pounds flooded into the City, including a redevelopment of Canary Wharf as a mecca to modern finance. Financial regulation, which had provided stability in the post-war period. were swept away as London was pushed to the forefront of developing complex new financial instruments and importantly not asking questions where the money came from. Financial services in London boomed, drawing in more professional and graduate jobs than ever before. Yet, whilst London attracted investment, jobs and growth, the impact on the rest of the UK economy was muted. Manufacturing as a share of GDP fell, leading to high unemployment in regions outside London. A scarring that has taken decades to overcome.

This brave new world of financial services has been great for London, but it remains primarily a London phenomenon. Whilst London is a mecca for growth, secondary cities and towns have struggled to provide an effective alternative. The result is that the UK has seen a rapid growth in regional inequality. Gross value added in London dwarfs that in other regions. The few areas to prosper have been those in geographical proximity, the southeast and the Oxford – Cambridge corridor. The impact is that the UK is geographically unequal and this disparity is holding back the economy.

A recent report by Centre for Cities shows that average wages in London are nearly £20,000 higher than in towns like Burnley, Huddersfield and Bradford. The problem is that if you exclude London, the UK is a relatively depressed economy. It is poorer than Mississippi the poorest US state.

Poverty in the Richest City

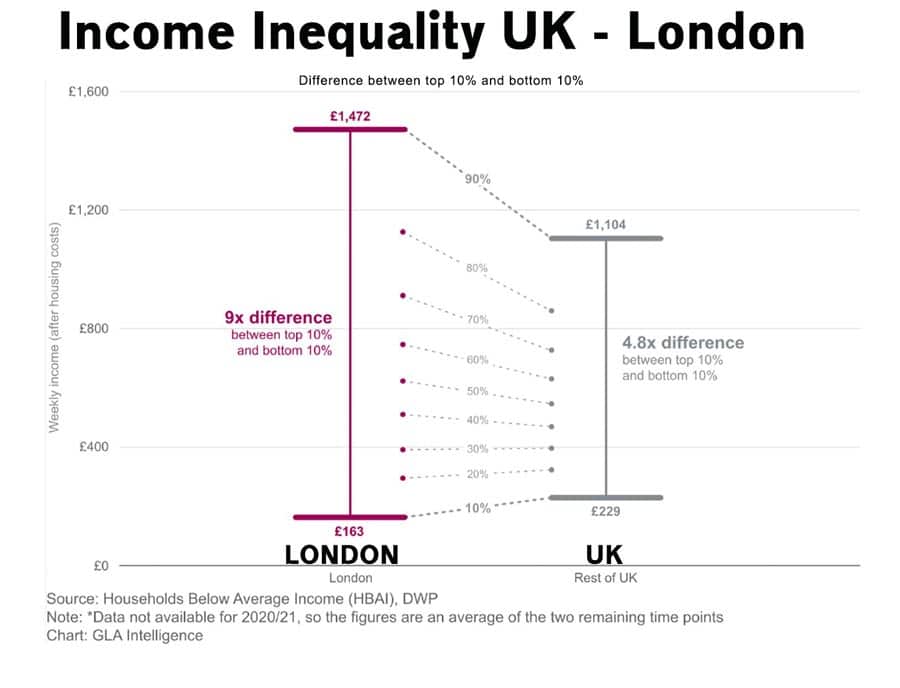

But, whilst London is undoubtedly wealthy, it doesn’t mean all Londoners have benefited from this rise in wealth. The high average London wages are skewed by professionals who are doing very well. But on the other side of the scale, many Londoners are still surviving on low-wage jobs and government benefits that have fallen in relative terms. The remarkable thing about London is that there is a greater range of income inequality than elsewhere. The highest paid do much better, but the poorest 10% get less than the UK average. The incomes of the top 10% in London are 9* higher than the bottom 10%. Material poverty of pensioners is worse in London, especially inner London than in many other parts of the country.

Housing Crisis

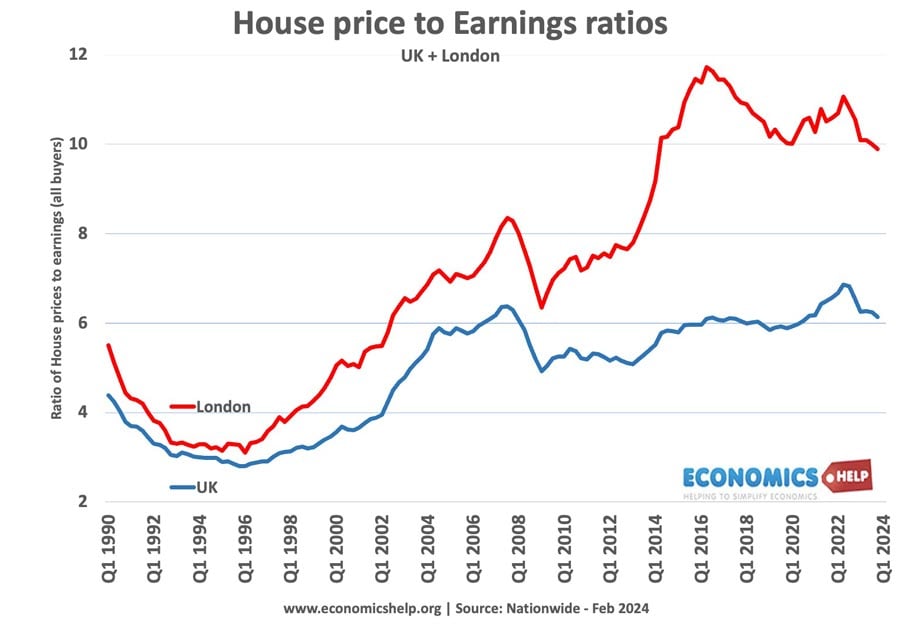

One of the dark shadows over London’s economic boom is the impact on the housing market. Rents and house prices have soared. Since the 1980s, the ratio of house price to incomes in London has increased to a record-breaking 14 times income – whole neighbourhoods have changed as families who have lived in local areas for generations have been forced out. The waiting list for council properties is near record levels.

Even those on good salaries, cannot afford to buy but are forced into a rental sector, which cannot keep up. London rents have soared to over £2,000 a month, with even one bedroom rents going for over £1,000. In London, the average rent for a one-bedroom dwelling is 45% of gross pay, compared to an average of 25% in the UK. The result is intense wealth inequality between those who saw soaring assets and those who are left out in the cold. Homelessness rates in London have increased, with nearly 3 times as many sleeping rough as in 2008.

The soaring London property market has attracted international investors. Buying up property in London has been a great way for foreign millionaires to diversify their portfolios. In 2023, Hamptons reported that 45% of Prime London property was bought by an international buyer. 23% in Greater London. Locals have been squeezed out. The tragedy is that recent exclusive property developments on the Thames Bank often sit vacant because they have been viewed more as investments than places to live. 1 in 3 properties in the city of London are kept vacant. In Tower Hamlets, it is 1 in 16. Since 1991, the population of London has increased by over 2 million but the amount of new buildings has failed to keep up. The impact on prices is inevitable. The bulk of the increase in the London population is caused by people born overseas. Immigrants have been attracted to London because of the booming job market, but the supply of housing has failed to keep up.

When a large share of the economy is so reliant on one city, housing costs can affect economic growth. Firms want to expand operations in London, but there is a real problem of struggling to recruit workers. This constrains growth and creates inflationary pressures. For all the wealth and success of London and the success of finance, the UK as a whole has witnessed its lowest growth in the post-war period. Since, the financial crash of 2008, the economy has never really recovered. True there are many reasons, but an over-reliance on London services didn’t help. It has crowded out over areas of the economy. Even today the Labour government is courting new financial deregulation as a shortcut to growth.

Dark Money

The London investment boom has relied heavily on foreign money. And in recent decades, London has actively courted foreign investment, no questions asked. London has been a dream for dark money and money launderers. In 2022, Transparency International estimated £6.7bn of UK property has been bought with dirty money. London is the main target. A quarter of this had links to Russians accused of corruption of links to the Kremlin. The influence of Russian money has been so strong it earned London the nickname of Londongrad. London was the ideal location for three reasons. Strong legal protection for assets and property, but very light regulation about where the money came from. Secondly, the global network of using off-share Crown dependencies like the Cayman Islands. Thirdly, Tier one visas gave a three-year visa for anyone who invested a million pounds. Even successive legislation to prevent dark money failed through the difficulties of enforcement, limited resources and often just a lack of political will. As an added bonus UK Libel law is 140 times more expensive than the European average, enabling oligarchs to hide from criticism behind prestigious law firms. The strong ties between wealthy foreigners and the British establishment are exemplified by Boris Johnson making Evgeny Lebedev a member of the House of Lords with the absurd title of Baron Lebedev, of Hampton in the London Borough of Richmond upon Thames and of Siberia in the Russian Federation.

It’s not just Russia – the gulf states, America and Europeans have all been buying up London property. Remember when the UK had a north sea oil bonanza and used it to cut taxes for high earners? Norway had the same north sea bonanza but built up a soverign wealth fund, which they used to buy up London property.

Success of London

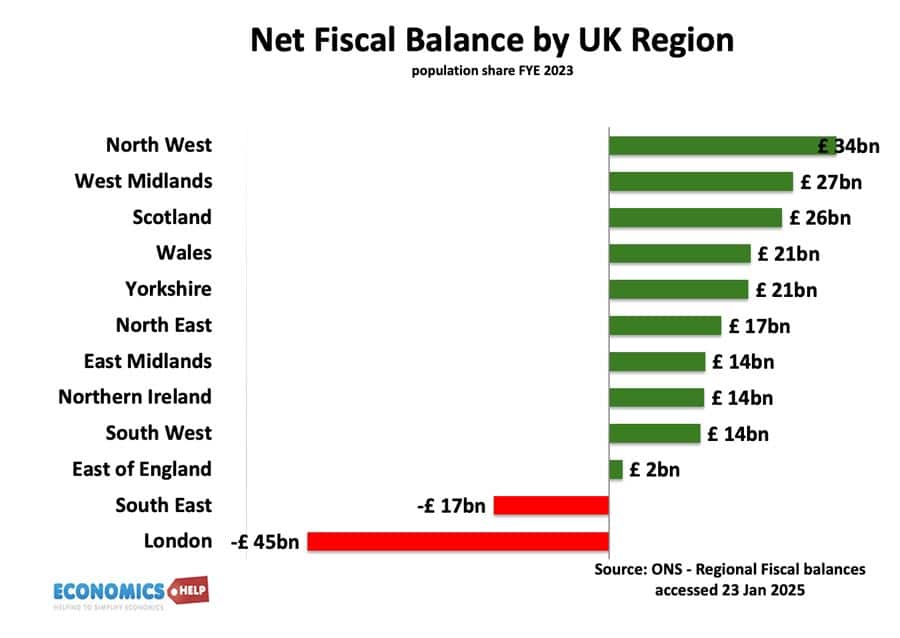

The success of London definitely does have benefits for the UK economy. London is responsible for a significant share of income tax revenue, economic growth and job creation, without London’s high salaries, treasury revenues would be depleted and the government’s fiscal position much worse. In many ways, London is subsidising the rest of the country through net fiscal transfers which help fund benefits and health care in the left-behind regions. In 2023, London made net fiscal transfers of £45bn. The solution is not to make London poorer but for want of a better term level up the left-behind regions. However, this can be difficult when London is such a magnet for investment. Crossrail cost £18.8 bn and has been a huge success for London. It will further help the London economy, but when it comes to public transport, investment outside London is more like a barren desert. London still attracts the bulk of transport spending with per capita spending over 400% more than northern regions. A cross rail for the north is talked about but is put on hold. Leeds a major city has been waiting for a tram system since the 1960s. The big effort to rebalance the country was through HS2. Symbolically it has been axed at Birmingham, there will be no connection to the north. HS2 is in effect a glorified commuting scheme for people to live in Birmingham and work in London. Over 1 million workers have to commute into London every day, spending money and time.

Graduate Jobs

50% of all graduate jobs are in London, and average graduate wages are significantly higher. The IFS reports that Outside London 43% of graduates are in a job that does not require a degree. Outside London, graduates can’t capitalise on a degree. Go to London, and you will have to pay a fortune in rent. The UK can’t break the mould of London being the dominant city. In recent decades, the US has seen a similar transition to a service sector, IT economy, but it isn’t reliant on one city like New York. If you don’t want to pay New York housing there are innumerable other cities which can offer similar opportunities. The UK doesn’t have that. Its second cities just can’t keep up. The UK is the only western G7 country where jobs have become more concentrated in the dominant region. And this dominance has led to a brain drain of the best young skilled workers ending up in or near London.

Also, the success of London finance is a mixed blessing for the rest of the world. Money flows into London kept the pound stronger than otherwise, making other exports less competitive. A kind of Dutch disease but for finance. Also, London’s finance has been subject to volatility. In the run-up to the credit crisis, the finance sector boomed, so did the UK economy. But, when the global credit crisis hit, UK tax revenues evaporated and the economy was hit harder than other comparable countries. The Pound fell 30% after the credit crunch and the UK’s poor productivity performance is at least partly related to the imbalance in the economy.

Efforts to relocate

There have been efforts to rebalance the economy away from London. The government have moved some civil servants and tax offices to Wales, Yorkshire and Scotland. The BBC periodically sends programmes out to regions. But, for young, mobile people, London’s booming economy and vibrant social life make it a strong pull, which even the delights of Swansea may struggle to compete with. If you can’t make it in London, is it time to leave the UK and live elswhere, is the grass really greener on the other side? This video looks at pros and cons.

Sources:

- data.london.gov.uk/dataset/state-of-london

- trustforlondon.org.uk/research/nobodys-home-how-wealth-investment-locks-londoners-out-of-housing/

- transparency.org.uk/news/stats-reveal-extent-suspect-wealth-uk-property-and-britains-role-global-money-laundering-hub

- theguardian.com/money/2020/dec/21/luxury-london-homes-still-used-to-launder-illicit-funds-says-report

- theguardian.com/business/2023/jul/21/mps-must-close-loophole-to-drive-out-dirty-money-from-uk-property

- tandfonline.com/doi/full/10.1080/09654313.2023.2221283#d1e314

- ifs.org.uk/news/increasing-concentration-high-skilled-jobs-london-means-graduates-elsewhere-cannot-fully