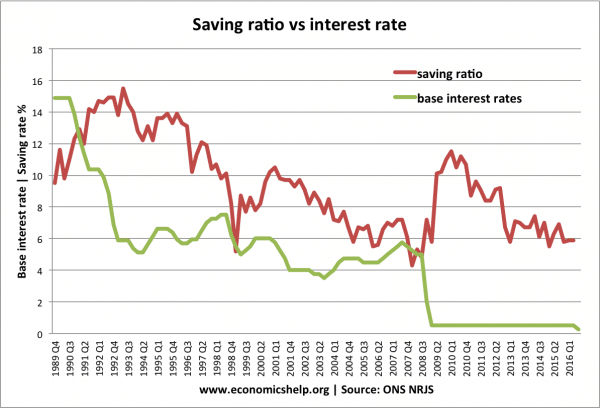

Is there any relationship between the base interest rate and the savings ratio?

In theory, the interest rate can affect the decision to save in two ways.

- Substitution effect of change in interest rate – lower interest rates reduce the incentive to save because of relatively poorer returns – lower interest payments. When interest rates are low, there is a bigger incentive to spend rather than keep saving.

- Income effect of a change in interest rates – lower interest rates reduce the income received from saving, and so people may need to save more in order to gain a reasonable return on your savings. This is important for people thinking of retirement.

You would expect the substitution effect to outweigh the income effect, with higher interest rates encouraging people to save, and lower interest rates reducing this incentive.

But, in practice, this link can be very weak.

Why is the actual link between interest rates and saving ratios so weak?

When making decisions about saving, the interest rate is a relatively low priority.

- Life cycle. For most people, decisions about saving depend on their individual circumstances. A young student will typically have student loans and very limited capacity to save. Someone in their 50s will be seeking to increase savings and improve their pension. The interest rate does little to alter the fundamental individual plan. Someone nearing retirement is not going to increase consumer spending, just because interest rates are very low.

- Expectations. One of the biggest determinants of saving ratios is expectations about the future. The sharp rises in the saving ratios occur during the onset of a recession – in 1991 and in 2009. The saving ratio falls during a period of sustained economic growth, such as 1992-2007. It will be interesting to see what happens to the saving ratio post-June 2016, but given the uncertainty, you would expect a rise in the saving ratio

- Alternatives. Many people with large savings don’t have many alternatives to saving. Even if interest rates are low, they may not want to spend all their disposable income.

Related

So, eventually interest rate and savings have direct relationship