The ‘pension time bomb’ refers to how demographic changes will cause a rise in the percentage of people entitled to a pension (both state and private). An ageing population leads to smaller workforce, more spending on pensions (and healthcare) and could require higher taxes to meet spending commitments. . Some argue this is a serious issue, others argue economic growth and sound policies can avoid any fiscal cliff.

In many developed countries, demographic changes are putting increased pressure on the provision of state pensions (and related benefits). Most countries have a fixed state retirement age, but, life expectancy is increasing, and birth rates declining. Thus we have a rising dependency ratio with a higher % of the population in retirement age in relation to the workforce.

In the UK 25% of boys born today can expect to live until they are 100. The average life expectancy of men is 77.4 years, women 81.7. By 2050, there will be an estimated three people 90+ for every birth in the UK.

The latest estimates suggest that by 2056, the life expectancy for a man will be 84 and 89 for women.

If nothing else, the Queen (or King if she ever retires) will have plenty of telegrams to send to all those centurions.

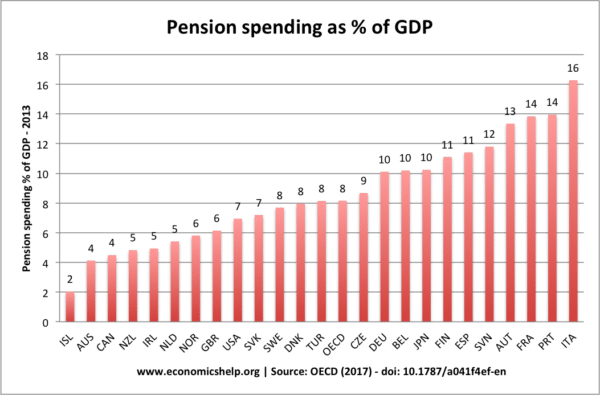

At a CEPR/Royal Economic Society discussion, Richard Disney compared the current costs of public pension programmes with the projected costs for the year 2030. The following figures state public pension payments in 1995 as a percentage of GDP, the figures in parentheses are the OECD’s projected costs for 2030:

- Japan 4.1% (13.4%),

- Germany 11.1% (16.5%),

- France 10.6% (13.5%),

- Italy 13.3% (20.3%),

- UK 4.5% (5.5%). – CEPR

This report was published in 2000. It does show the UK has a comparatively light pension time bomb compared to countries like Japan and Italy. The UK is less effected because we still have a growing population (partly due to net migration) unlike Italy and Japan which have a shrinking population

The government are proposing

- Raising retirement age to 66 by 2016 and upto 70 years in the future.

- Raising the retirement age would help to restore link between pensions and earnings. This would mean state pensions rise in line with earnings rather than just inflation. This would help pension be more meaningful.

- Commitment to auto-enrollment in state pensions.

With an ageing population, the alternative to raising retirement age, is to devote an increasing proportion of National Income to paying pensions. Given structural budget deficit, this would require either a higher tax burden (higher VAT / income tax) or real cuts in spending on public services or other welfare benefits.

Raising the retirement age could potentially increase the labour supply and increase the productivity of the economy. On the one hand, older workers often find it hard to gain employment, but, on the other hand they are often highly skilled, experienced and reliable. Given changing nature of workforce, firms may need a cultural change to be more willing to recruit older workers.

As I argue in Raise Retirement Age, raising retirement age is one of best ways to tackle budget deficit without hampering economic activity.

Raising retirement age is not without problems.

- You could argue it increases inequality.

- Those with low paid jobs / without private pension, will need to work for longer, without any guarantee of employment.

- There is a disparity in life expectancy depending on income group.

- Disparity between manual work and non-manual work. It is easier to stay in employment for non-physically demanding work in the service sector. For those in manual labour working later into life is much more taxing. Although the economy is more service based, there is still substantial labour.

The Pension Time Bomb gives society a difficult choice. – Choices that aren’t likely to be popular. But, if pension ages were set when life expectancy was much lower, it makes sense to re-evaluate whether we can justify devoting an ever increasing proportion of national income to financing retirement for over 30 years. (Interestingly the first non-contributory state pension introduced in 1908 had a minimum wage of 70)

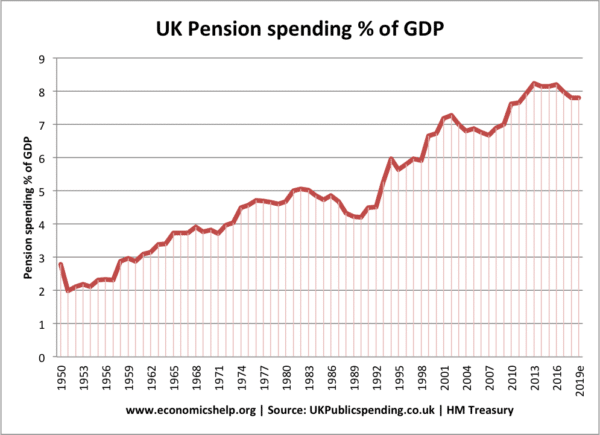

How UK spending on pensions has increased

Related

2 thoughts on “Pension Time Bomb”

Comments are closed.