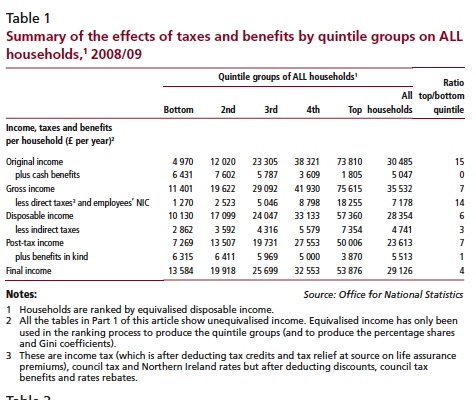

There is often much discussion about the impact of tax and benefits on the distribution of income.

This is an interesting graph which shows the impact of different taxes and benefits on income distribution.

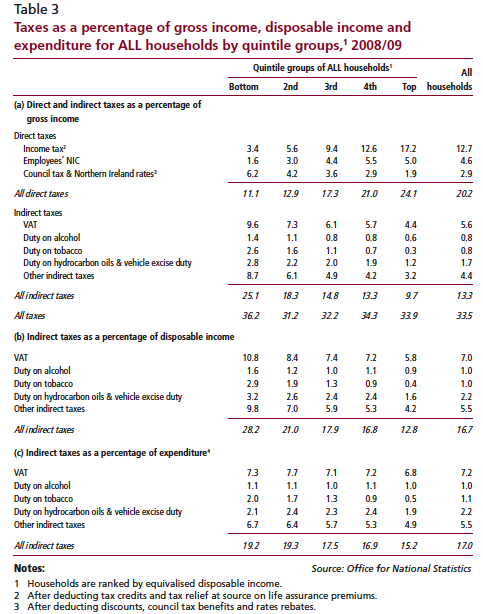

- As expected, direct taxes (like income tax) are progressive – i.e. they take a bigger % of income from high earners.

- Indirect taxes (like VAT and cigarette tax) are regressive i.e. they take a bigger % of income from low earners.

- Within these broad categories, we can see that the most regressive tax is tobacco duty. The most progressive tax is the income tax. Note figures are from 2008/09 before the introduction of a 50% tax rate.

- Another interesting thing is how regressive council tax is. (it certainly takes a very high % of my own disposable income)

Source: Economic and Labour Review

How UK tax and benefits impact income distribution

Source: Economic and Labour Review

Related