All economic forecasts are subject to margins of error. This is because:

- There are many variables affecting the economy. For example, the role of shadow banking was largely ignored in 2007 forecasts but failed sub-prime mortgage debt had a much bigger impact on the wider economy than ever before.

- There is always a big element of uncertainty, e.g. how will consumers react to certain events, e.g.what will happen to oil prices?

- It is hard to know even the actual state of the economy (delays in getting data, data incomplete)

In the UK, the role of economic forecasts has become highly political in 2016 given that much of the debate around Brexit has hinged upon forecasts for what would happen to the UK economy if the UK voted to leave the EU, and what will happen when the UK actually leaves the EU. It has made forecasts for 2017 highly politicised.

Some forecasts are easier to make than others.

If you try to forecast the economic impact of a Trump presidency, it is difficult because we don’t know what policies will be enacted and how business and consumers will respond to the new presidency. There are many unknowns, not least the President himself.

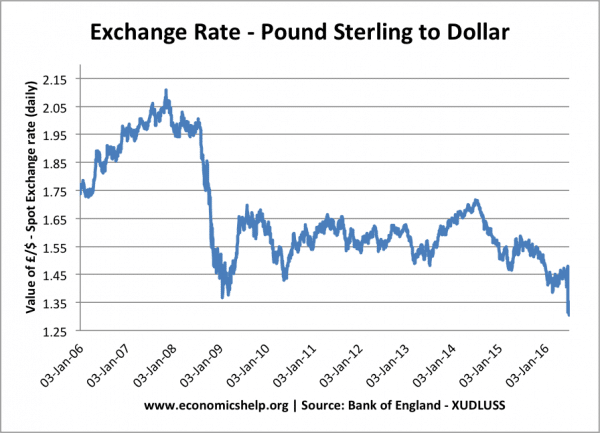

If we try to forecast the impact of a 15% depreciation in the Pound, we are on firmer ground. There is a reasonably strong correlation between a falling exchange rate, rising input prices – feeding through into higher inflation. Forecasts of higher inflation in the UK are relatively robust (assuming the depreciation doesn’t reverse).

Yet, even the impact of Pound depreciation has an element of uncertainty.

A 15% depreciation will also make exports cheaper. Basic analysis suggests that cheaper exports should boost export demand from overseas. Also, UK consumers will switch from more expensive imports to relatively cheaper domestic goods. Therefore, a depreciation should help to boost domestic demand and economic growth.

However, this doesn’t always occur. The last major depreciation in the Pound Sterling (2009) had very little impact in either boosting demand or reducing the current account deficit. The last depreciation was hampered by three factors:

- Price inelastic demand for UK exports. Increasingly specialised UK exports have proved to be relatively price inelastic. This means the depreciation may only cause a smaller percentage rise in demand.

- Weak growth abroad. If the rest of the world (especially Europe) is in recession, then cheaper UK exports are insufficient to see rising demand.

- Weak real wage growth. If the cost-push inflation is higher than nominal wage growth, then consumers will see fall in real incomes and will cut back on spending.

Impact of Sterling Depreciation in 2017

How might we expect the Pound depreciation to affect UK economic growth in 2017

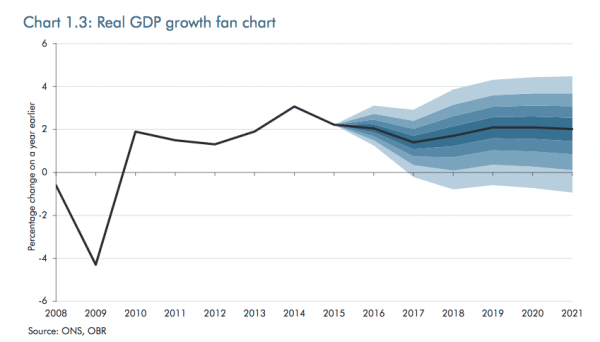

Source OBR, Nov 2016

The fan chart shows the range of economic forecast, but the median growth forecast for 2017 is a decline in the rate of economic growth from 2.1% to 1.4%.

The decline in forecast economic growth is due to several factors:

- Brexit uncertainty causing firms to delay or postpone investment.

- Rising prices from depreciation and fall in real wage growth holding back consumer spending.

On the positive side

There are strong signs of growth in the US (with recent figures showing annualised economic growth of 3.2%) Tax cuts and infrastructure spending could boost US economic growth even more. This could help the US economy to break the long-term cycle of zero interest rates. This would have an important effect for dragging the world economy out of a prolonged liquidity trap. Signs of growth in the Eurozone are also more positive in recent months. A strong recovery in the Eurozone would definitely feed through into the UK economy.

Some slowing of the pace of fiscal tightening. Abandoning past fiscal targets, the government has given itself more leeway to reduce the deficit. The OBR have forecast an extra 0.1% on the rate of economic growth due to greater capital expenditure. However, only 0.1% shows the relatively small size of extra capital investment.

Uncertain factors for 2017

- What kind of Brexit strategy will the UK pursue? Will it be for hard Brexit as soon as possible – or will the government seek to stay in Single Market?

- Oil prices. OPEC has shown some interest in halting oil price slide. A rapid rise in oil prices would compound cost-push inflation factors.

- Global growth. This is probably the biggest unknown. Will China’s economy have a hard landing – sending shockwaves through the global economy. Will Italian banks falter causing renewed problems in the Eurozone? Will the US economy forge ahead or come unstuck?

Conclusion

It is difficult to make economic forecasts. I can’t see any major flaw in the analysis of OBR. They have done a good job given current state – yet they could well end up being quite wrong – with growth either significantly above, or significantly below.

Related

Is it time to hedge with Gold, or invest more in property?