Readers Question: what are the advantages and disadvantages of inflation?

Inflation occurs when there is a sustained increase in the general price level. Traditionally high inflation rates are considered to be damaging to an economy. High inflation creates uncertainty and can wipe away the value of savings. However, most Central Banks target an inflation rate of 2%, suggesting that low inflation can have various advantages to the economy. Some economists even argue we should target a higher inflation rate during periods of economic stagnation.

The advantages of inflation

1. Deflation (a fall in prices – negative inflation) is very harmful. When prices are falling, people are reluctant to spend money because they feel that goods will be cheaper in the future; therefore they keep delaying purchases. Also, deflation increases the real value of debt and reduces the disposable income of individuals who are struggling to pay off their debt. When people take on a debt like a mortgage, they generally expect an inflation rate of 2% to help erode the value of debt over time. If this inflation rate of 2% fails to materialise, their debt burden will be greater than expected. Periods of deflation caused serious problems for the UK in 1920s, Japan in 1990s and 2000s and Eurozone in 2010s.

See more Costs of deflation

2. Moderate inflation enables adjustment of wages. It is argued a moderate rate of inflation makes it easier to adjust relative wages. For example, it may be difficult to cut nominal wages (workers resent and resist a nominal wage cut). But, if average wages are rising due to moderate inflation, it is easier to increase the wages of productive workers; unproductive workers can have their wages frozen – which is effectively a real wage cut. If we had zero inflation, we could end up with more real wage unemployment, with firms unable to cut wages to attract workers.

3. Inflation enables adjustment of relative prices. Similar to the last point, moderate inflation makes it easier to adjust relative prices. This is particularly important for a single currency like the Eurozone. Southern European countries like Italy, Spain and Greece became uncompetitive, leading to large current account deficit. Because Spain and Greece cannot devalue in the Single Currency, they have to cut relative prices to regain competitiveness. With very low inflation in Europe, this means they have to cut prices and cut wages which cause lower growth (due to the effects of deflation). If the Eurozone had moderate inflation, it would be easier for southern Europe to adjust and regain competitive without resorting to deflation.

4. Inflation can boost growth. At times of very low inflation, the economy may be stuck in a recession. Arguably targeting a higher rate of inflation can enable a boost in economic growth. This view is controversial. Not all economists would support targeting a higher inflation rate. However, some would target higher inflation, if the economy was stuck in a prolonged recession. See: Optimal inflation rate

For example, the Eurozone has had a very low inflation rate in 2013-14, and this has corresponded to very weak economic growth and very high unemployment. If the ECB had been willing to target higher inflation, then we could have seen a rise in Eurozone GDP.

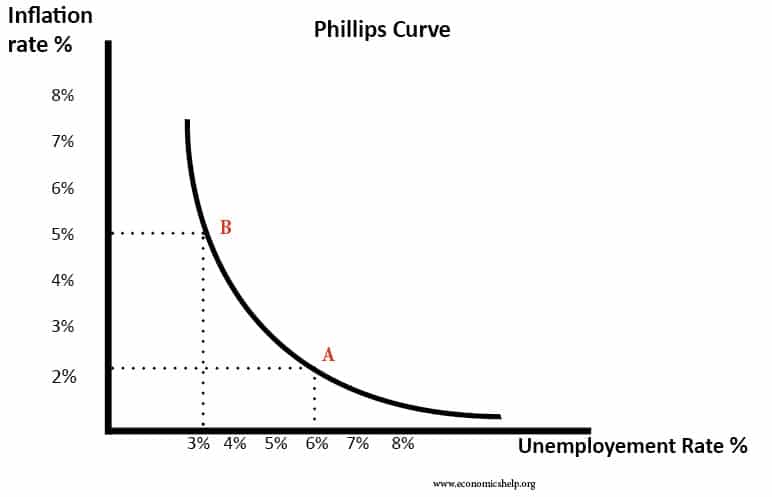

The Phillips Curve suggests there is a trade-off between inflation and unemployment. Higher inflation leads to lower unemployment (at least in the short-term) there is a debate about how meaningful this trade off is.

5. Inflation is better than deflation. The only thing worse than inflation, joke economists, is deflation. A fall in prices can cause an increase in the real debt burden and discourage spending and investment. Deflation was a factor in the Great Depression of the 1930s..

Disadvantages of inflation

Inflation is usually considered to be a problem when the inflation rate rises above 2%. The higher the inflation, the more serious the problem is. In extreme circumstances, hyperinflation can wipe away people’s savings and cause great instability, e.g. Germany 1920s, Hungary 1940s, Zimbabwe 2000s. However, in a modern economy, this kind of hyperinflation is rare. Usually, inflation is accompanied with higher interest rates, so savers do not see their savings wiped away. However, inflation can still cause problems.

- Inflationary growth tends to be unsustainable leading to a damaging period of boom and bust economic cycles. For example, the UK saw high inflation in the late 1980s, but this economic boom was unsustainable, and when the government tried to reduce inflation, it led to the recession of 1990-92.

- Inflation tends to discourage investment and long-term economic growth. This is because of the uncertainty and confusion that is more likely to occur during periods of high inflation. Low inflation is said to encourage greater stability and encourage firms to take risks and invest.

- Inflation can make an economy uncompetitive. For example, a relatively higher rate of inflation in Italy can make Italian exports uncompetitive, leading to lower AD, a current account deficit and lower economic growth. This is particularly important for countries in the Euro-zone because they can’t devalue to restore competitiveness.

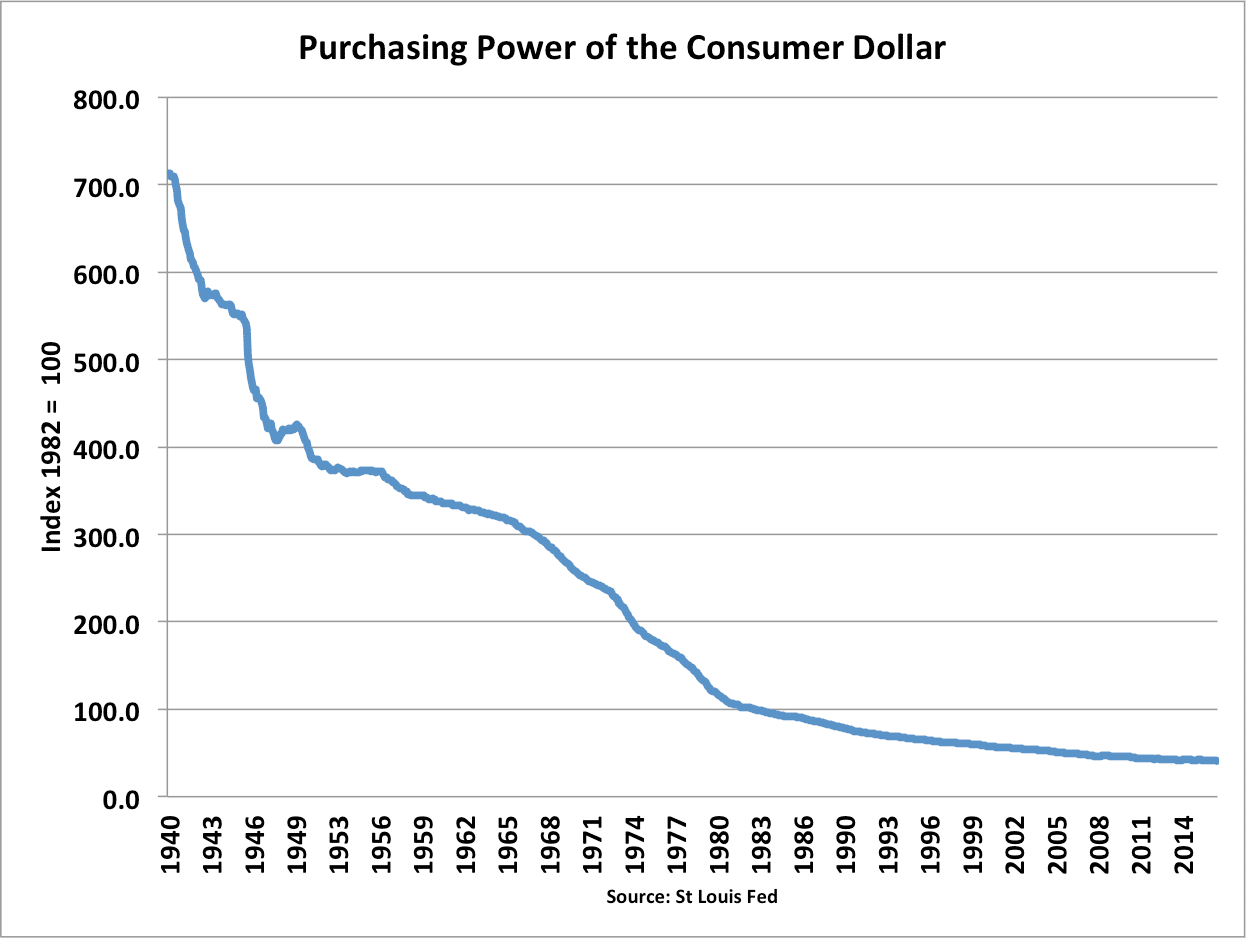

- Reduce the value of savings. Inflation leads to a fall in the value of money. This makes savers worse off – if inflation is higher than interest rates. High inflation can lead to a redistribution of income in society. Often it is pensioners who lose out most from inflation. This is particularly a problem if inflation is high and interest rates low.

- Menu costs – the cost of changing prices lists becomes more frequent during high inflation. Not so significant with modern technology.

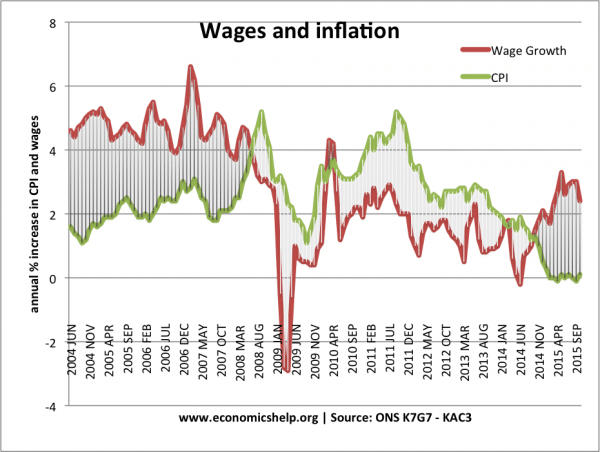

- Fall in real wages. In some circumstances, high inflation can lead to a fall in real wages. If inflation is higher than nominal wages, then real incomes fall. This was a problem in the great recession of 2008-16, with prices rising faster than incomes.

Inflation (CPI) above wage growth 2008-14, caused a decline in living standards – especially for workers in low-wage, zero-hour contract jobs.

Related

I AM SAMEER WE CAN SAY THAT INFLATION IS NOT HELP FULL TO OUR COUNTARY /

According to my thinking capacity, inflation can be helpfull to your country in such a way that it can reduce the demand, which is one of the most courses of inflation…In addition , it can also encourage foreign investors as they will get more interest from their investment,,by this way your country will benefit from more foreign currencies………..

Hello im Rajesh Mulchandani according to me it is very dangerous rise in infltion mostly in developing countries and when there is crisis picture of economy of that particular contry in opposite of that that very same country face the deflation and unemployment.

i would disagree on this point because inflation is still better than deflation due to people try to buy goods at the prevailing price ,as they know that there would be a increase in price in the near future on the contrary while deflation people wait for the product to become more cheaper ,which results into the blockage of stock.making the condition worse thus from the two devils inflation is a better option .!

ACCODING TO ME,

INGFLTION IS A DANGERIOUS OBSTACLE TO THE POOR. IT AFFECTS THE POOR BADLY AND PUSHES THEM INTO THE POVERTY TRAP. THUS INFLATION IS AS DANGERIOUS AS A MASSIVE WEAPON

plz mail me about inflation, deflation, indusrial analysis on iron n steel .

thanking you , byeeeeeeeeeeeeeeee

what i saw from the feedback that alot of people prefer inflation. the question am asking now is; why do most people prefer inflation to deflation ? is it because such guys are business owrners and they don’t to earn alittle or what ? what about poor people. how can they make ends meet? think properly, think widely, think about the poor first. then i am sure, you are going to change your mind.

My feeling is that depending on the nature of the economy of a country, inflation can either be good or bad. But in general, mild inflation (anticipated level) is encouraging producers while high level of inflation will put everybody such as individuals, lenders, bussinessmen, government, economies, etc into a bad shape.

inflation may not be that good but dn is not very bad because it does not encourage productivity.at least a low inflrate is helpfull but not deflation

inflation may not be that good but deflation is not that good because it does not encourage productivity.at least a low inflrate is helpfull but not deflation

Your comment is awaiting moderation

I my point of view inflation in the luxuries goods will not affect more people. But inflation in the daily product (milk, onions,sugar) it will affect lot of poor people in developing countries…. by junior economics student….

honestly, there is “NO ANSWER” for which one better than the other one in case of deflation and inflation. There are pros and cons in every of this macroeconomic problems. To be simple, lets take a look on the inflation problem,

As we know, inflation rise in the general price level. Do you think it effecting us more? or effecting badly for those who giving loan to others?. This is because when inflation happen, the value of money currently not representing the value they expecting during the past value of money. Meaning to say, they earn loss. Therefore, inflation scared for those who are giving loan to others, but, becoming an advantages for us who previously applying loan.

Inflation is that condition of an economy which is harmful and at the sametime it is a hurdle to developing any economy and contry. inflation prevents development of economy, growth of economy and same time it affect badly to the service sector of any economy. During inflation people suffer from such a condition that is very different. People do have money, but the purchasing power of that money is very low.”

According to me inflation should be controled very iffectively otherwise it may affect each and every factor of balancing every economy.”.

In reality inflation is a threat to the economy, it decline the economic growth and it can lead it to financial crisis…However it can be as an advantage to the conuntry simply because it decrease the demand……

Inflation has both positv &negatv side hence we cannot rule out that it bad

think big,the problem is an inconsistency between fiscal policy and monetary policy which ends with the figure of unbalanced and cause economic problems to a particular country affected ………………