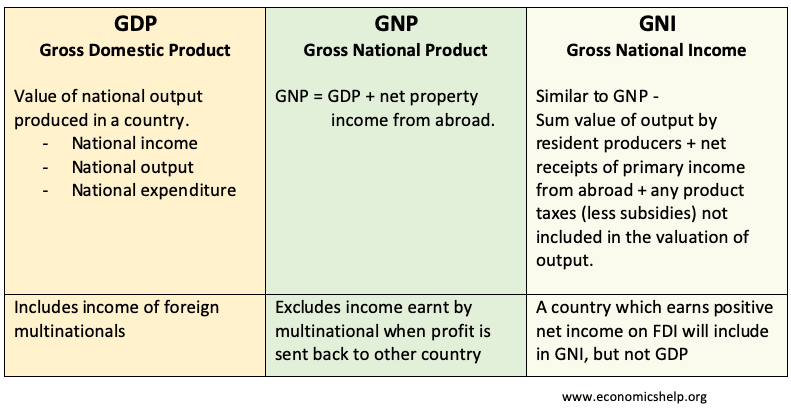

GNP and GDP both reflect the national output and income of an economy. The main difference is that GNP (Gross National Product) takes into account net income receipts from abroad.

- GDP (Gross Domestic Product) is a measure of (national income = national output = national expenditure) produced in a particular country.

- GNP (Gross National Product) = GDP + net property income from abroad. This net income from abroad includes dividends, interest and profit.

- GNI (Gross National Income) = (similar to GNP) includes the value of all goods and services produced by nationals – whether in the country or not.

Example of how GNP is different to GDP

If a Japanese multinational produces cars in the UK, this production will be counted towards UK GDP. However, if the Japanese firm sends £50m in profits back to shareholders in Japan, then this outflow of profit is subtracted from GNP. UK nationals don’t benefit from this profit which is sent back to Japan.

If a UK firm makes a profit from insurance companies located abroad, then if this profit is returned to UK nationals, then this net income from overseas assets will be added to UK GNP.

Note, if a Japanese firm invests in the UK, it will still lead to higher GNP, as some national workers will see higher wages. However, the increase in GNP will not be as high as GDP.

- If a county has similar inflows and outflows of income from assets, then GNP and GDP will be very similar.

- However, if a country has many multinationals who repatriate income from local production, then GNP will be lower than GDP.

For example, Luxembourg has a GDP of $87,400 but a GNP of only $45,360.

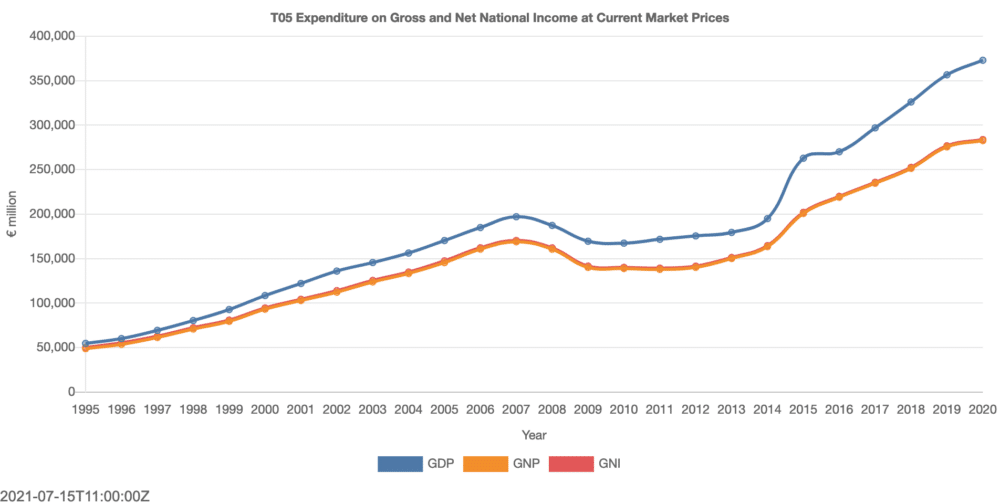

A country like Ireland has received significant foreign investment. Therefore for Ireland, there is a net outflow of income from the profits of these multinationals. Therefore, Irish GNP is lower than GDP.

GNI

GNI (Gross National Income) is based on a similar principle to GNP. The World Bank defines GNI as

“GNI is the sum of value added by all resident producers plus any product taxes (minus subsidies) not included in the valuation of output plus net receipts of primary income (compensation of employees and property income) from abroad.” (World Bank)

The World Bank now use GNI rather than GNP.

UK GNI and GDP

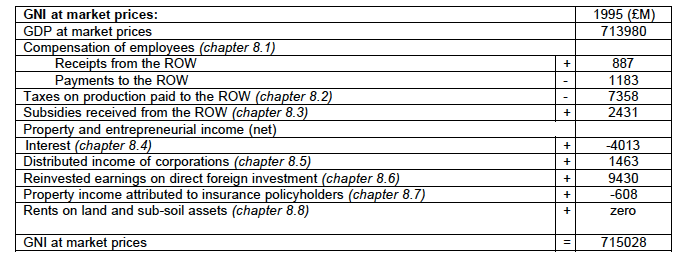

from: pdf ONS (1995)

This shows a small net income from abroad, so the GNI £715,028m is greater than GDP (£713,980)

Related

between gnp and gdp which one is likely to be lower in developing countries and why?

GNP, because developing countries tend to rely on foreign investments and MNCs that operate in their country, which greatly increases GDP, but not GNP because GNP does not calculate products of such MNCs as explained in the article

Gnp tends to be lower in developing countries.

Thank you

In the Japanese example, I don’t understand why the outflow of profit is subtracted from the GNP. Shouldn’t it be subtracted from UK’s GDP?

The example:

If a Japanese multinational produces cars in the UK, this production will be counted towards UK GDP. However, if the Japanese firm sends £50m in profits back to shareholders in Japan, then this outflow of profit is subtracted from GNP. UK nationals don’t benefit from this profit which is sent back to Japan.

Yes, it should and it is subtracted. GNP= GDP + net income from abroad. If the net income is negative, then mathematically it is eventually subtracted from the GDP.

If your GDP is 4500 and the net factor income from abroad (income earned

abroad and income earned by foreigners in India) is 1000. Then calculate

NNP (Net National Product) if the depreciation is 15 percent of GDP