Readers Question: Evaluate the possible consequences of a falling rate of inflation for the performance of the UK economy.

A falling rate of inflation means that prices will be rising at a slower rate.

A fall in the inflation rate could cause various benefits for the economy:

- Goods of that country becoming more internationally competitive increasing exports and growth

- Increase rates of return for savers

- Improved confidence, encouraging firms to invest and boost long-term economic growth.

- Increased disposable incomes (if nominal wage growth is constant)

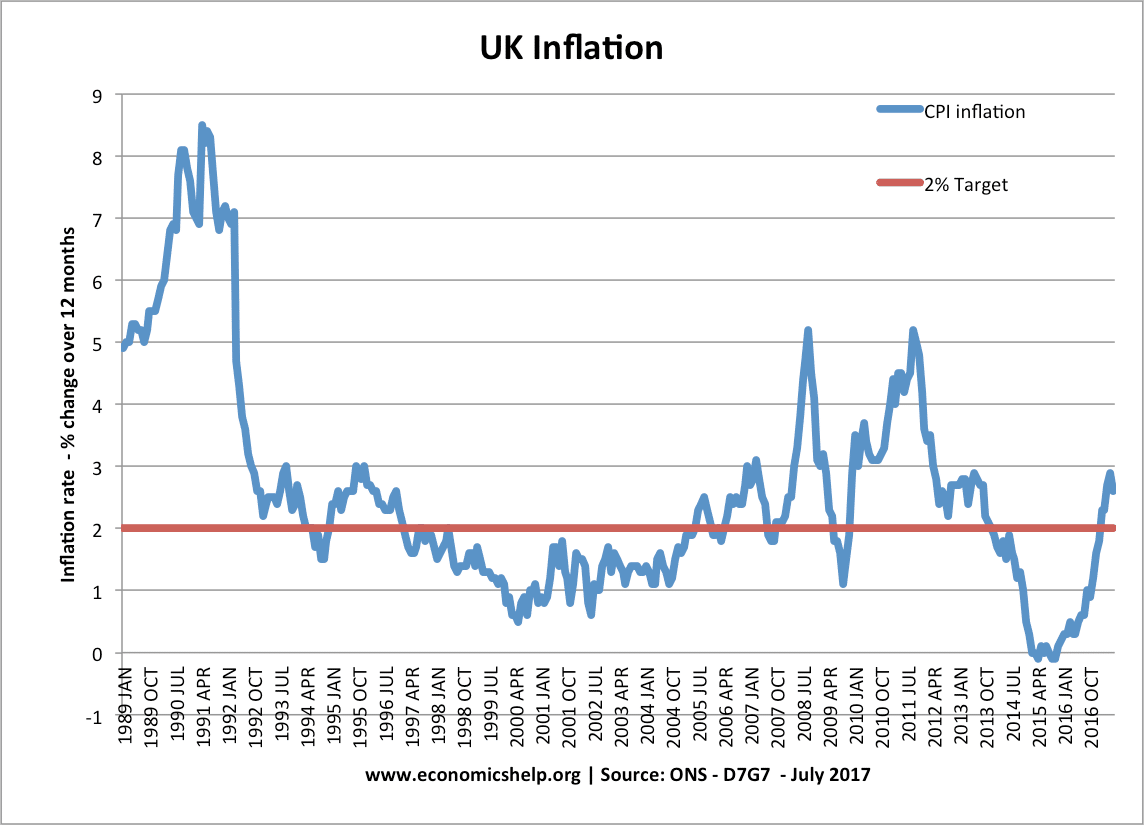

However, if a fall in the inflation rate is due to depressed demand, it could create deflationary pressures which make it hard to boost economic growth. It is worth bearing in mind governments usually target an inflation rate of 2%. If inflation falls from 10% to 2%, this will tend to have economic benefits. If inflation falls from 3% to 0%, this could indicate a depressed economy.

Benefits of a falling inflation rate

In the late 1990s and early 2000s, there was a fall in the inflation rate. This means UK goods were increasing at a slower rate.

- Increased competitiveness Lower inflation can help UK goods become more competitive because UK goods will be increasing at a slower rate. if goods do become more competitive it will lead to an improvement in the trade balance and higher economic growth.

- However, it does depend on relative inflation rates. If inflation is also falling in US and Europe, then the UK will not be receiving a competitive advantage because prices will not be relatively cheaper.

- Encourage investment. Firms prefer low inflation. When inflation is low, it is easier to predict future costs, prices and wages. The stability of low inflation encourage them to take on riskier investment; this can lead to higher growth in the long-term. Countries with low long-term rates of inflation tend to have improved economic performance.

- However, if inflation falls due to depressed demand (e.g. in 2009 or 2015) then this fall in inflation may not encourage investment. This is because the depressed demand makes investment unattractive – low inflation on its own is not sufficient to increase investment, firms need to expect growing demand.

- Improved return for savers. Assuming constant interest rates, a lower rate of inflation will give a better real rate of return for savers. For example, 2009-17, interest rates were stuck at 0.5%. With inflation of 5%, we saw in 2012, this meant many savers were seeing a real fall in the value of their savings. A fall in inflation means the value of money declines at a slower rate.

- Sometimes a lower rate of inflation causes the Central Bank to cut interest rates. For example, in 1992, interest rates were 15%, which meant savers were doing very well. When inflation fell in 1993, interest rates were sharply cut, so savers were not better off.

- Lower menu costs If inflation is lower, prices will change less frequently. Firms can spend less time and energy updating prices.

- With modern technology, this is less costly than it used to be. Menu costs are more of a problem with very high rates of inflation.

- Increased value of debt payments. In the past, people may take out loans/mortgages expecting inflation to reduce the real value of debt payments. If inflation falls to a very low rate, then real interest rates can be higher than predicted. This increases the real debt burden and can lead to slower economic growth

- This has been a problem in Europe around 2012-15, where very low rates of inflation have created problems similar to that of deflation.

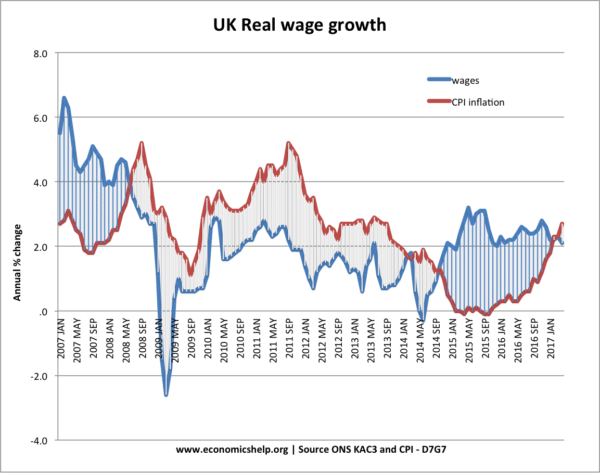

- Real wages. In the period 2009-17, nominal wage growth was very low. Nominal wages have been growing around 2-3%. The labour market is very weak. In this period, when inflation rose to 5%, workers saw a fall in real wages. Therefore, a fall in inflation reverses this and enables real wages to rise.

- Falling inflation in 2015 – enabled real wage growth to be positive.

- This was quite an unusual period in that falling real wages are not common in the post-war period. Usually, a lower inflation rate is not needed to boost real wages.

More evaluation

It depends on why the inflation rate is falling.

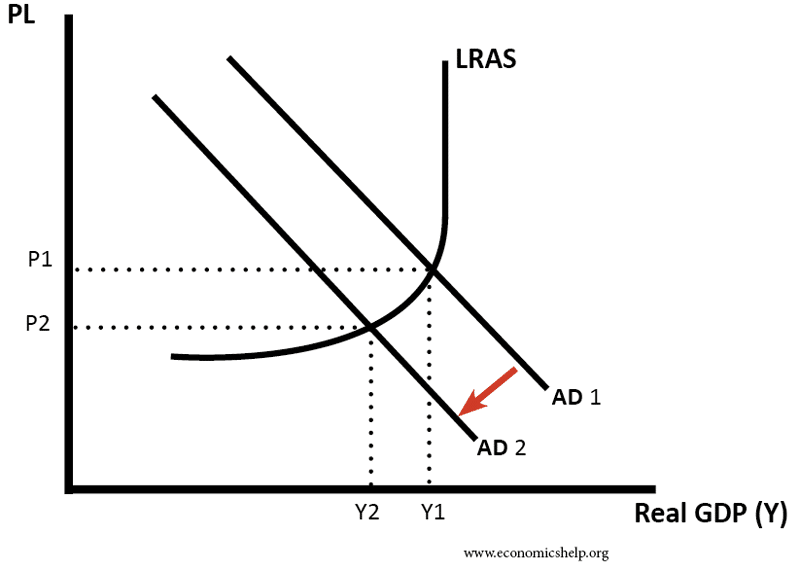

For example, in 1980/81, the UK had a rapid fall in the inflation rate. However, this caused a serious economic downturn with falling GDP and rising unemployment. Therefore, the cost of lower inflation may be higher unemployment. See 1980 recession

- However, Monetarist economists will argue that this short-term cost of unemployment and recession were a ‘price worth paying’ for reducing inflation and getting it out of the system. The recession was inevitable, but once you have low inflation, the economy is in a stronger position to grow in the future.

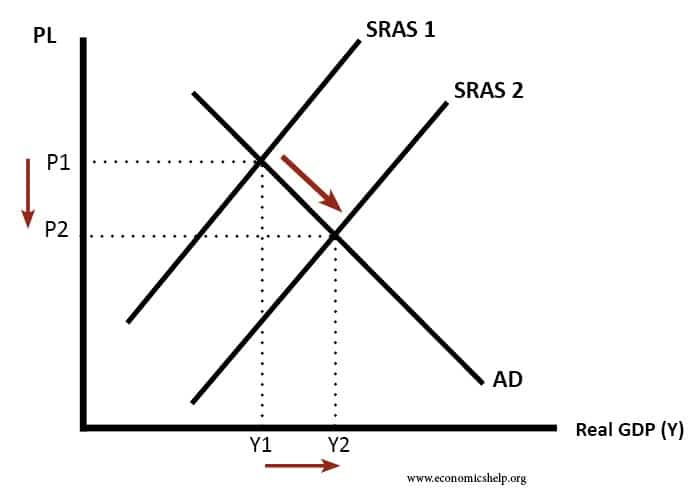

Lower inflation from lower costs

If we have lower inflation from a fall in costs of production (e.g. lower oil prices) then this tends to be very beneficial – we get lower prices, but also rising GDP. Consumers have more discretionary income to spend because travel is cheaper.

Related

- Costs of Inflation

- What is the optimal rate of inflation? – why Central Banks target 2% and why some economist suggest target should be increased to 4% in some circumstances.