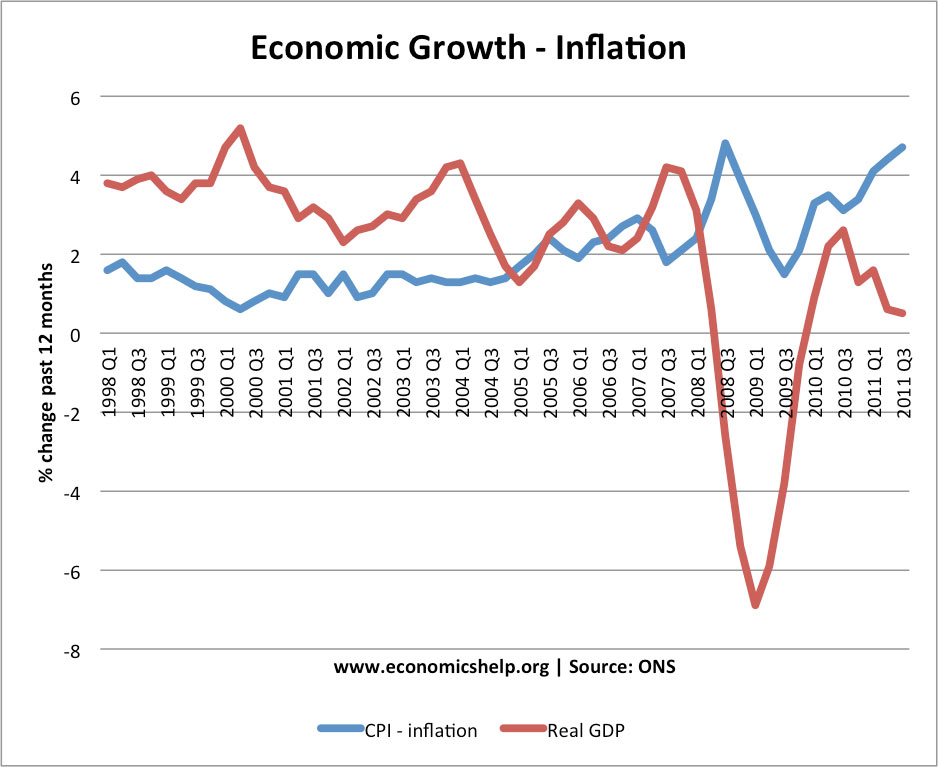

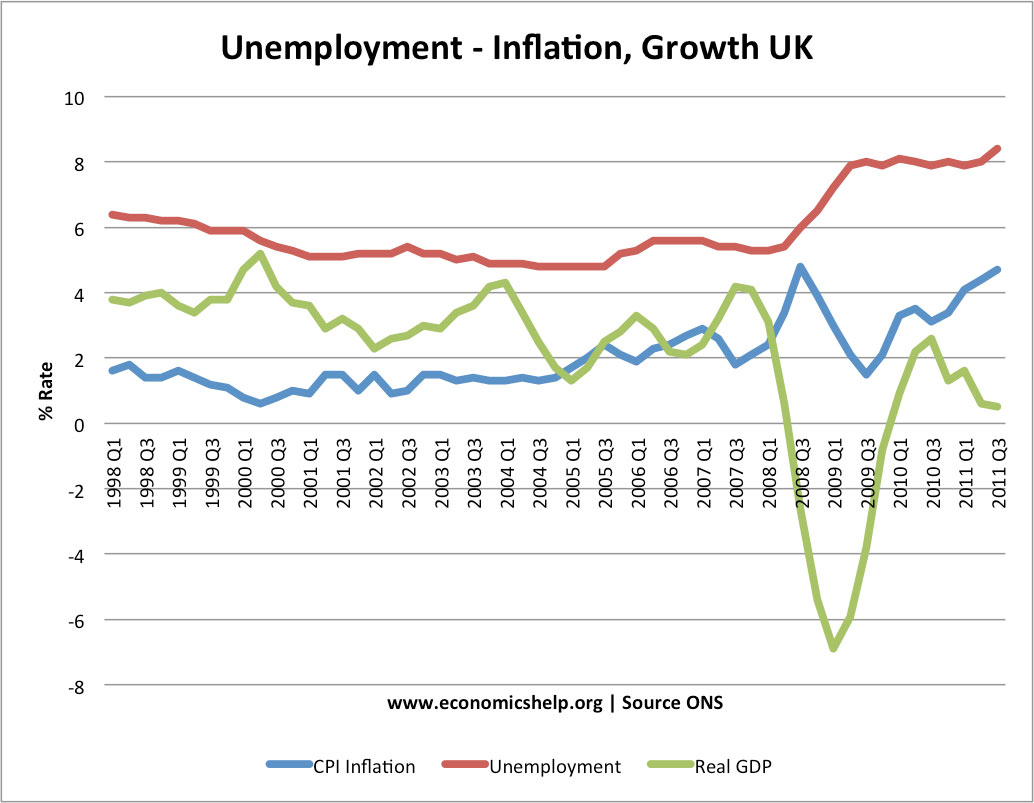

Since 2007, the UK has experienced a variety of economic shocks which have caused a prolonged period of economic stagnation, high unemployment and uncertainty. In 2011, the economic recovery proved much weaker than expected, yet inflation was stubbornly high. In 2012, fundamental weaknesses are likely to keep the UK economy depressed with high unemployment and low / negative growth. The one small crumb of comfort is the expected fall in headline inflation.

UK Snapshot

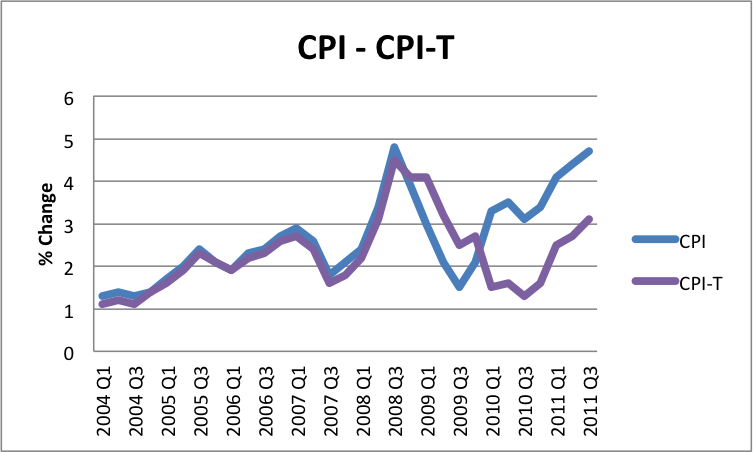

UK Inflation 2012

In 2011, CPI inflation reached 5.2%. RPI reached over 6%. (CPI RPI Inflation) However, the Bank of England forecast a sharp fall in inflation during 2012. This is because in 2011, inflation was caused by temporary cost-push factors, which will expire during the course of 2012. These cost-push factors include:

- One-off tax rises, such as VAT

- Effect of devaluation and higher import prices

- Rising commodity and food prices

In 2012, underlying inflationary pressures will be weak. Spending cuts, high unemployment and weak wage growth will prevent any demand-pull inflation. A global economic slowdown will weaken pressure on commodity prices. There is risk by end of 2012, inflation could fall below government’s target of 2%

Inflation Forecast 2012/2013

The Bank of England forecast a sharp fall in inflation in 2012. (Bank of England inflation forecast)

Interest Rate Forecast 2012

With this inflation forecast, and prospect of double dip recession it is highly unlikely the Bank of England will be wanting to increase interest rates during 2012. (Interest rate forecast)

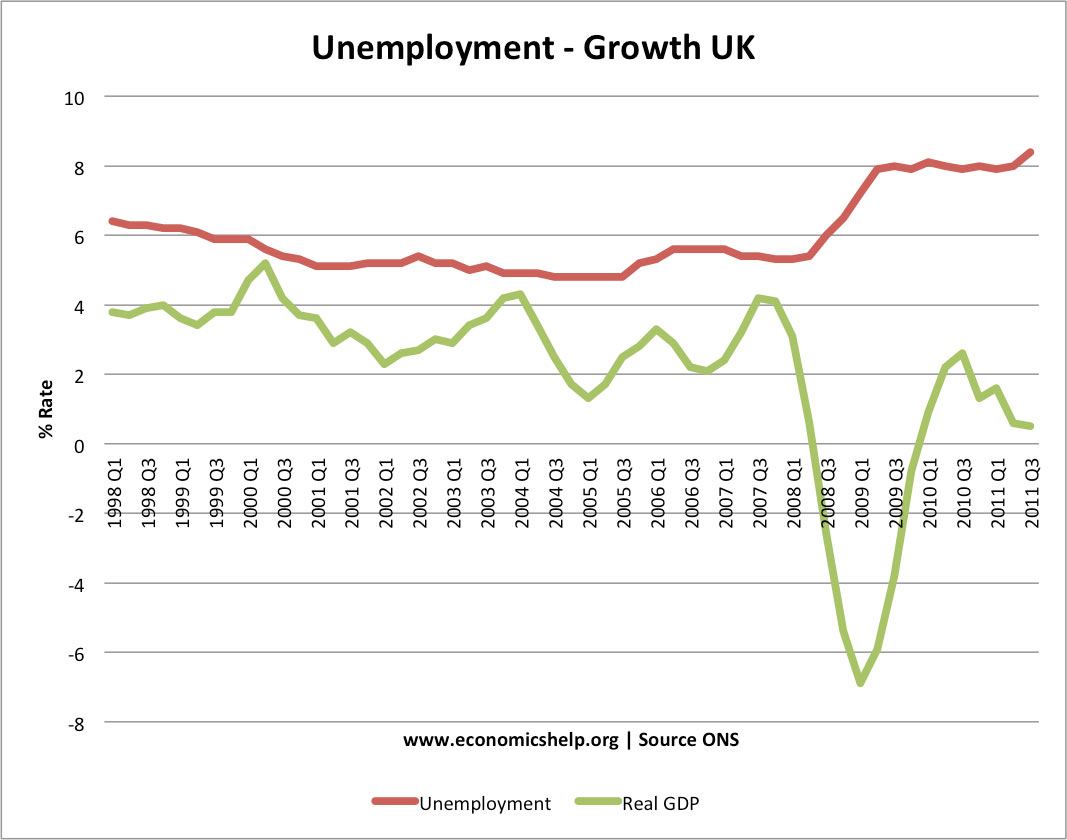

Unemployment

2011 was a grim year for unemployment in UK and EU. The ILO measure of unemployment rose to over 2.6 million. Youth unemployment rose to over 1 million, with an increase in the average duration of unemployment. With weak / negative growth predicted for 2012, unemployment is likely to continue to slowly rise.

The Misery Index

2011 was an unwelcome combination of rising inflation, higher unemployment and lower economic growth. At least in 2012, inflation is likely to fall. But, unemployment will stay high.

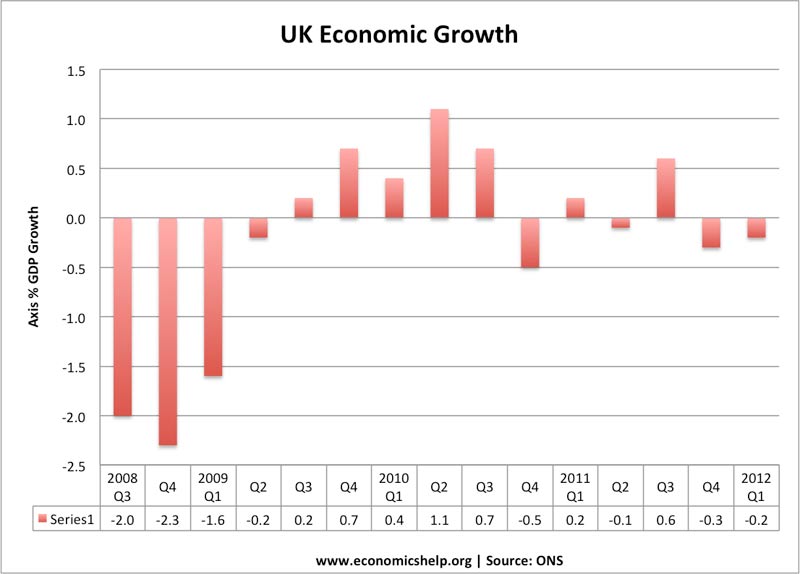

Economic Growth Latest

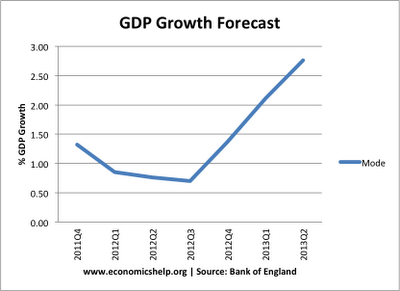

Economic Growth Forecasts for 2012

There is a mixture of economic growth forecasts. The Bank of England and OBR predicted positive growth of around 0.8% in 2012. Recently, the OBR revised economic growth down from 2.5% to 0.7% for 2012.

ITEM Club report forecasts GDP growth of just 0.2%

However, other independent forecasters, such as, Standard & Chartered, predict a double dip recession. Growth in 2012 is likely to be lower than previously expected because:

- Prolonged squeeze in real incomes from weak wage growth and higher costs of living

- Recession in EU and global economic downturn

- Continued weakness of bank lending

- Fiscal austerity as government tries to reduce budget deficit

- Unlikely to see benefit of devaluation seen in previous years

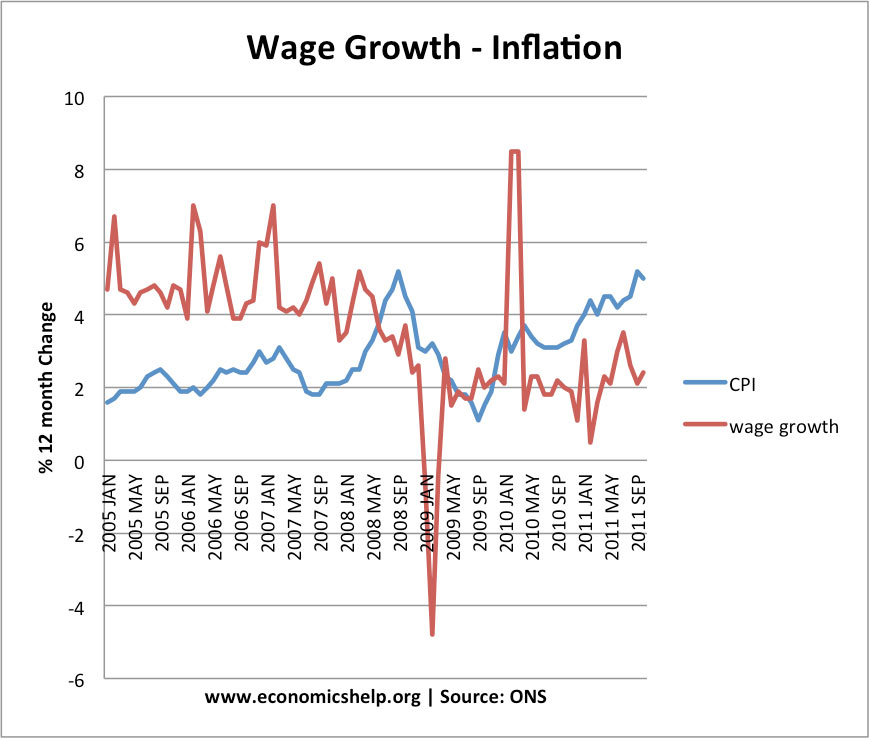

Real Wages

2011, saw one of the biggest falls in real incomes since the 1930s. Inflation is likely to fall in 2012, but wage growth will remain weak against a backdrop of recession and high unemployment. (Real wages UK) There is still prospect of falling living standards.

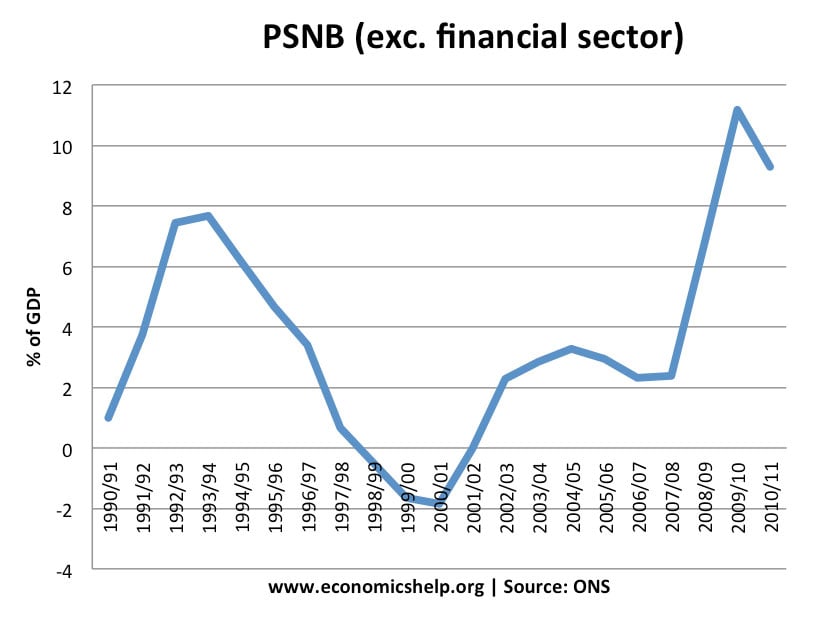

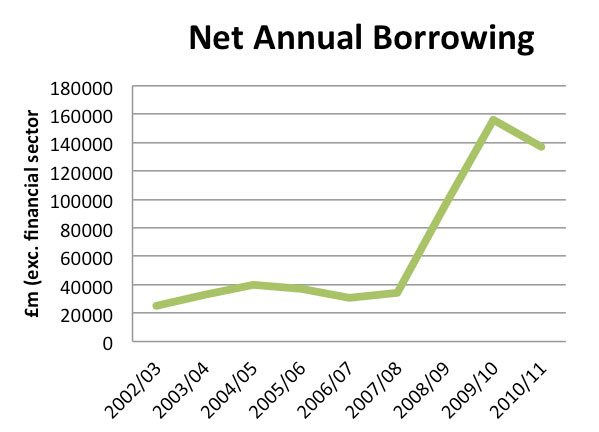

Government Borrowing

After reaching a peace-time record, the government have sought to aggressively reduce the budget deficit with spending cuts and higher taxes. However, the deficit has fallen slower than expected because of weaker growth and corresponding weaker tax receipts. In 2012, the government is likely to miss its targets for deficit reduction.

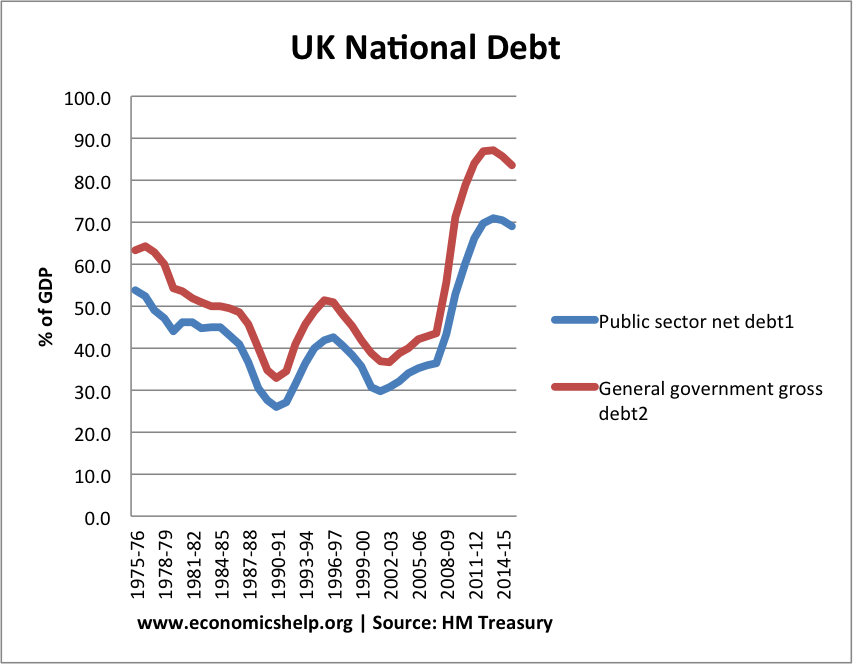

UK National Debt as % of GDP

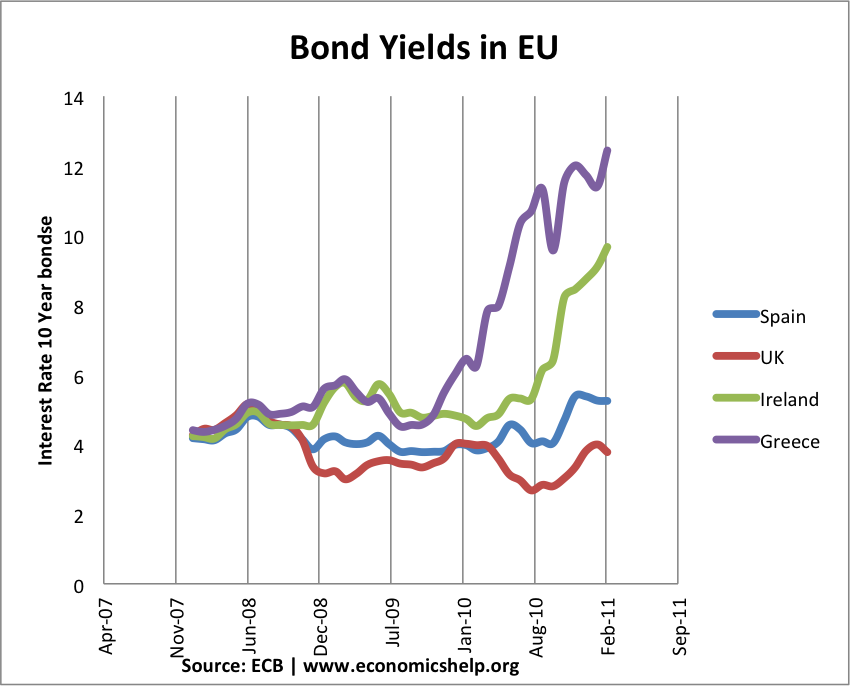

Bond Yields and Credit Rating

Bond Yields on UK government debt has fallen since credit crunch. There is a marked difference between UK bond yields and many European countries. The low bond yields help keep interest rate costs low. Yet, despite the low interest rate, the UK will still spend more than £48bn on debt interest payments in 2012.

However, markets, at the moment, feel the UK finances are OK. Helped by independent Central Bank willing to purchase bonds.

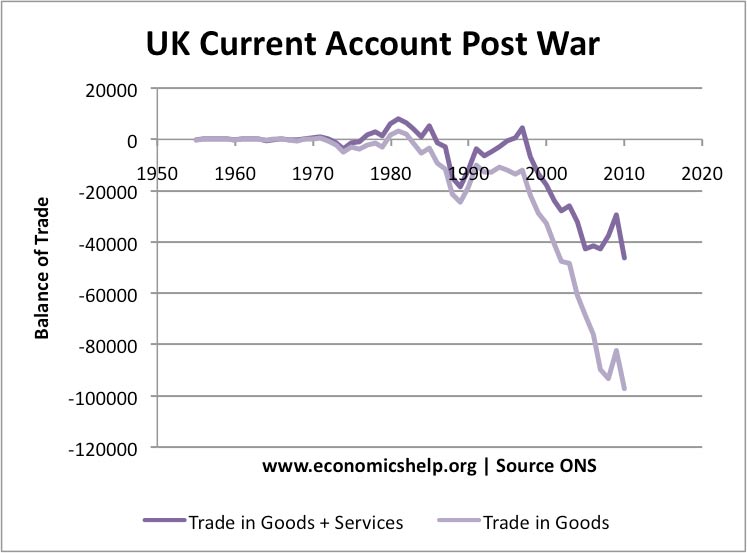

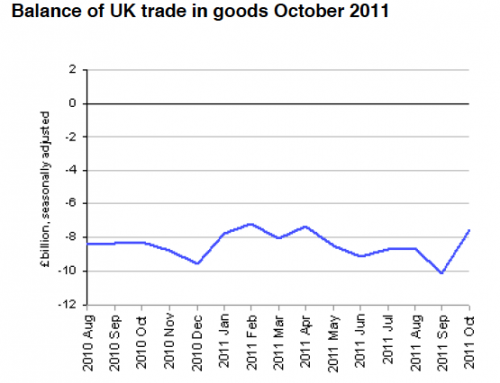

UK Current Account

The UK current account slowly improved in 2011, due to lower consumer spending and less spending on imports. Also, the effects of devaluation in pound has helped to slowly boost export demand.

source: ONS – UK Trade October 2011

Forecasts for Sterling to Euro 2012

The Eurozone looks more vulnerable than ever before. In this climate of debt default, investors have shown preference for government bonds outside the Eurozone, where there is less risk of liquidity shortages. The Eurozone’s troubles have led to weakening of the Euro and making Sterling relatively more attractive.

Forecasts for Pound Sterling to Dollar

The US economy may prove more resilient than UK economy. The US is less tied to fortunes of Eurozone. There are occasional signs of green shoots of recovery in the US. If these proved to be more resilient than in 2011, it could raise prospect of an interest rate rise in US, earlier than UK. This could lead to an appreciation in dollar against Pound Sterling.

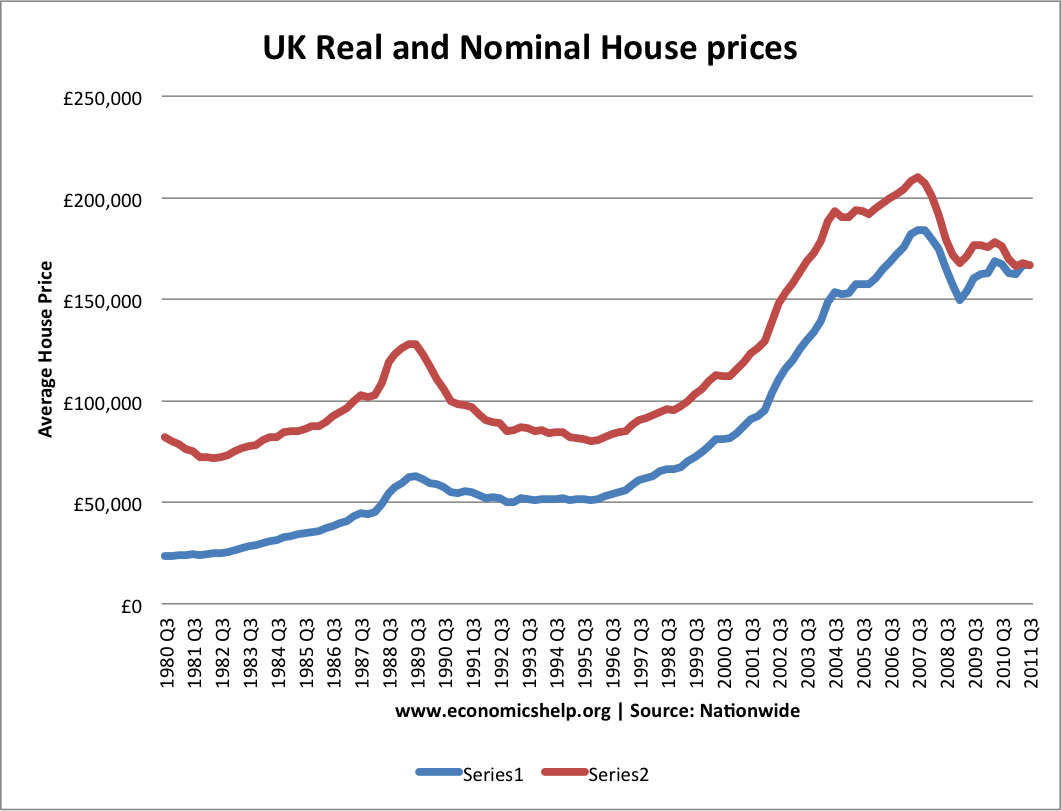

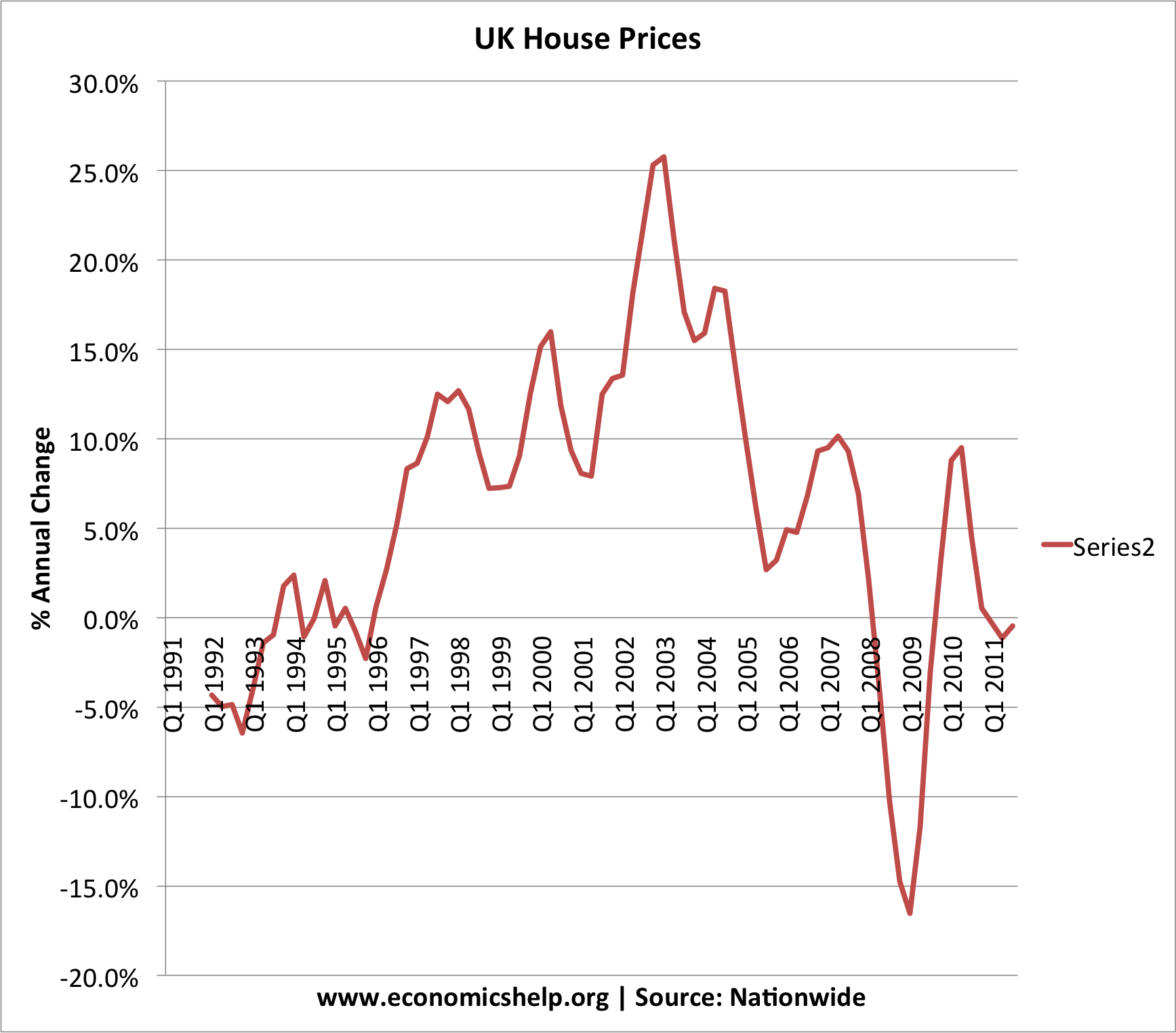

UK Housing Market

Forecasts for UK House Prices

Analysts such as Ernst & young predict a small fall in UK house prices during 2012. (Forecasts UK House Prices 2012)

Demand for buying houses will remain weak because of: high unemployment, recession and difficulty of getting mortgage finance.

Yet, despite poor affordability levels, a bigger house price fall will be avoided by lack of supply, which keeps prices artificially high.

see also: UK House price statistics

Sources:

- Bank of England – latest inflation and interest rates

- ONS – official of national statistics.

At the end of the day, this is ashame to read such news but at the same time I do think we are one of many going through this. If you look across the Eurozone, there are many countries with much more to do to fix their economies. WIth the UK I think we can at least expect to see some minor growth.