Inflation – is defined as a persistent increase in the general price level.

The inflation rate is a key statistic and has important consequences for industry. In particular, high rates of inflation often discourage investment and lead to lower long-term growth for the following reasons:

How inflation affects industry

- Uncertainty. High and volatile inflation creates uncertainty and confusion about future prices and costs; this tends to reduce investment and lead to lower rates of growth in the economy, and therefore less demand for goods.

- Menu costs of changing price lists. When inflation is high, prices need to be changed more frequently, which incurs a cost. Also, high rates of inflation may incur frequent wage negotiations with trades unions who will be trying to maintain their real wages; this can be costly for a manufacturing firm.

- However, firms can mitigate these menu costs with technology which makes it cheaper to update prices.

- High inflationary growth is often unsustainable. To reduce inflation often requires painful readjustment such as higher interest rates and deflationary fiscal policy; these lead to lower growth. Therefore countries with high inflation may be susceptible to a recession in the near future.

- Less competitive. High inflation means UK costs will be rising and this will make the country’s exports less competitive compared to the rest of the world.

- Another factor about high inflation is that it is likely to cause a depreciation in the exchange rate; this will restore competitiveness of exports – though it will make imports more expensive

- Less confidence. People are suspicious of country’s with high rates of inflation, it discourages inward investment and creates lower growth.

- Upward pressure on wages. Higher demand-pull inflation is likely to cause upward pressure on wages; this will raise costs for firms.

- However, it depends on the type of inflation. If the inflation is cost-push inflation – e.g. caused by rising oil prices then the pressure on wages may be less.

- Impact on savings. It is not just households who have savings, firms can have substantial cash reserves. In periods of high inflation, the real value of savings can fall – unless the firm can save in accounts with interest rates higher than inflation. Also, in periods of high inflation, the real value of debt can fall. Ceteris paribus, Inflation will benefit firms in debt more than with high savings. See – real interest rates

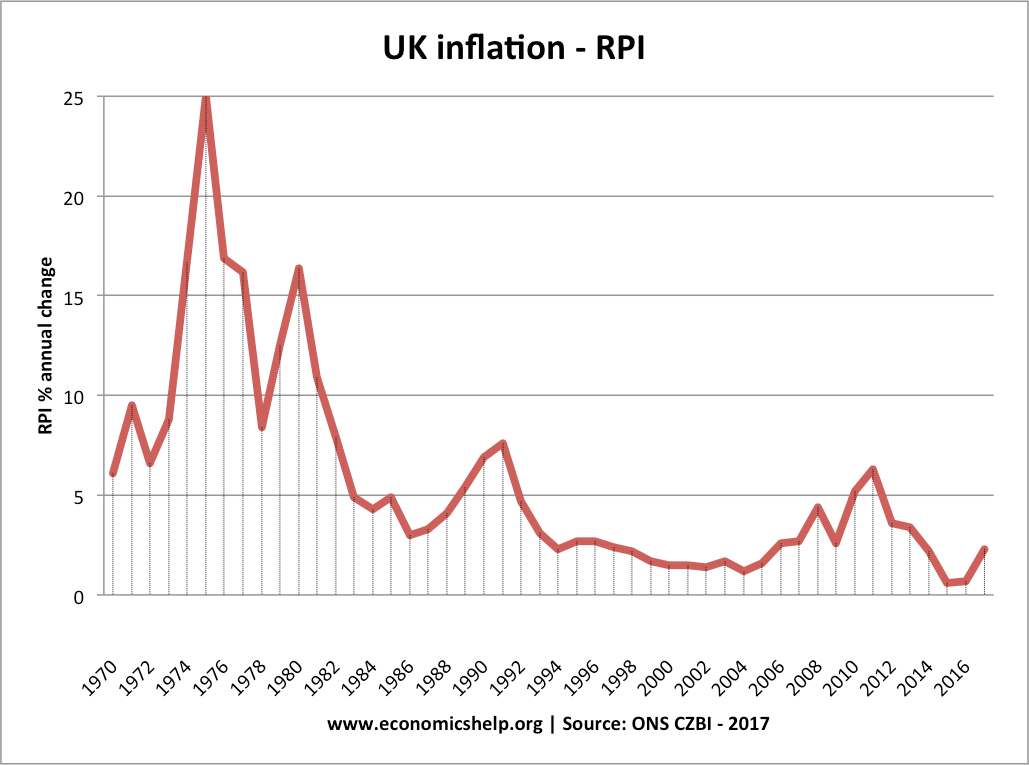

UK inflation since 1970. In 1975, UK inflation hit 25% – caused by a combination of increased oil prices, higher wages and rising demand. The inflation was a shock which caused instability for industry. It also aggravated industrial unrest with unions wanting to keep wages rising faster than prices.

Between 1992 and 2008, UK inflation was low. This was a period of economic stability and a long period of economic expansion known as the ‘great moderation.’ However, despite the low inflation, there was a less visible credit bubble – showing that low inflation, on its own, is not sufficient, to ensure economic stability.

- Note inflation is considered to be a serious problem at over 10%. Anything over 100% could lead to hyperinflation and serious destabilisation.

- Inflation between 2-4% would be considered a good target.

- However, reducing inflation could lead to lower growth and less demand

Deflation

Deflation is when prices fall. In many cases, this can be worse than inflation. Falling prices discourage people from spending and leads to lower growth, for example, Japan in the late 1990s. (Occasionally deflation may occur due to technological improvements.

CPI trend

The previous trend of inflation is instructive because inflation rates are often influenced by past inflation rates. i.e if inflation trends have been high in the past it encourages people to demand higher wages and pass cost increases on. Therefore, Inflation expectations become self-fulfilling. A country with a low inflation trend makes an attractive proposition for investment because it suggests economic stability, economic maturity and less risk associated with the investment.

Countries with persistently low inflation, make an attractive place for investment because they offer economic stability which encourages firms and investors.

See also: