Readers Question: How much are US economic policies are responsible for its current account deficit?

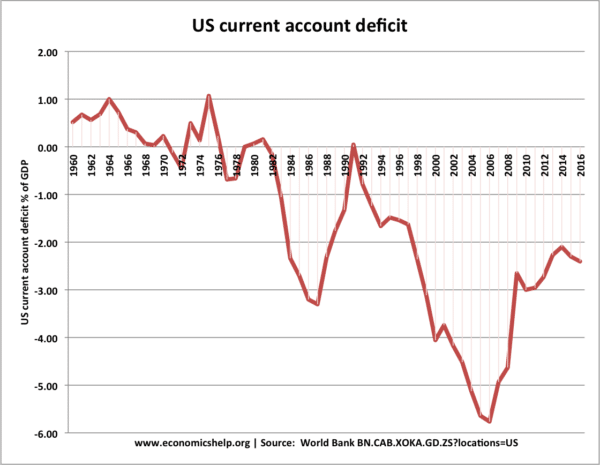

At one stage, the US current account deficit reached 6.5% of GDP, which was one of the highest in the industrialised world. Since the early 1980s, the US has been running a persistent current account deficit.

Reasons for the US Current Account Deficit

1. Low Savings Ratio/high consumer spending.

This is one of the most important factors. When consumer spending is high, and the saving ratio low, then it encourages people to buy imports. This low savings ratio is due to:

- Low real interest rates, especially in the period 2002-2006. Note: this is not government policy but the policy of the Federal Reserve and Alan Greenspan. However, they will argue their target was inflation and not the current account deficit.

- Rising house prices. The rise in house prices encourages people to consume more because of the wealth effect.

- Cheap credit. Borrowing was encouraged due to lax financial control and an attitude of borrowing is good. The government could take some blame for allowing an era of cheap and easy credit, which helped fuel a consumer boom. But, also you could blame banks and the willingness of consumers to take on debt and spend more.

- Cultural and social factors that led to relatively higher consumer spending (as % of income) in US than Asian economies.

2. Declining Competitiveness in Manufacturing and Industry

The US has seen a decline in competitiveness – especially in manufacturing. This decline in competitiveness has been making US exports relatively less competitive.

- You could blame the government for not pursuing sufficiently innovate supply-side policies to improve productivity and increase efficiency.

- However, you could also argue that it merely reflects a shift in comparative advantage which means countries like China can produce manufactured goods at much lower cost than high wage economies like the US. It is also dubious to what extent even well-meaning government intervention could attempt to overcome a decline in competitiveness. Most of the decline in competitiveness reflects long-term trends such as changing technological advances and relative wage rates between US and rest of the world.

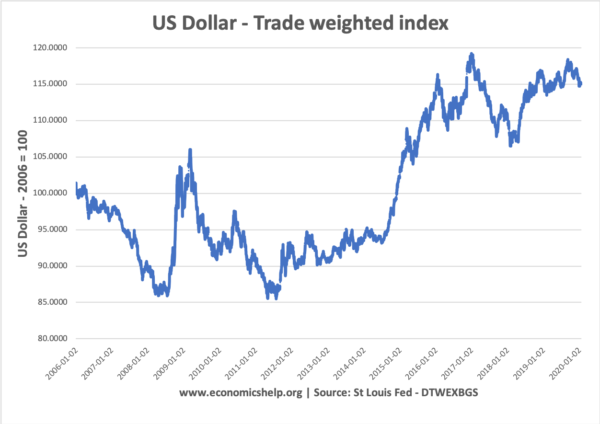

3. US Reserve Currency

One factor that has enabled the US to support a current account deficit for so long is that the US is the world’s unofficial reserve currency. This means that foreigners are willing to buy dollar assets at a lower premium. This means the US has been able to attract capital inflows, which effectively finance the current account. Without these capital inflows, the dollar would have devalued (earlier and more intensely) and this would have helped improve the current account. Recently, the dollar has been declining because foreigners are more wary about holding dollar assets; this has caused a devaluation in the dollar and improvement in the current account.

- You could argue, the US foreign and Economic policy has contributed to a decline in confidence in America and this has helped reduce demand for the dollar.

4. US Government Debt

You could argue that the high levels of US government debt contribute to a current account deficit. This is because, the large national debt has increased due to tax cuts, which increased consumer spending and helped increase the level of imports and reduce the savings ratio. Also, the high US debt has led to a rise in government bond sales and these sales are often financed by Asian/European investors buying US dollar assets and keeping the US dollar higher than it would be.

5. Overvalued exchange rate.

A strong US dollar makes exports relatively less competitive. Some economists (and politicians) have claimed that the US dollar is unfairly overvalued due to currency manipulation by China. By aggressively selling Yuan and buying dollar assets, China has kept its currency weak, and the dollar relatively stronger. This makes Chinese imports relatively more attractive than US exports.

This is a possible reason, though it is worth pointing out that currency manipulation is a controversial point. In recent years, China has had less involvement in exchange rate markets and the Yuan has appreciated somewhat, but still, the US dollar has appreciated 15% on its broad trade-weighted index since 2008

See also

Wouldn’t a floating exchange rate correct the deficits via the automatic stabilizer? High demands for foreign goods causes a huge supply of the US dollar and subsequently the value of the dollar should fall.

A depreciated currency would mean less goods are imported since it would be more expensive, therefore, correcting the deficit.

On a side note, is the term “devalue” correct in a floating exchange rate system? I have been told the terms “revalue” and “devalue” only comes in a pegged exchange rate. For a floating system, “appereciate” and depreciate would be used instead.

Thanks =)