- Expansionary monetary policy aims to increase aggregate demand and economic growth in the economy.

- Expansionary monetary policy involves cutting interest rates or increasing the money supply to boost economic activity.

- It could also be termed a ‘loosening of monetary policy’. It is the opposite of ‘tight’ monetary policy.

When to pursue expansionary monetary policy

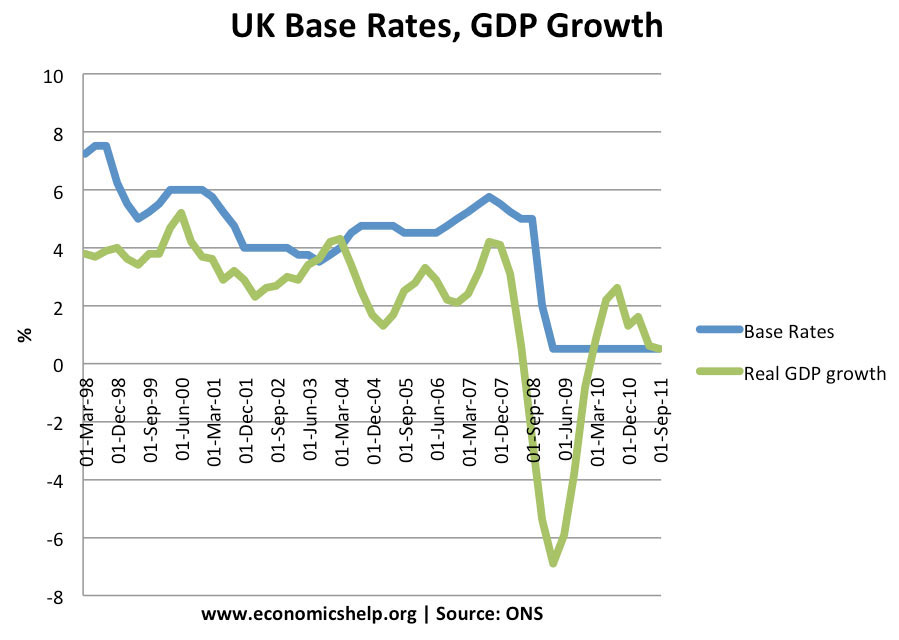

The recession in 2008/09, caused the Bank of England to cut interest rates dramatically to try and boost economic recovery. Interest rates fell from 5% to 0.5% in a few months

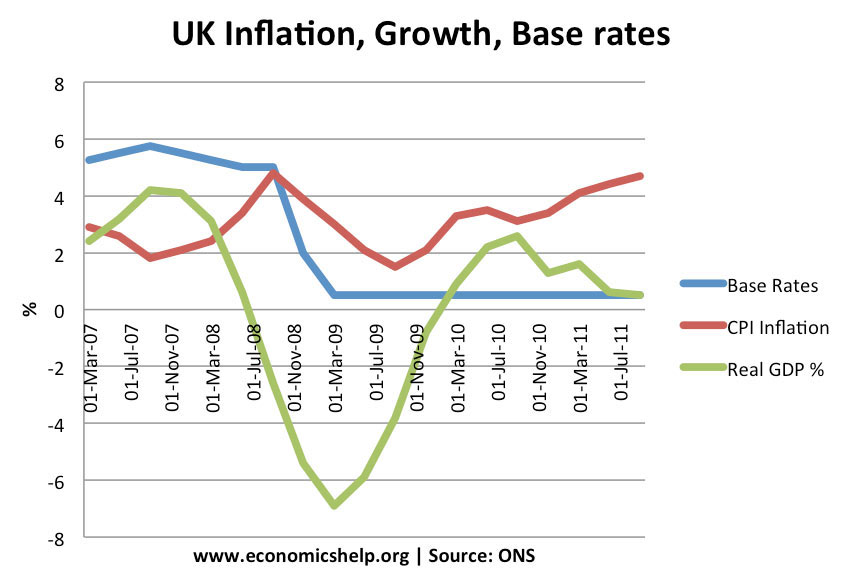

The MPC of the Bank of England has an inflation target of 2% +/-1. They also consider other economic objectives such as economic growth and unemployment. If inflation is forecast to fall below the target, they can consider loosening monetary policy to target higher inflation and enable a higher rate of economic growth.

Also, if the economy is forecast to enter into a recession, they are likely to cut interest rates and try to boost economic growth.

In some cases, they may pursue expansionary monetary policy, even if inflation is above target – if they think inflation is temporary and there is a greater risk of recession. (see: cost-push inflation)

How does expansionary monetary policy work?

If the Bank of England cuts interest rates, it will tend to increase overall demand in the economy.

- Lower interest rates make it cheaper to borrow; this encourages firms to invest and consumers to spend.

- Lower interest rates reduce the cost of mortgage interest repayments. This gives households greater disposable income and encourages spending.

- Lower interest rates reduce the incentive to save.

- Lower interest rates reduce the value of the Pound, making exports cheaper and increase export demand.

In addition to cutting interest rates, the Central Bank could pursue a policy of quantitative easing to increase the money supply and reduce long-term interest rates.Under quantitative easing, the Central bank creates money. It then uses this created money to buy government bonds from commercial banks. In theory, this should:

- Increase the monetary base and cash reserves of banks, which should enable higher lending.

- Reduce interest rates on bonds which should help investment.

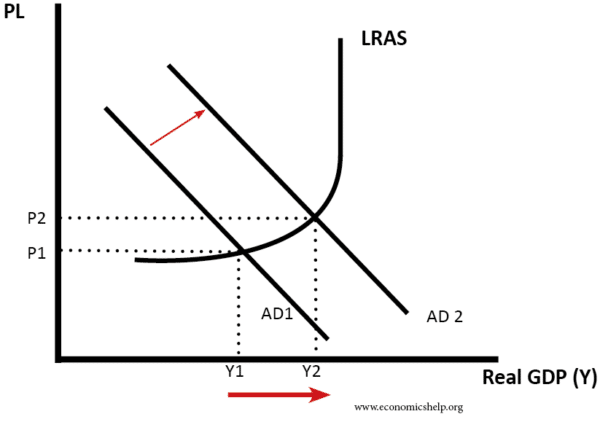

Diagram Showing Increase in AD as a result of Expansionary Monetary Policy

Effect of Expansionary Monetary Policy

In theory, expansionary monetary policy should cause higher economic growth and lower unemployment. It will also cause a higher rate of inflation. To some extent, the expansionary monetary policy of 2008, helped economic recovery. But, the recovery was weaker than expected showing limitations of monetary policy.

Why expansionary monetary policy may not work

Cutting interest rates isn’t guaranteed to cause a strong economic recovery. Expansionary monetary policy may fail under certain conditions.

- If confidence is very low, then people may not want to invest or spend, despite lower interest rates.

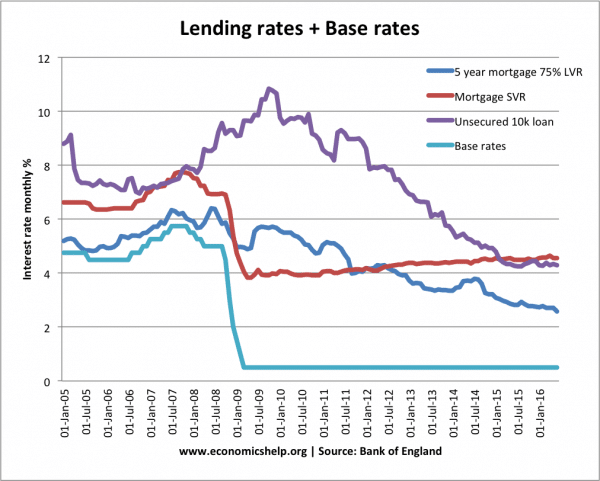

- In a credit crunch, banks may not have funds to lend, therefore although the Central Bank cuts base rates, it is still difficult to get a loan from a bank.

- Commercial banks may not pass the base rate cut on.

- In the Credit crunch, banks standard variable rate (SVR) didn’t fall as much as the base rate.

- It depends on other components of aggregate demand. Expansionary monetary policy may boost consumer spending, however, if we are in a global recession, then there may be a strong fall in exports which outweighs the improvement in consumer spending.

- Time Lags. It can take up to 18 months for interest rate cuts to increase spending. For example, people may have a two-year fixed rate mortgage. Therefore, they only see the impact of the rate cut when they remortgage.

Did Expansionary Monetary Policy of 2008 Work?

The recession of 2008-2009 was very deep. The UK was hard hit by the credit crunch and knock to the financial sector. Despite interest rate cut and £200bn of quantitative easing, the economy was quite slow to recover. In 2011, this weak recovery petered out.

However, without the expansionary monetary policy, the recession could have been even deeper. Also, the double-dip recession of 2011-2012 was partly caused by a tightening of fiscal policy (higher tax, lower spending)

Unorthodox types of expansionary monetary policy

- Helicopter money drop – giving cash directly to consumers to encourage spending.

- Quantitative easing – increasing money supply and purchasing government bonds to reduce interest rates

Related

Fiscal tightening has involved cut backs in public sector spending. Public sector spending is added into GDP at cost. If the value of marginal spending is less than cost then GDP (in real terms) will be artificially inflated by the accounting method.

If that is so, then In order to re-allocate resources to more productive uses it will be necessary to reduce public sector spending…that will reduce GDP (but by more the the loss of output value). It will mean resources are idle but eventually the economy will (I hope) use the resources freed up more productively. That may be a slow process; the state of the economy is not helpful and many of the unemployed will be in areas with poor short/medium term prospects.