Readers Question: What is the impact of debt on the housing market in the UK? If the UK is in such a debt crisis, what impact has this had on the housing market.

Firstly, a debt crisis could imply both government debt and household debt. The UK is facing a combination of both (see: total UK debt)

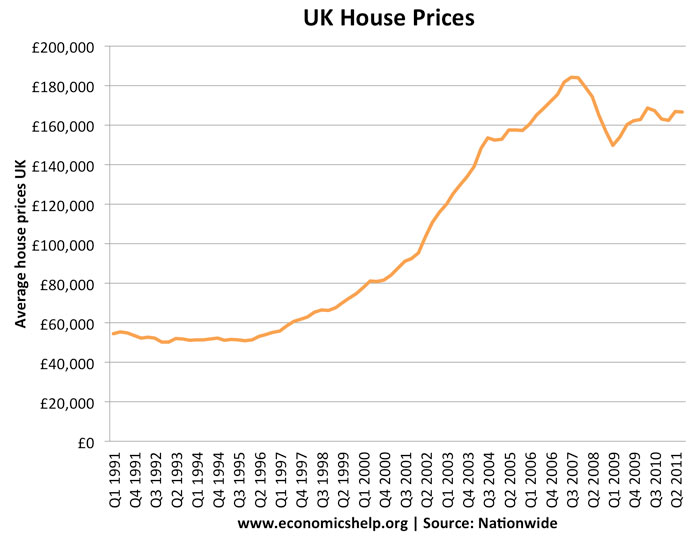

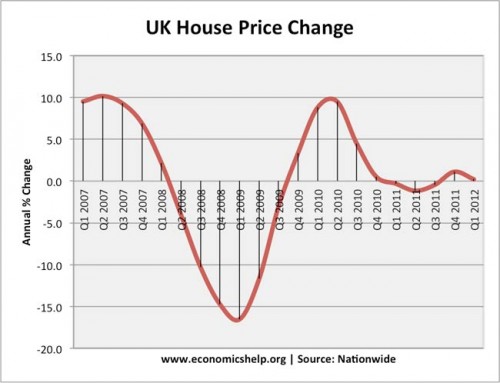

Since the financial crisis started in 2007, UK house prices have fallen. One of the main reasons for the initial fall of 20% was the drying up of mortgage finance. After the credit crisis, banks became short of liquidity and so reduced the amount of available mortgages. The number of approved mortgages fell rapidly leaving lower demand for housing, pushing down prices.

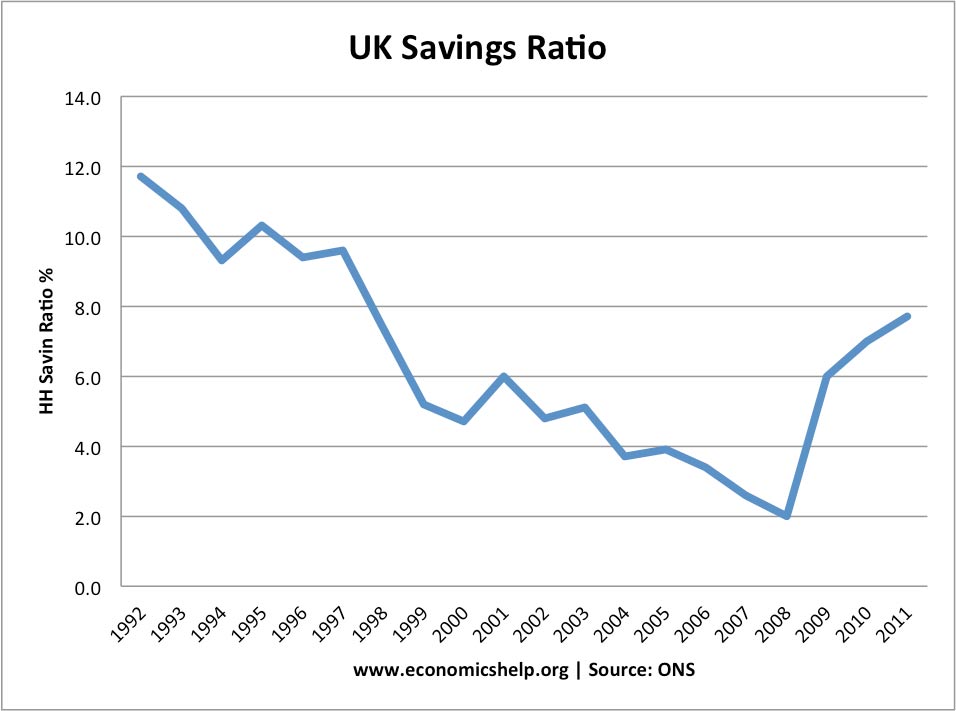

After the credit crunch, banks required homeowners to save a bigger deposit. (Remember before the crash 100% mortgages were available. Now, many banks require a 25% or 10% deposit). This deposit requirement meant that many first time buyers were priced out of the market and unable to buy. In 2008, the UK savings ratio was very low. This indicates that households had taken on more debt and had low levels of savings for a deposit. This was a factor in depressing house prices.

In the aftermath of the financial crisis, both financial institutions and households have been seeking to reduce debt levels and improve their reserves. This is why banks are more reluctant to lend and why households have increased their savings ratio.

Sharp increase in savings after 2008.

In addition, the economic recession also reduced demand for buying. This was due to the rise in unemployment, decline in consumer confidence and the threat of losing your job.

Government debt levels have caused the government to announce spending cuts. Since 2010, the economy has stalled due to austerity measures and problems in Europe. This second recession could cause further problems for the housing market.

House Price Falls Limited

The most recent data, suggests house prices have fallen by less than we might expect. UK house prices have fallen by less than countries, such as Spain and the US. House price to income ratios are still above long term trends. There has been a stagnation in house prices since 2009. Despite the economic recession, house prices have not fallen. This is because

- Low-interest rates have cushioned the impact of the recession and debt levels. Mortgages may be scarce, but at least mortgage payments are relatively low, unlike the 1990s. Interest rates are likely to remain low as economic growth is as fragile as it is at the moment.

- Limited supply keeping prices high. Unlike other countries, the UK has not had a housing building boom. The financial and economic crisis have curtailed further house building schemes and helped prevent excess supply

Could Debt Crisis Cause Second Fall in House Prices?

Some analysts fear that if the Eurozone breaks up and Europe enters a deep recession, the UK could see further falls in house prices. The UK has already entered a double dip recession and a further rise in unemployment could lead to less demand. If banks lose money from debt default in Eurozone, mortgage availability could dry up again.

This is a very pessimistic outlook but sadly most of it is said with good cause. The price to earning ratio has risen to 6:82 within the last three months. Therefore, the UK market is becoming a forever difficult one. Property agents such as Chesterton Humberts ( http://www.chestertonhumberts.com ) can offer advice and detailed reports on the housing market to make you more aware before you buy.