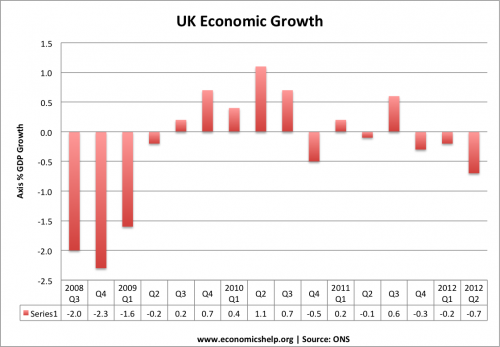

The UK economy contracted by a provisional -0.7% in Q2 2012. This is a much bigger decline than most analysts expected. It means more bad news for the UK economy, struggling to regain positive economic growth.

The biggest falls in economic output occurred in sectors such as:

- Agriculture – 2%

- Mining -5.9%

- Manufacturing – 1.4%

- Construction – 5.2%

Services only showed a small decline of -0.1%

- It means UK real GDP is 0.8% lower than corresponding period in 2011. Output is still well below the 2008 peak.

- It is hoped that these figures reflect poor weather and extra bank holidays. There is an expectation that the Olympics and improved weather should see a rebound in figures from a very disappointing base.

- However, although these figures may slightly exaggerate the UK’s economic woes, it is still very strong evidence of a sluggish economy – struggling to recover and return to normal growth figures.

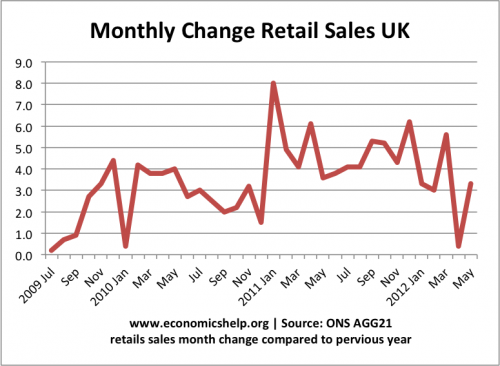

UK Retail Sales

source: ONS – retail sales

Contradictions in UK economy

Retail sales were more promising. All retail sales values in May 2012 are estimated to have increased by 3.3 per cent compared with May 2011. Also employment figures show some kind of recovery – employment up 200,000. Unemployment down 100,000 since 2011)

IMF Report on UK Economy

- The bad figures on GDP growth come shortly after an IMF report on the UK economy, which makes gloomy reading

- “the output gap is projected to remain large for an extended period and not close until 2018.”

- The IMF estimate that fiscal “consolidation has so far reduced GDP by a cumulative 2½ percent.”

IMF Recommendations for UK Economy

- Reducing interest rates from 0.5% to 0.25%

- If growth remains low, the government may have to abandon deficit reduction targets.

- Infrastructure spending with their high multipliers can play a role in improving growth.

Related

1 thought on “Double Dip Recession Deepens 2012”

Comments are closed.