The Chancellor George Osborne is coming under pressure to alter government policy and promote economic growth through higher public spending financed by government borrowing.

After two years of focusing on deficit reduction, critics argue the government should change approach and concentrate on getting the economy out of the persistent recession. The IMF recently stated:

“The planned pace of structural fiscal tightening will need to slow if the recovery fails to take off even after additional monetary stimulus and strong credit easing measures.”

In the past, the IMF have been a supporter of the government’s austerity policies.

Austerity in the UK

- Changes in government spending 2009-10 +4.6%

- Changes in Government spending 2010-11 +0.3%

- Change in government spending 2011-12 -1.5%

A common response to current crisis is to argue that there has been no austerity, and government spending is as high as ever. It is true that (thankfully) the UK has not embarked on austerity with the same intensity as Eurozone economies. But, the government’s fiscal position, and rhetoric has been focused on deficit reduction. In the middle of a recession, the minor, but still significant reduction, in government spending has contributed to lower GDP.

At a time of falling private sector investment and falling consumer spending, the economy needs a stimulus from other quarters. The government retrenchment has not ‘restored confidence’ as they hoped – it has done the opposite. (Confidence fairy explained)

Government spending has been cut, but, it is also true, the general public would guess the spending cuts are much greater than they actually are. This is because in the past two years, the government has given the impression that spending cuts are the most important policy for the UK economy. The frequent talk of austerity and deficit reduction has created a belief that we are facing much greater austerity than we actually are.

The talk of job losses, pay freezes and austerity has contributed to record low levels of consumer confidence. At a time when the economy needed positive news, the government have been doing the opposite.

After a third consecutive quarter of falling GDP, UK GDP is forecast to be 0% for 2012 – but forecasts have proved to be overly optimistic.

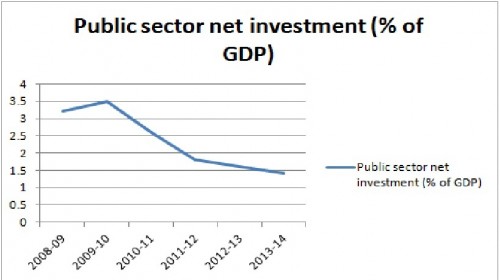

Government Net Investment as % of GDP

Source ONS | NTV

I have posted this graph quite a few times because some commentators are sceptical there has been any cut in government spending at all.

Reasons to Pursue Higher Public Sector Investment Through Borrowing

1. Liquidity trap

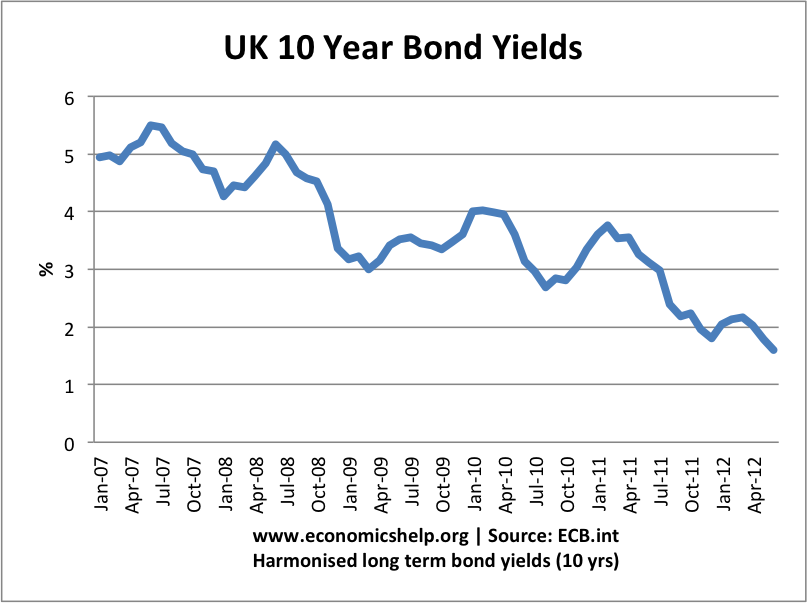

Despite higher government borrowing, UK bond yields have fallen. This is because the private sector has an appetite for the security of government bonds. Higher government borrowing will not cause crowding out in our current liquidity trap.

2. Weakness of Private Sector Demand

Private sector spending and investment have proved to be weak. There has been no evidence of crowding in (when government spending cuts have caused rising private sector spending). The sector with the biggest drop in output in the last quarter was construction. This is an area that the government could help through public sector investment.

3. Bond Markets Fear Recession as Much as Higher Borrowing

What causes unsustainable debt to GDP ratios? It is a continued fall in nominal GDP. Eurozone bond markets are under great pressure because countries are struck in an unenviable trap of falling GDP and falling tax revenues. The most important thing to make UK debt manageable is to return to a normal path of economic growth. When there is robust economic growth – then the economy can absorb spending cuts.

4. Austerity in a Boom

The UK does have long-term debt issues due to rising social security budget, demographic changes and pressures for government spending on health and education. But, these long-term budgetary issues will not be solved by short-term austerity. The time for austerity is during strong economic growth – not in a recession when the economy is in a double dip recession. Timing of austerity is very important.

5. Cheap To Borrow.

At around 1.4%, it is very cheap for the government to borrow. There are many public sector investment projects which will give a good long-term return. The private sector is not going to solve congestion on British roads. There is opportunity for the government to invest at a record low rate.

The government may claim that the fall in bond yields reflect market approval of their austerity, but you can look at it the other way and argue the rapid drop in bond yields shows there is no fear of debt default and the lower bond yields reflect pessimism over the economy and investing in the private sector.

6. Restore Consumer Confidence

The public have lost confidence in the government and the economy. We have come to expect austerity and recession. A commitment to boost economic growth through higher public sector investment could change that. Confidence will not be changed by mere empty words. A change in policy is needed.

7. UK is not like Greece / Spain / Italy

The Euro crisis does mean markets are scrutinising debt more closely, but the UK has the advantage of having its own single currency and independent Central Bank. That is why there is a huge difference between UK bond yields and those in the Eurozone. It is also worth remembering that the debt crisis in the Eurozone is as much about negative growth as it is about high debt.

Related

Re item No. 5, the idea public sector investment is currently a good idea because it is currently cheap for government to borrow, is barmy. The government / central bank machine can print any amount of money it wants anytime. Why on earth would it want to borrow?

Of course the stimulatory / inflationary effect of “print and spend” is more per pound than the “borrow and spend” option. But that just means that for a given stimulatory effect less money is involved under the former option than the latter.

Moreover, it takes time to get public sector investment projects going, by which time the recession may be over.

In short, the entire “borrow and invest” argument is complete hogwash: which explains why it’s so popular with our economically illiterate elite.

Brilliant, thanks Ralph.

Short of using the words “sheeple” and “illuminati” I cannot see how your comment could have been more ridiculous. A work of art. Thanks for the inadvertent boost you just gave to the left 😀

What do you think of this?

http://www.bbc.co.uk/news/business-21589128#TWEET627777

interesting. Largely untried. In theory may encourage banks to lend. But, it’s hard to know how effective