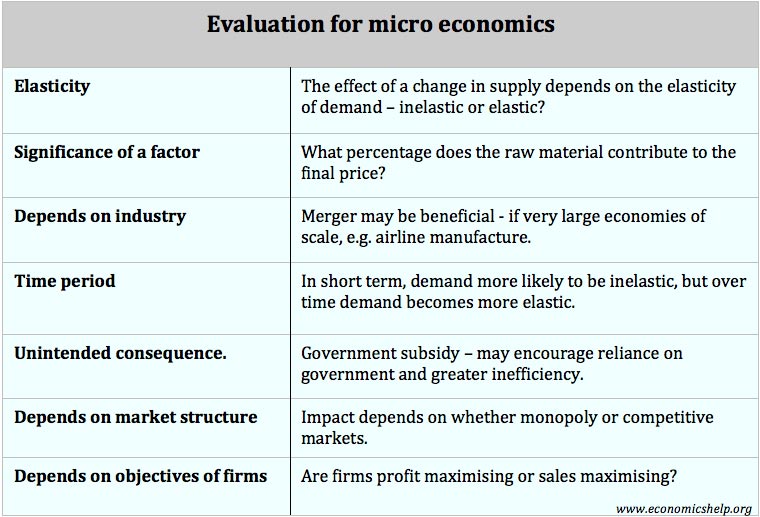

Evaluation is the ability to look at issues from a critical perspective; to look at other potential outcomes. Evaluation questions will typically begin with words like, discuss, evaluate, to what extent, assess.

These are some ways to get evaluation marks for microeconomics. (note there are potentially more ways to evaluate but this gives a few ideas)

1. Elasticity. e.g the effect of a tax increase depends upon the elasticity of demand. If demand for cigarettes is inelastic, a tax will be relatively ineffective in reducing demand. However, if demand for a good is quite price elastic, then a tax increase will reduce demand significantly. If we look at the effect of a minimum wage or trade union, the impact will also depend on the elasticity of demand. For example, if demand and supply are inelastic, then the impact of a minimum wage on unemployment will be relatively small.

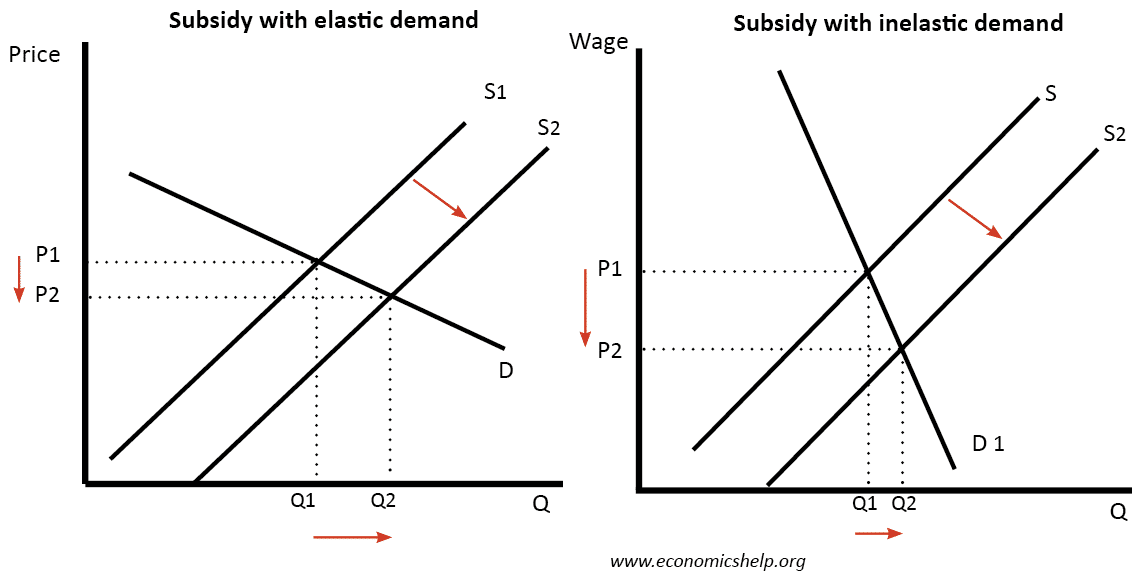

The impact of a subsidy depends on the elasticity of demand

If demand is price elastic (e.g. diagram on the left, then a subsidy causes a bigger percentage change in demand. If demand is price inelastic, then a subsidy only causes a small rise in demand.

2. Significance A rise in the price of oil has a significant impact on the costs of firms. A rise in the price of water is much less significant.

For example What is the impact of a rise in the price of coffee beans on coffee shops like Starbucks? Estimates suggest that coffee beans only account for 2% of the final price of a Starbucks, therefore it will be relatively insignificant. Starbucks would be more greatly affected by a change in city centre rents or an increase in the minimum wage.

For a question on – discuss why women get lower wages than men, you could one reason why women get lower paid than men is men tend to gain more qualifications. However, this point is relatively insignificant because women’s academic qualifications have, more or less, caught up with men and so this point is no longer so significant as it was 40 years ago.

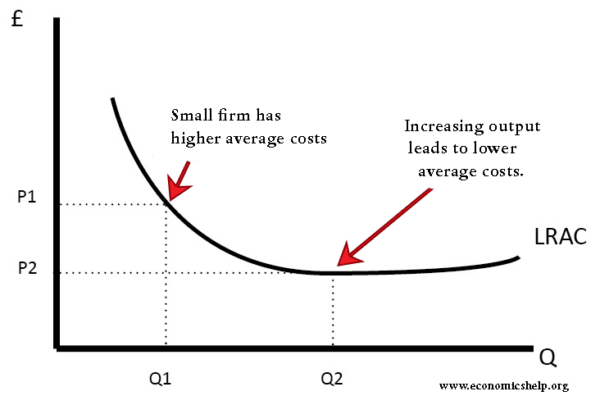

3. Depends on the industry. If we are examining whether a merger is in the public interest, it depends very much on the industry in question. For example a merger between two firms in the car industry may enable significant economies of scale, because in that industry there are high fixed costs. However, if the merger was between two firms in the retail business, the scope for economies of scale is much less. Therefore, the Competition and Markets Authority will look at the scope for economies of scale in the industry.

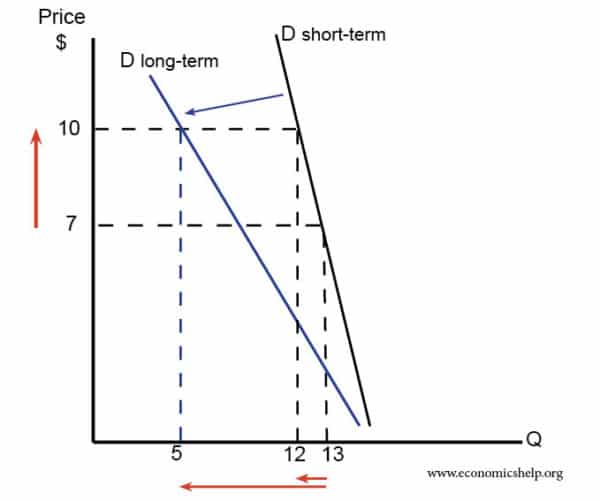

4. Short Term / Long Term. The impact of a rise in oil prices in the short term is likely to involve only a small fall in demand because demand is inelastic. But, over time demand becomes more elastic as people start to find alternatives to oil, such as hybrid cars. Therefore, the effect of rising oil prices will be different in the long term to the short term.

5. Government intervention may always lead to government failure

E.g. government subsidies may encourage inefficiency because firms start to rely on government handouts. This is an unintended consequence. The EU Common Agricultural Policy (CAP) involved subsidies to ensure minimum prices but this caused an increase in supply and the cost proved much higher than expected.

6. Depends on market structure

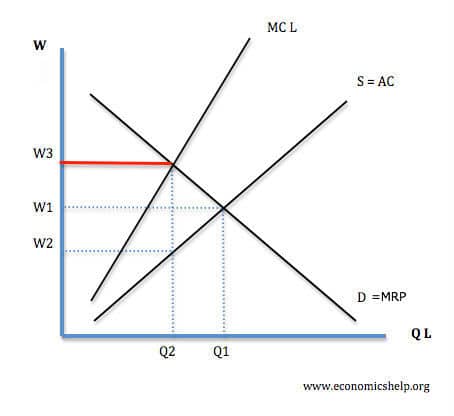

The effect of a trade union depends on whether it is operating in a competitive market or monopsonistic market.

7. Depends on the objective of firms

For example, a profit maximising firm is more likely to collude. A firm seeking to maximise market share is more likely to start a price war. Useful for a question on – Discuss how firms in Oligopoly compete?

See: Objectives of firms

8. Depends on contestability of market

A merger may be OK, if the market remains contestable. But, if there are barriers to entry the merger may reduce competition too much.

Related