Readers question: What is the difference between tax and inflation?

Tax is a way for the government to raise revenue. It includes charges placed by the government on goods/income. For example, VAT is a tax which means consumers have to pay an additional 20% of the price in the form of tax which goes to the government.

Inflation means a rise in living costs – a rise in the price of living. It is measured by Consumer Price Index (CPI).

The inflation tax

Some economists, such as Milton Friedman suggest that, under certain circumstances, inflation can become an effective form of tax. The effects are not immediately obvious, so they have a certain political appeal.

- Suppose that inflation is 0%, and the government borrow $10 billion.

- Households purchase government bonds expecting a bond yield of say 3% and inflation of 0%.

- However, suppose the government increase borrowing to $20 billion, but the government don’t want to raise tax. Instead, they print money to finance the extra spending.

- In this case, the government finances its extra borrowing by increasing the money supply. It finances its debt – however, by increasing money supply faster than growth in real GDP, it causes inflation (e.g. inflation of 5%).

- This means that those households who bought government bonds expecting inflation of 0% are now seeing inflation of 5% and therefore a fall in the real value of their bond. Although they do not pay a tax directly, inflation has eroded the real value of their wealth, and so it is effectively a hidden tax.

- The government have quietly financed extra borrowing through increasing the inflation rate – but, the original bond-holders lose out.

- See also: understanding bonds

Inflation can also give extra gains to the government

- Bracket creep. If the income tax threshold is $10,000. Inflation will mean wages rise and therefore more people earn above the tax threshold. Therefore more will pay income tax.

- Reduction in real national debt as % of GDP. Inflation makes it easier to reduce real debt as a % of GDP.

Evaluation

It is important to note inflation/increasing money supply is not always a form of a hidden tax.

- In a recession/liquidity trap – the Central bank can increase the money supply – without causing inflation. For example the period 2009-17 – we saw a rapid growth in the monetary base – but inflation remained low. Therefore, it depends on economic circumstances and underlying inflationary pressures.

- It depends on inflation expectations. Governments can only keep reducing the real value of debt by inflation – if inflation expectations are consistently wrong. If the government keep increasing the inflation rate above expectations – investors will lose confidence. For example, if you are worried about inflation – you can buy index-linked bonds which means a rise in inflation automatically leads to higher interest payments – the bondholder is protected from unexpected inflation.

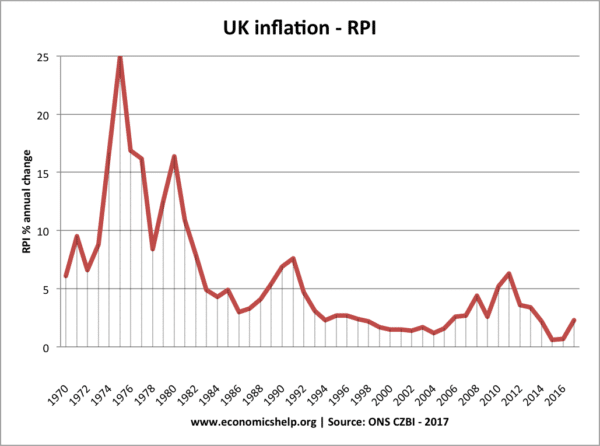

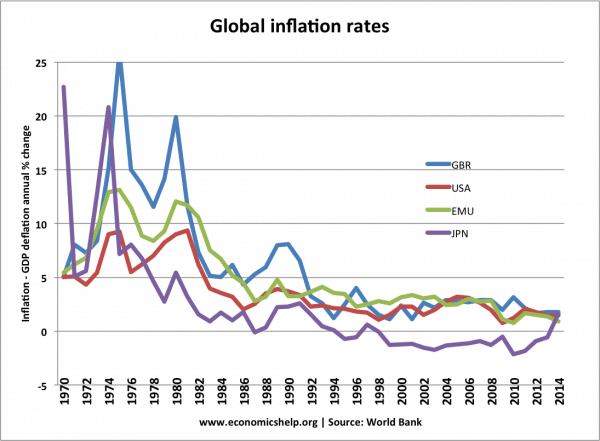

- In the 1970s, inflation proved higher than expectations at the start of the decade. It is true that in the 1970s, inflation did erode the real value of bondholders – while governments benefited from the reduction in the real value of debt as % of GDP. However, as a consequence, bondholders started demanding higher bond yields to compensate for the increased risk.

- Income tax and corporate tax brackets can be index-linked. If inflation is 3%, then tax thresholds can rise by 3%

If anything global inflation rates have been falling in past few decades.

What is the link between indirect tax and the inflation rate?

If the government increased the rate of excise duties (a tax on petrol/alcohol) or increased VAT – then we would get an increase in the price of goods. The above diagram shows the effect of a tax on a good.

This would cause a temporary rise in the rate of inflation.

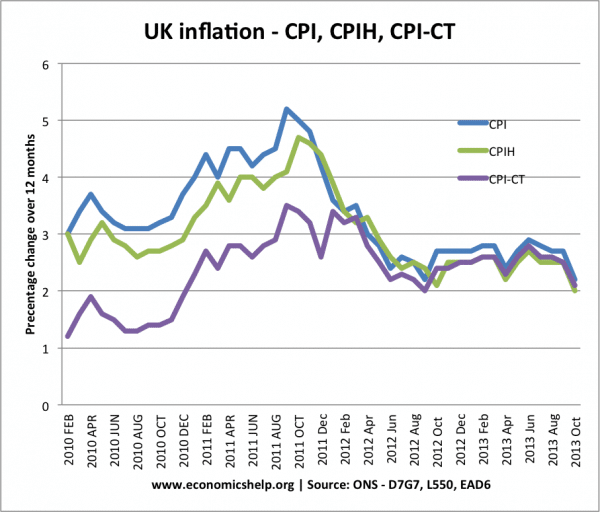

- In Dec 2009, UK VAT increased from 15% to 17.5%.

- In Jan 2011, the government increased VAT from 17.5% to 20%

- This partly explains why there was an increase in the inflation rate – goods rose in price during this period.

- The purple line CPI-CT is inflation minus the effect of taxes. In this period of rising VAT rates 2010-2011, the ordinary inflation rate CPI was higher than the rate of inflation which ignores the effect of inflation.

- This shows how higher indirect taxes can lead to a temporary rise in inflation. However, it tends to be just a temporary effect, which is why policymakers often ignore the effect of tax in making interest rate decisions.

What is the relationship between income tax and inflation

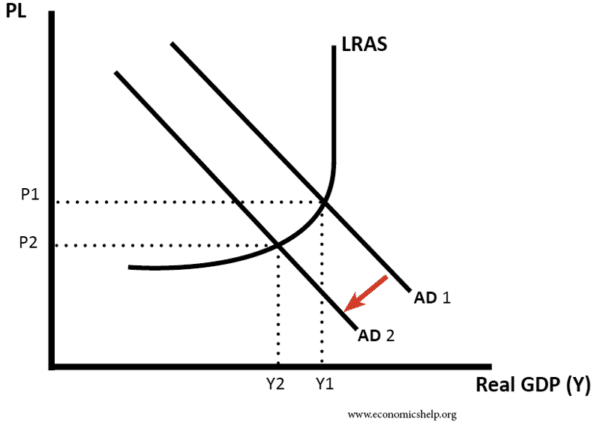

If there is an increase in income tax rates – this will not cause inflation. If anything, it will lead to a lower rate of inflation. Higher income tax will reduce disposable income and therefore spending; this will cause a fall in aggregate demand. Ceteris Paribus this will lead to a lower rate of inflation.

What about the statement inflation is a disguised form of tax?

Related

We don’t use singular in English “tax on a good”

Better to write “tax on any goods”