Readers Question: According to my syllabus I need to be able to evaluate the role and the benefits and disadvantages of capital inflows from MNC’s in an EU context. Could you give me a hand?

Capital inflows from Multi-National Companies (MNCs) refer to inward investment from MNC into European economies.

Capital flows can also involve the purchase of assets, such as property, assets and government bonds.

The effect of these capital inflows involves increased levels of Investment. MNCs inject investment into the economy. This causes several benefits for the economy.

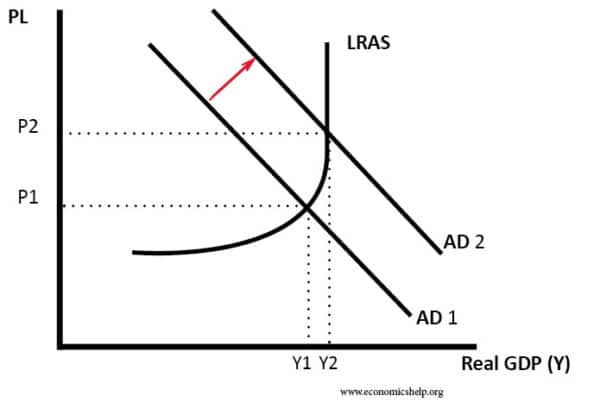

1. Increased Aggregate Demand As a component of AD, higher Investment will boost AD, causing improved economic growth. This should lead to lower levels of unemployment.

- However, as a percentage of total Aggregate Demand, inward investment from MNCs are quite small. Therefore, the impact on AD may be quite limited.

- The effect of increased AD depends on the situation of the economy. For example, when Ireland had low growth and high unemployment, inward investment helped to boost the economy. However, if the economy is close to full capacity, increased AD may cause inflation.

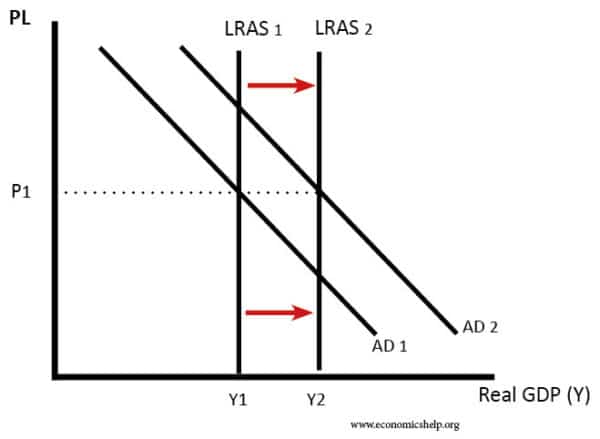

2. Increased productive capacity. Inward investment will not only increase AD but also increase Aggregate Supply. Investment in new factories increases productive capacity, and AS should shift to the right. This enables an increase in economic growth without inflation.

3. Technological improvements. MNCs may not only invest in new capacity. They may also introduce new working practices that help increase labour productivity. For example, when Japanese firms invested in the UK, it was said that they helped to improve labour relations and get more out of the workforce. Japanese firms introduced new practices such as ‘Just in time management’ and a less confrontational attitude between workers and managers. Therefore, it can contribute to increased labour productivity.

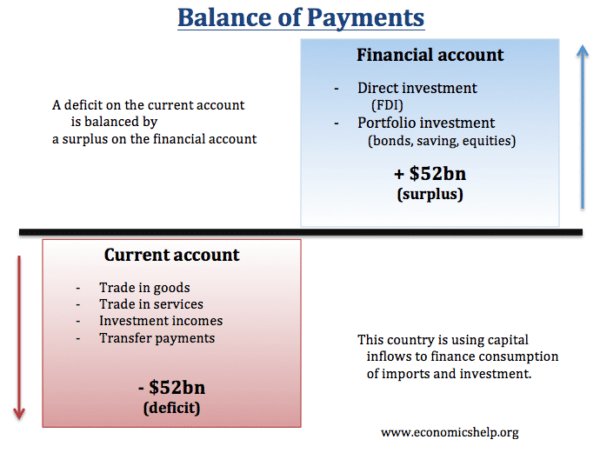

4. Surplus on the Financial Account of the Balance of Payments

Capital inflows from abroad can help to finance a current account deficit. Through attracting capital flows, it enables UK households to effectively import more goods and services. Without these capital inflows, a current account deficit would lead to a devaluation in the exchange rate to restore equilibrium in the balance of payments.

5. Lower Prices for Consumers

Investment from foreign firms offers the chance for goods to be produced more efficiently and could lead to lower prices for domestic firms.

6. Finance public sector debt

Capital flows which involve foreigners buying UK government bonds – means it is easier and cheaper for UK to finance its government borrowing.

Potential disadvantages of capital inflows

Potential Capital outflows. If foreign firms increase their capital holdings in the UK, it means that the UK becomes more dependent on the health of other economies. For example, a severe recession in Japan, may cause Japanese firms to withdraw from the UK economy, leading to job losses.

- However, in an era of globalisation, it is not really possible to insulate the UK economy from global effects. Also, despite the slowdown in the Japanese economy, most Japanese investment continued in the UK.

Domestic firms may lose out to the new multinational firms. For example, local coffee shops may lose out to bigger chains, such as Starbucks. We can get increase homogonesiation of products

Tax avoidance. An issue is that large multinationals like Facebook, Apple and Google have moved to countries with the lowest corporate tax rates. For example; Amazon – Luxumberg, Google in Ireland. This power of multinational companies to choose the lowest corporate tax rates means it encourages tax competition – with countries feeling they have to cut corporate tax to remain competitive. As a result, global corporate tax rates have fallen in recent decades putting a bigger burden on consumers and workers. (tax competition)

Distorted asset markets. Capital inflows can also include the purchase of property and assets. Foreign firms and individuals have played a considerable role in buying UK property and investing in new property development – especially in London. On the positive side, we could see this as investment in the UK economy and providing funds for building new property. But, in an overheated property market, it has had the effect of pushing property prices above long-term price to income ratios making them less affordable for average workers. Some have called for limits on the foreign ownership of UK property.

Money laundering. Another concern is that foreign money gained by illegal or semi-illegal ways is effectively laundered by investing in UK property.

Related