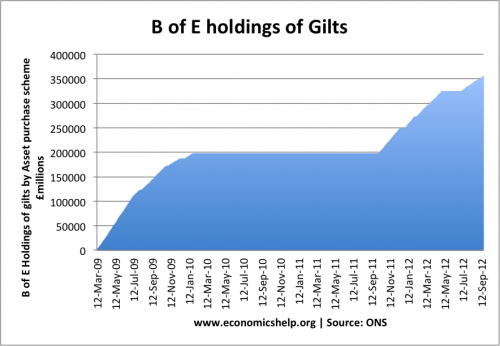

Between 2009 and 2015, the Bank of England has been authorized to create £375bn of assets by the creation of central bank reserves. This new money was used to purchase government gilts.

The theory is that by creating extra money and buying gilts from financial institutions, there would be an increase in the money supply and increase economic activity.

- Banks would have more liquidity because they have sold gilts to the Bank of England and received cash instead.

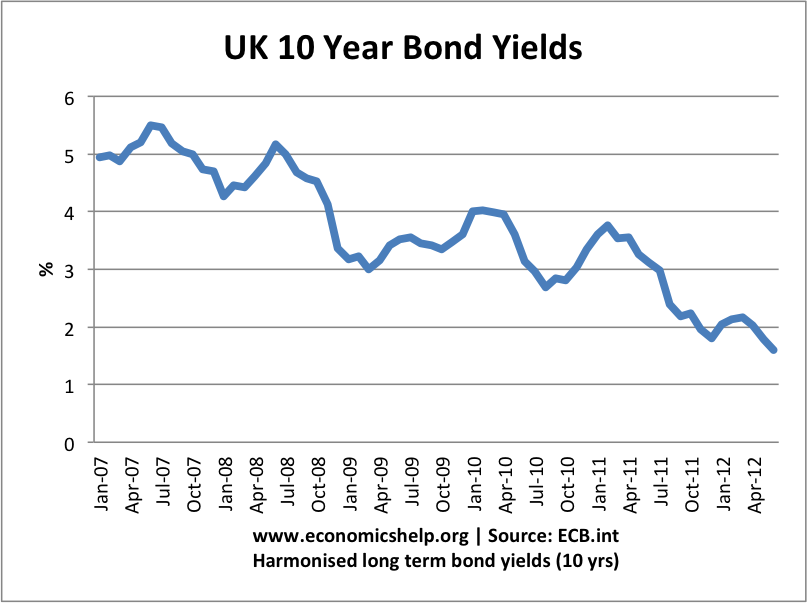

- Secondly, the asset purchase scheme was intended to reduce bond yields on government gilts. With lower interest rates on bonds, banks have more incentive to lend money on more profitable investments.

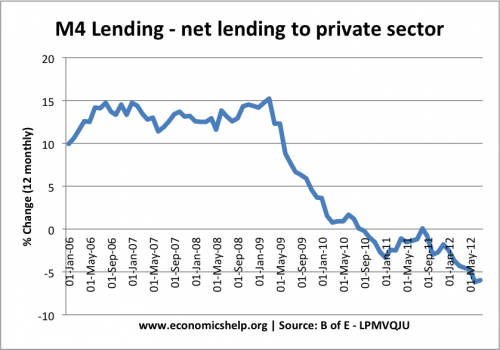

However, despite falling bond yields, and a rapid growth in the Bank of England’s balance sheet as it purchases more government gilts, we have seen a fall in the broad money supply. M4 lending falling 6% in the past 12 months.

In the past four years the stock of outstanding loans to non-financial companies has shrunk by 17% from its peak, to £420bn in June this year.(BBC)

John Walker, national chairman of the Federation of Small Businesses, recently said:

“Four in 10 small firms were refused [bank credit] in the second quarter and this needs to change if the economy is to grow.

The implication is that in a liquidity trap and depressed money, creating money does not necessarily lead to a growth in the money supply and inflationary pressures as classical theory may predict.

In short, banks may have greater liquidity but they haven’t been lending this extra money to business. Banks feel in the current economic climate, any private sector business lending is risky. Consumer demand is weak, therefore banks are taking this opportunity to improve their balance sheets rather than increase lending.

Does this mean Quantitative Easing has been a Failure?

It is hard to quantify. Without quantitative easing, there may have been a bigger fall in money supply and an even deeper recession. The fall in money supply and bank lending shows the extent of the adverse economic situation as a result of the overhang from the financial crisis. It also shows the limitation of this particular form of unorthodox monetary policy.

Alternatives to Quantitative Easing

The current problem with quantitative easing is that the government can’t force banks to lend to the private sector. However, the government are concerned that lack of finance is still holding bank business from investment. Therefore, there have been proposals for a government bank to lend directly to firms and bypass commercial banks.

Funding for Lending

The Bank of England has launched a new ‘Funding for lending’ scheme where the Bank of England helps underwrite loans and helps decrease the cost of lending. So far five major banks have signed up for the scheme. BBC

- Banks and building societies can initially borrow Treasury bills up to 5% of the amount they currently lend

- They will be charged just 0.25% interest, much lower than the going rate

- The banks use the Treasury bills as backing to buy money cheaply on the financial markets. It is this money that they then lend out.

Quantitative easing in the US

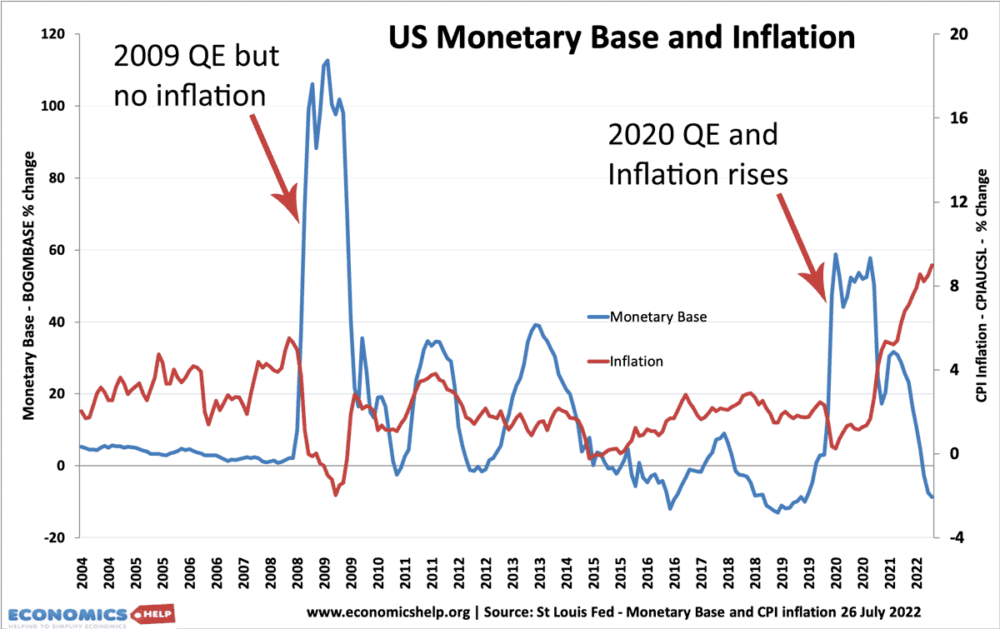

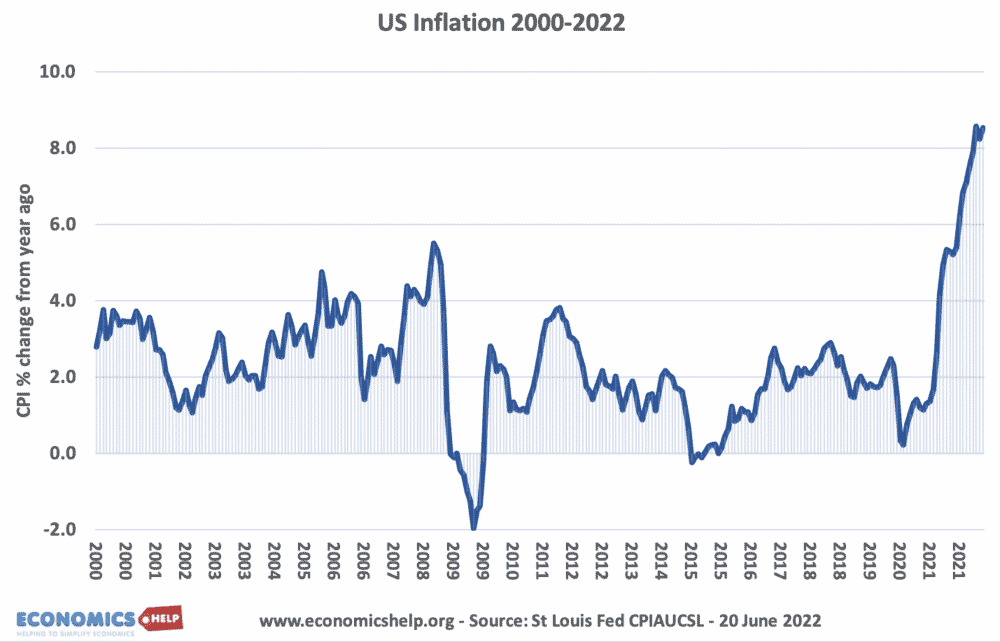

In 2009, quantitative easing had little impact on inflation. But, in 2020, less quantitative easing had a bigger impact on promoting a strong economic recovery (at cost of higher inflation.)

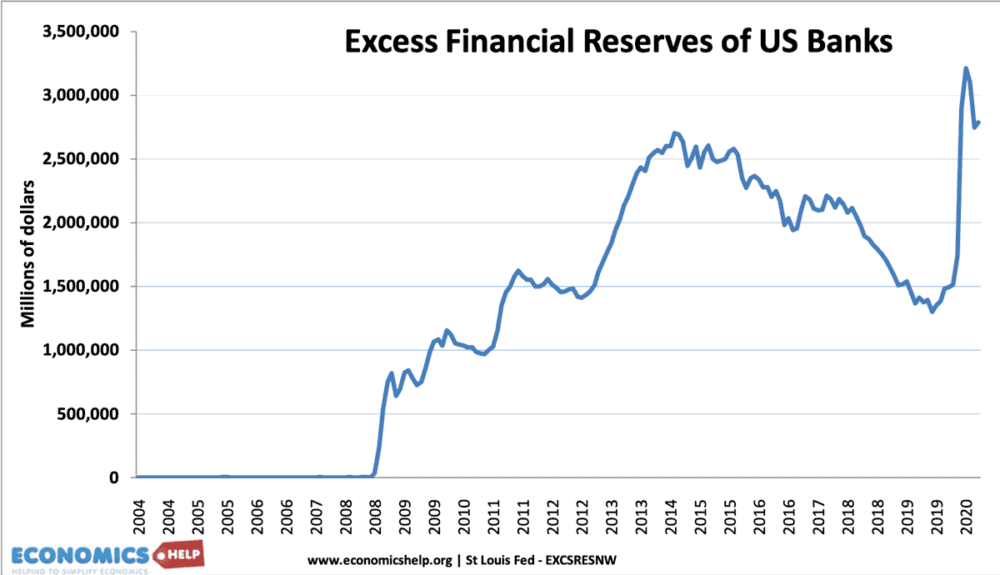

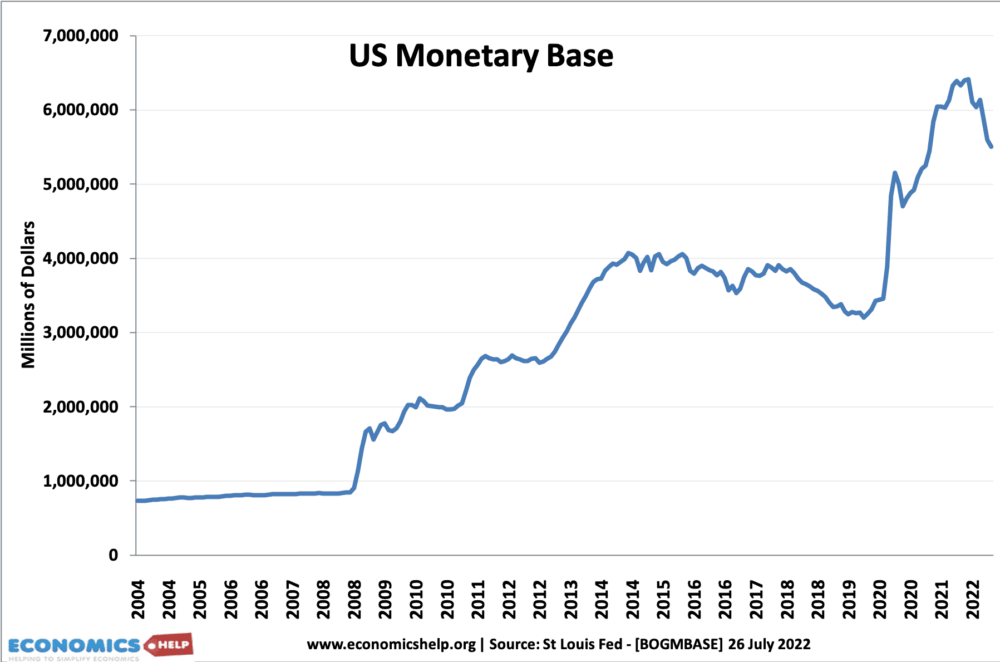

In 2008/09 the Federal Reserve increased the money supply (monetary base) by over 120%. But, this did not cause inflation. In fact, the US experienced temporary deflation. The main reason is that banks increased their reserve ratio. Essentially banks received extra money from Federal Reserve, but did not want to lend it to ordinary firms and households. Therefore, the extra money supply did not reach the wider economy and there was no inflationary impact.

The Federal Reserve created money to buy bonds from commercial banks. Banks saw a rise in their reserves.

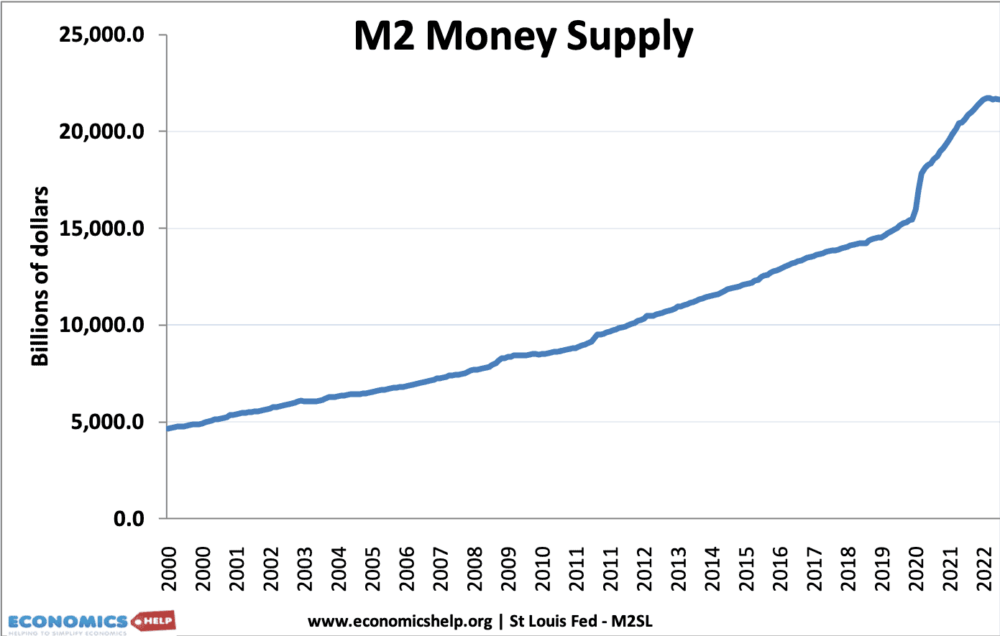

However, commercial banks didn’t lend this money out. Therefore the growth of the broader money supply (M2) didn’t change much.

What happened is that from 2009-2015, commercial banks didn’t want to lend this extra money. But, in 2021, there was strong demand for loans and banks were willing to lend.

The US inflation rate was largely unaffected by the 2009 increase in the monetary base. Stripping out volatile cost-push factors (food and fuel), core inflation remained below the 2% inflation target. But, in 2021, the increase in money supply did cause inflation.

Related

Alan Sugar says banks are right not to lend. Given the choice between accepting the opinion of a successful businessman and alternatively, the opinion of a bunch of politicians most of whom haven’t got a GCSE in economics and couldn’t run a whelk stall, I tend to favour Alan Sugar. See:

http://www.dailymail.co.uk/news/article-2114287/They-win-Alan-Sugar-defends-banks-restraint-lending-small-business.html