Readers Comment. Why doesn’t the Bank of England just print the money instead of borrowing the money?

Printing more money doesn’t increase economic output – it only increases the amount of cash circulating in the economy. If more money is printed, consumers are able to demand more goods, but if firms have still the same amount of goods, they will respond by putting up prices. In a simplified model, printing money will just cause inflation.

Video explanation

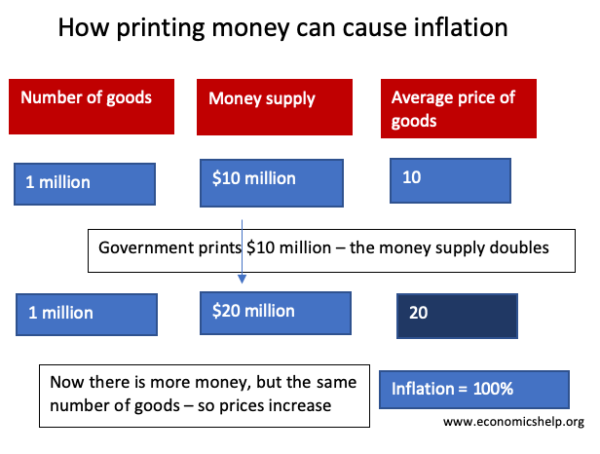

How printing money causes inflation – Example

- Suppose an economy produces $10 million worth of goods; e.g. 1 million books at $10 each. At this time the money supply will be $10 million.

- If the government doubled the money supply, we would still have 1 million books, but people have more money. Demand for books would rise, and in response to higher demand, firms would push up prices.

- The most likely scenario is that if the money supply were doubled, we would have 1 million books sold at $20. The economy is now worth $20 million rather than $10 million. But, the number of goods is exactly the same.

- We can say that the increase in GDP is a money illusion. – True you have more money, but if everything is more expensive, you are not any better off.

- In this simple model, printing more money has made goods more expensive, but hasn’t changed the quantity of goods.

Doubling the money supply, whilst output stays the same, leads to a doubling in price and inflation rate of 100%

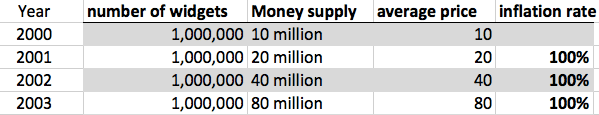

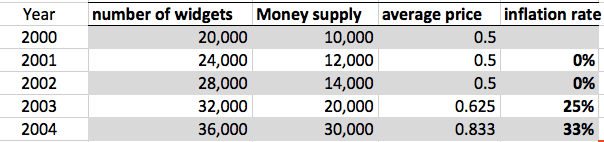

- From the year 2000 to 2001, the money supply increases without inflation.

- In 2001, the money supply increases 20%, and the number of widgets increases 20%. Therefore, prices stay the same – the extra money is matched by an equivalent rise in the money supply.

- It is only in 2003 when the money supply increases from 14,000 to 20,000 that the money supply increases at a faster rate than output and we start to get rising prices.

Problems of inflation

Why is inflation such a problem?

- Fall in value of savings. If people have cash savings, then inflation will erode the value of their savings. £1 million marks in 1921 was a lot. But, due to inflation, two years later, your savings would have become worthless. High inflation can also reduce the incentive to save.

- Menu costs. If inflation is very high, then it becomes harder to make transactions. Prices frequently change. Firms have to spend more on changing price lists. In the hyperinflation of Germany, prices rose so rapidly that people used to get paid twice a day. If you didn’t buy bread straight away, it would become too expensive, and this is destabilising for the economy.

- Uncertainty and confusion. High inflation creates uncertainty. Periods of high inflation discourage firms from investing and can lead to lower economic growth.

Printing money and national debt

Governments borrow by selling government bonds/gilts to the private sector. Bonds are a form of saving. People buy government because they assume a government bond is a safe investment. However, this assumes that inflation will remain low.

- If governments print money to pay off the national debt, inflation could rise. This increase in inflation would reduce the value of bonds.

- If inflation increases, people will not want to hold bonds because their value is falling. Therefore, the government will find it difficult to sell bonds to finance the national debt. They will have to pay higher interest rates to attract investors.

- If the government print too much money and inflation get out of hand, investors will not trust the government and it will be hard for the government to borrow anything at all.

- Therefore, printing money could create more problems than it solves.

- See also: Printing money and national debt

Hyperinflation in Germany during the 1920s

Inflation was so bad in Germany that money became worthless. Here a child is using money as a toy. Money was used as wallpaper and to make kites. Towards the end of 1923, so much money was needed, people had to carry it about in wheelbarrows. You hear stories of people stealing the wheelbarrow, but leaving the money.

Printing more money is exactly what Weimar Germany did in 1922. To meet Allied reparations, they printed more money; this caused the hyperinflation of the 1920s. The hyperinflation led to the collapse of the economy.

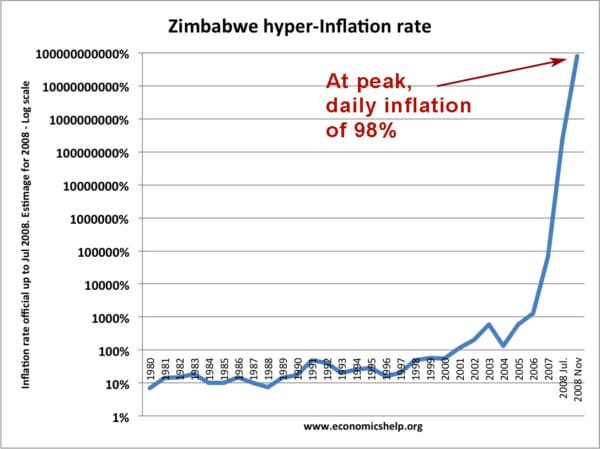

Hyperinflation also occurred in Zimbabwe in the 2000s.

Printing money and the value of a currency

If a country prints money and creates inflation, then there will be a decline in the value of the currency.

- Suppose inflation in Germany is 100%, and inflation in the UK is 0%.

- This means German prices are doubling compared to the UK.

- You will need twice as much German currency to buy the same quantity of goods.

- The purchasing power of the German currency is declining, therefore the value of mark will fall on exchange rates.

- See also: Printing money and the exchange rate

Value of one German Mark to US Dollar 1922-23

Hyperinflation in Germany causes a rapid fall in the value of the German mark to the dollar.

In a period of hyperinflation, investors will try and buy a stable foreign currency because that will hold its value much better.

Real Life example of Money Supply and Inflation

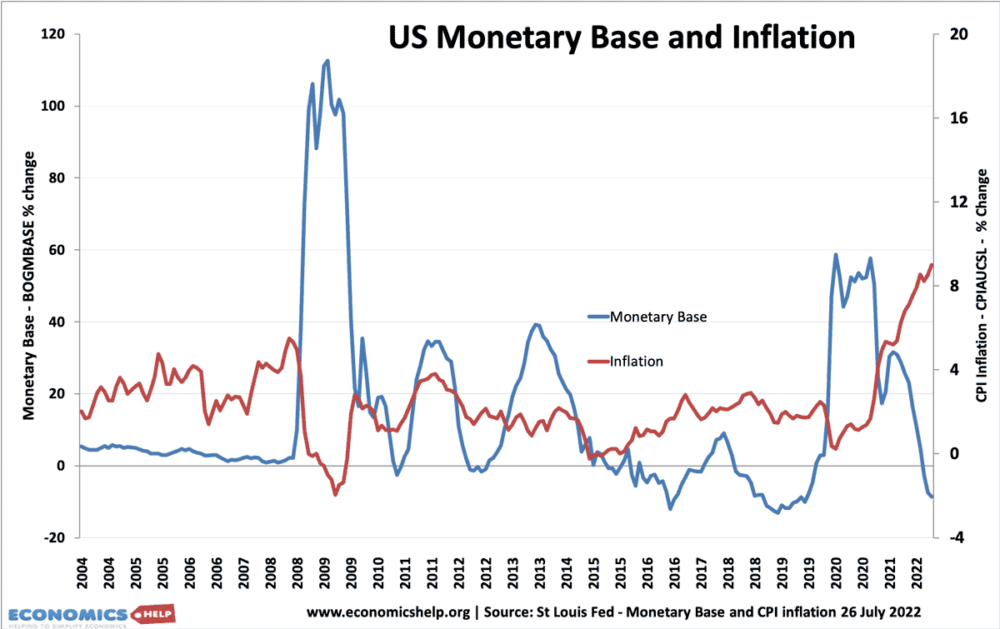

In a recession, with periods of deflation, it is possible to increase the money supply without causing inflation.

This is because the money supply depends not just on the monetary base, but also the velocity of circulation and the willingness of banks to lend. For example, if there is a sharp fall in transactions (velocity of circulation) then it may be necessary to print money to avoid deflation,

In the liquidity trap of 2008-2012, the Federal reserve pursued quantitative easing (increasing the monetary base) but this only had a minimal impact on underlying inflation. This is because although banks saw an increase in their reserves, they were reluctant to increase bank lending.

However, if a Central Bank pursued quantitative easing (increasing the money supply) during a normal period of economic activity then it would cause inflation. In 2020, quantitative easing was pursued and a year later, inflation in the US rose. (though inflation also rose due to higher oil prices)

Related

Last updated: 26th July 2022, Tejvan Pettinger, www.economicshelp.org, Oxford, UK

Hi

I would be grateful if any one had any thoughts on the following question.

I understant that if a government were to print more money and circulate it into its own economy, that this would inevitably lead to increased inflation in its country. Sound argument for not printing more money.

But why would a country not print more money to purchase from other countries (e.g. to repay debt or to purchase raw materials). Wouldn’t the extra money then simply be dumped into the other country, leading to higher inflation in that country and not your own? Or perhaps is the answer that in dumping the extra money overseas, you are indirectly creating more money in your own territory?

Maybe a naive question but I would love to have a good answer to it!

Many thanks

AG

Hmmm….does printing money cause more or less inflation than borrowing from institutions who lend on a fractional reserve system?

The reason the Govt borrows is because the king (&country) got conned by William Patterson in 1694 and has been screwed ever since.

This explanation completely ignores the fact that when the government “borrows” money from the Central Bank that’s exactly what it does. It creates the money out of thin air and gives it to the government to spend in exchange for Government debt (i.e. IOU’s).

Not only that, but through the process of fractional reserve banking private banks use the Central Bank’s “new money” as the basis for increasing the money supply by an additional 1,000% (10X) through private lending.

Adding insult to injury, not only does the current system multiply the inflationary impact of government deficit spending (10X as much as if the government had simply been honest and printed the money itself), but it also requires the government to levy additional taxes on our children to “repay” the principal and interest on the original “loan”.

The fact is, if the government cut out the middleman and used seignorage (i.e. the government’s power to levy an indirect tax on its citizens by simply printing more money) we would all be much better off (at the expense of the bankers).

Printing money does NOT necessarily cause inflation. There are obvious instances of where printing very large amounts of money HAS caused inflation, e.g. Germany in the 1920s and Zimbabwe today. But print the right amount at the right time and the results with luck can be entirely beneficial. Here are some examples of where money printing is not inflationary.

1. The instance cited above, namely paying off the national debt with newly printed money. Japan has printed large amounts of money and bought back national debt over the last ten years. This goes by the fancy name “quantitative easing”. The idea is to drive down long term interest rates with a view to simulating demand. Unfortunately this ploy has had precious little effect in Japan (on inflation or anything else). One of the reasons for the non effect is not too difficult to fathom: holders of national debt regard it as SAVINGS – they are not going to run out and spend this just because a tranche of savings are converted from government debt to cash. They’ll just plonk the cash in a deposit account. Put another way, expanding the money supply depends crucially on what people do with the newly printed money. If they don’t do much with it, there will be no effect.

2. Given a recession, it is entirely reasonable to print a bit of money with a view to stimulating demand and getting employment levels back to normal. Prof Joseph Stiglitz has been saying for years that Japan ought to do this. If governments can print exactly the right amount, the effect would be to bring employment levels back to normal with minimal inflation. There is also a discussion at a Financial Times site on the merits of printing money: http://blogs.ft.com/wolfforum/2008/12/central-banks-need-a-helicopter/

However, it is questionable as to whether governments have the skill to print exactly the right amount. Milton Friedman claimed that governments do not have this skill and that the best option was to go for a small annual money supply increase, while allowing booms and recessions to work themselves out.

Thanks.

I recently wrote a post here: saying how increased money supply wasn’t causing inflation in US https://www.economicshelp.org/2008/12/money-supply-and-inflation-in-us.html

The example of 1 million books is good but forgets one thing. There is a recession and although he may have 1million books the problem is only half of them have sold and probably at a discount too. Put more money in peoples pockets and maybe he can stop discounting and sell more of the million. This would increase GDP and stop deflation too. The trick would be to not put so much money out that demand for the books dosen’t exceed the 1million available. Simple eh!

I’m confused, please help!

Say, eg, the govt printed money to double the money supply for every 1million currently in circulation, thus making 2million, would my savings of 1million then be worth half million?

Can anyone answer AG’s wonderful question? I’m struggling withg it myself. Just to repeat his question :

Hi

I would be grateful if any one had any thoughts on the following question.

I understant that if a government were to print more money and circulate it into its own economy, that this would inevitably lead to increased inflation in its country. Sound argument for not printing more money.

But why would a country not print more money to purchase from other countries (e.g. to repay debt or to purchase raw materials). Wouldn’t the extra money then simply be dumped into the other country, leading to higher inflation in that country and not your own? Or perhaps is the answer that in dumping the extra money overseas, you are indirectly creating more money in your own territory?

Maybe a naive question but I would love to have a good answer to it!

Many thanks

AG

I do not understand “printing money”.I take it is not borrowed through gilt sales so where and how does it appear in the governments figures?

Now hold on a minute! This article is bogus. You can simply print more money and destroy the money slowly over a longer period from taxes collected. This is the equivalent of interest-free borrowing. And therefore would not lead to inflation in the long term.

To answer the question about using printed money to buy goods from other countries: it comes to the same thing because those printed pounds will always end up with somebody, and those pounds will inevitably come back to the UK, because no other country besides the UK accepts pounds! So to avoid inflation, the government should destroy the money over time from taxes like I’ve said. By the way I’m not an economist, just figuring it out like you folks. I’m right, am I not?

Printing money by a government, might not lead to inflation, if that government handles that printed money wisely. Take the US and other Western economies that are in trouble today because of the credit failure by banks and financial institutions.

If I were one of those governments looking to get out from under these financial problems by “printing” my way out I would do it this way to solve the problem and prevent any form of inflation that might result from that “printing”.

First, the money that I “print” I would give directly to the “people” in the form of a 33 year interest-free loans limited to $400,000 dollars per. Instead of giving it to any industry or business. This way would get the money into the economy quicker, more efficiently and have a better affect on the economy than going through the regular business cycle and hope they lend it out.

This method lets the borrower pay-off all his interest-burdened monthly debt: mortgage, credit cards, student and auto loans etc. Lowering the borrowers monthly costs substantially allowing him to either save or spend that positive differential created by ridding himself of the interest on his debt and the extention of his principal out over 33 years. While at the same time re-capitalizing those finacial institutions that held that debt. This would keep government out of business’s business and solve two problems using the same dollar a two-for-oner.

To prevent any inflation from this printing the government, as those loans are repaid, would take that money out of the economy. And the banks, having received a large influx of capital, would only lend out what they would have been repaid over the year had nobody defaulted on their debt.

Though trillions were printed only a 1/33 of the money would be affecting the economy at any given time. So, at most, inflation would be around 3%. Had the money been borrowered we be paying about 6% compounding for years.

hey the quetsion which AG asked is very good i was thinking about solution so just trying to find the answer through applying accountacy i dont know may be i am wrong……..when u print money and pay off your debt with it to other country the debt on the laibility side of the balance sheet is wipped off but your assets standing as it is so your balance sheet will not tally….where will you put the diffrence….? well i think this may be a wrong solution but if any of you have the anwer then please reply

The biggest problem with government printing money is that banks regard it as their prerogative and is the source of all their income. Since, under a fractional reserve banking system, banks lend out between 10x and 30x what depositors invest, banks have created between 90% and 97% of all the money in use and they charge interest on all that money. If government stepped in to create money instead, the banks in their current lucrative form would cease to exist.