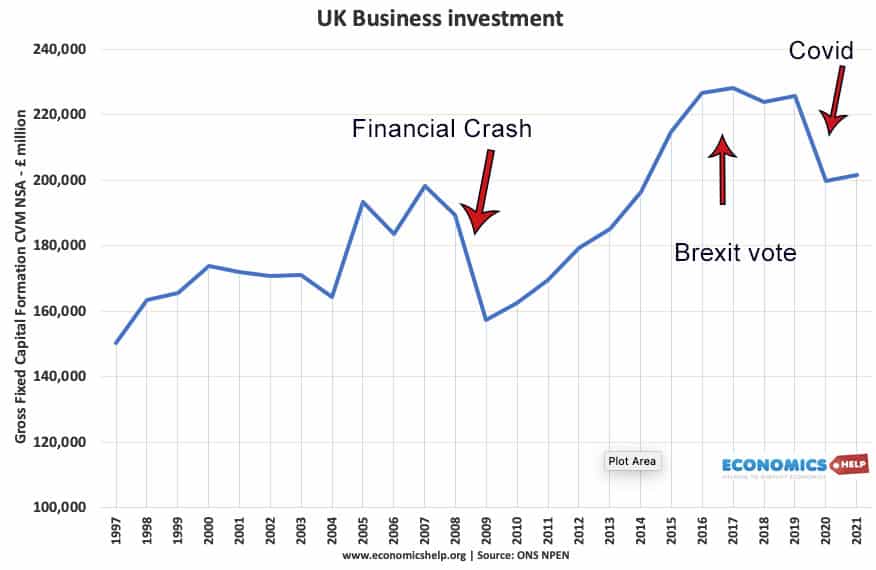

Source: ONS NPEN

Total UK Business investment since 1997. After sharp fall in 2009 due to global recession, investment recovered quite strongly. In 2016, Investment fell, at least in part, due to the uncertainty of the Brexit vote and leaving the Single Market. The covid pandemic caused another sharp fall in investment.

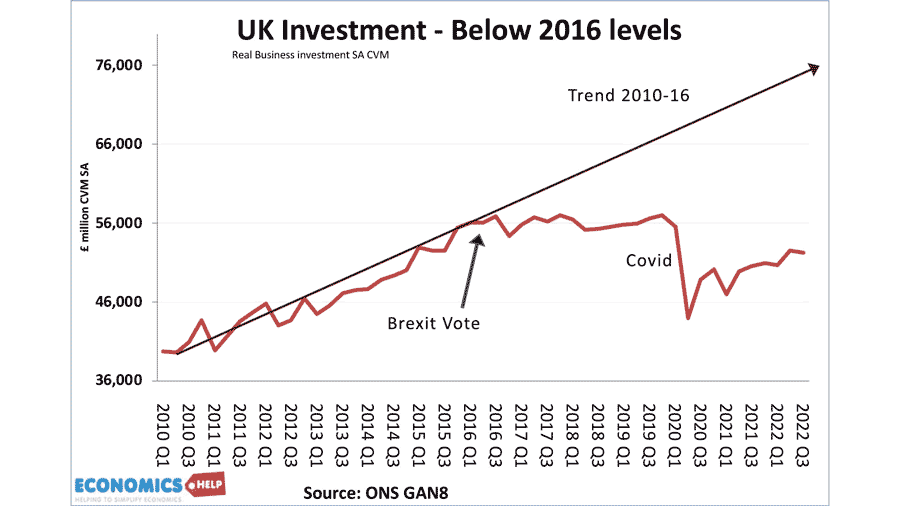

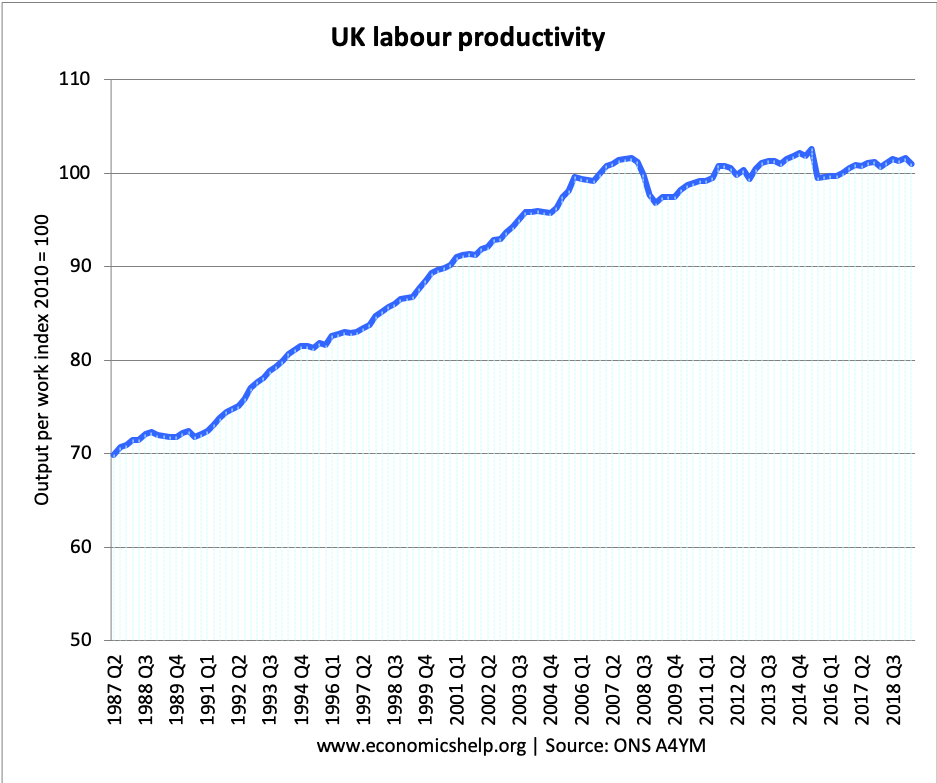

The poor investment performance is concerning for the UK economy as it is reflected in poor productivity growth, low economic growth and limited real wage growth

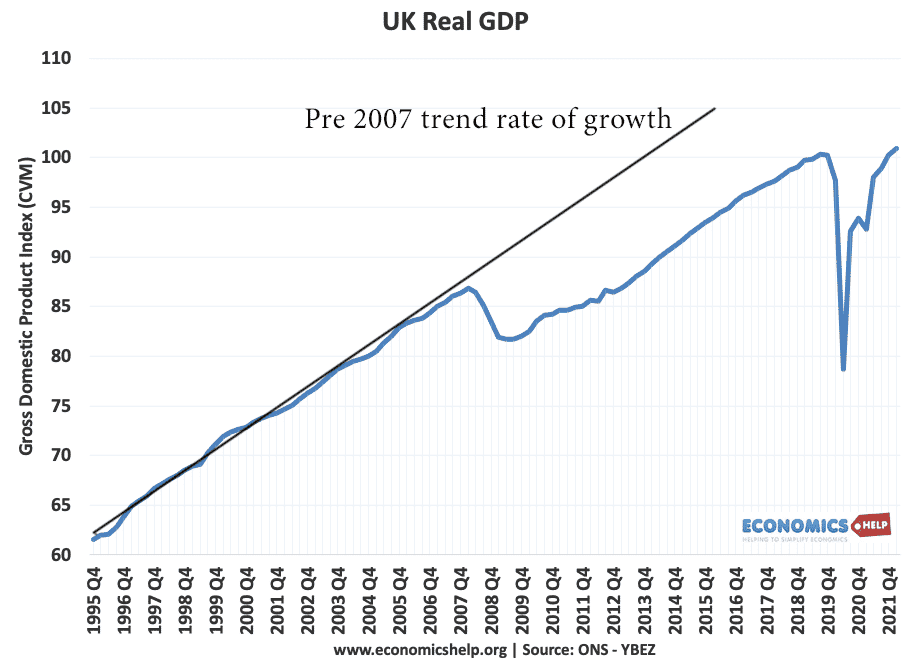

UK real GDP has never recovered its pre-2007 trend rate of growth.

The poor levels of investment post 2008 are reflected in poor labour productivity growth.

Investment in profile

From 2007 to 2010 we see a 22% fall in private sector business investment. This was the result of

- Banking crisis – banks didn’t want to lend

- Fall in consumer confidence

- Recession, which caused firms to hold bank from investment

Recovery in business investment since 2010

- From a low basis and 20% fall

- Helped by low interest rates making investment more attractive, but availability of funds a bigger problem than the cost of borrowing.

- Business investment has fallen behind past trend growth in value of business investment.

- Still volatile and uncertain, e.g falls in 2014 and the end of 2015

Factors influencing future investment levels

- Despite low interest rates, banks are maintaining strict lending criteria and rationing finance. Many small and medium sized firms still state finance is difficult to come by.

- Prospects for economic recovery are poor. The Bank of England’s latest inflation report painted a gloomy picture of an economy struggling to post positive economic growth.

- Fall in inflation rate and possible deflationary pressures

- Uncertainties over Britain’s place in Europe.

- Euro-zone debt crisis and EU recession also weigh heavily on UK investment decisions.

- Future of interest rates. Will interest rates rise to increase the cost of borrowing.

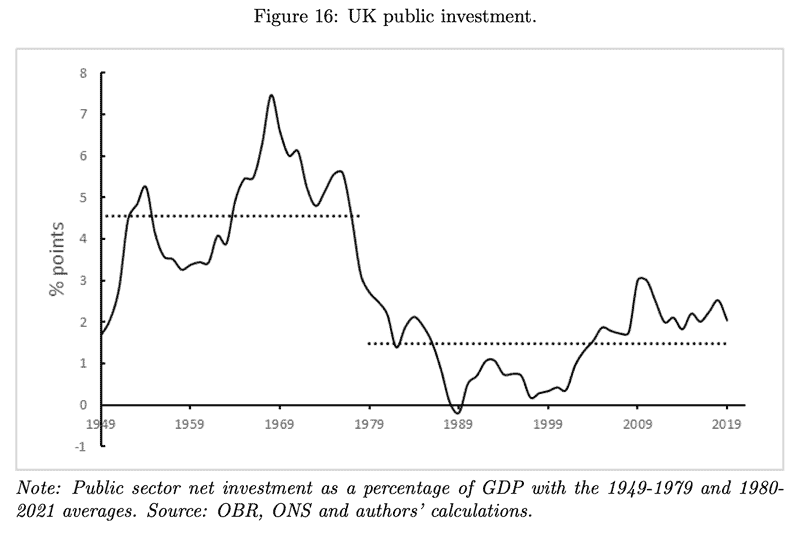

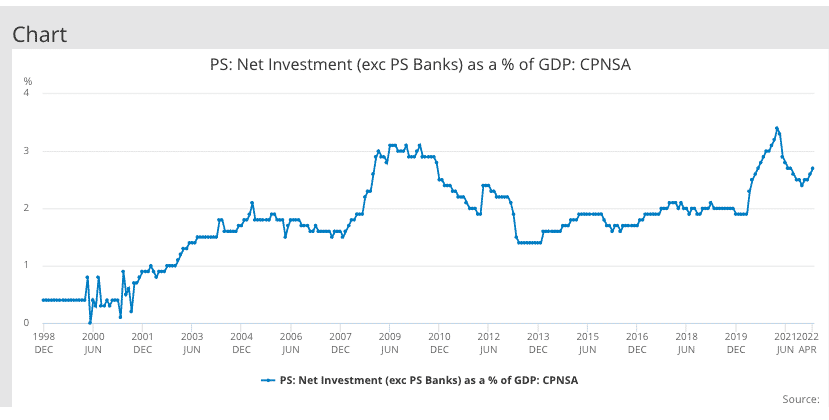

Public Sector Investment

Net public sector investment has been squeezed in 2012/13 by the government’s austerity policies.

Importance of Investment to the Economy

(Some notes for A level Students)

1. Impact on Aggregate Demand (AD=C+I+G+X-M)

I (investment) accounts for around 16% of total domestic demand. A rise in investment can help to promote higher Aggregate Demand. In a depressed economy, increased investment can also trigger a positive multiplier effect. With investment creating knock-on effects on related industries.

2. Impact on Aggregate Supply (LRAS)

Net investment will increase the productive capacity of the economy and enable higher long run economic growth. If investment is efficient, it can increase the productive capacity of the economy. Without necessary investment, the economy is more likely to experience supply constraints, and it will lead to a lower long run trend rate of economic growth.

Evaluation

- It depends on other components of AD. With Consumer spending and exports weak, a boost in I could have a significant impact on increasing AD.

- It depends on the quality of investment. If banks are stricter with lending requirements, firms may have to focus on projects which offer best return – but equally, good projects may not occur simply because of market failure in credit markets.

- Both business and public sector investment is important. Business investment is main driver of private sector expansion. But, business also need public sector investment to finance infrastructure improvements such as transport.

Related

External links

- Investment at ONS

Do you have an analysis of domestic Vs foreign industrial investment in the UK?