Readers Question: Why do countries that experience a boom risk losing international competitiveness?

An economic boom implies that an economy is growing above its long term trend rate. This means that the rate of economic growth is high, but there tend to be inflationary pressures because demand is growing faster than supply.

The impact of high growth and inflation will tend to cause a current account deficit and declining export competitiveness.

The labour market

In a boom, we will see a rapid fall in unemployment. The number of job vacancies will increase as firms try to hire more workers to meet rising demand. This invariably puts upward pressure on wages. Because demand for labour is high, workers are in a position to bargain for higher wages. This could be exacerbated by labour market imperfections, e.g. a shortage of key skilled workers could push up wages, even before full employment is reached. Rising wages will be a significant factor in causing higher unit labour costs and higher export prices. This will lead to a decline in competitiveness. This will be especially important if the country is producing labour-intensive goods, such as textiles.

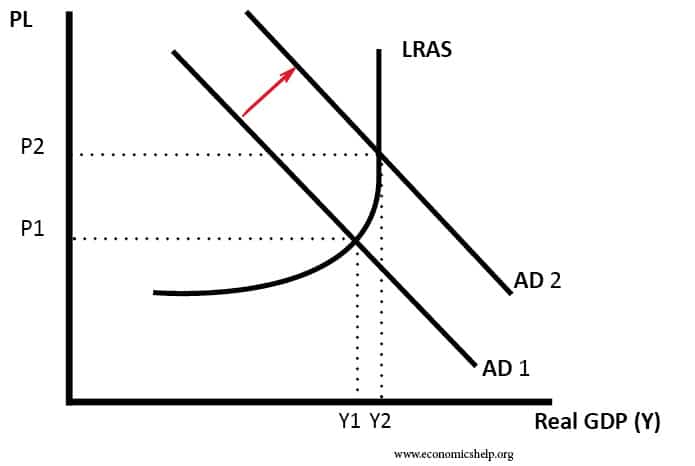

Boom and inflation

A simple AD/ AS diagram shows that as the economy reaches full capacity, an increase in AD will cause inflation to increase significantly. This will push up wages, but also raw materials and the general cost of production. This will be reflected in higher export prices.

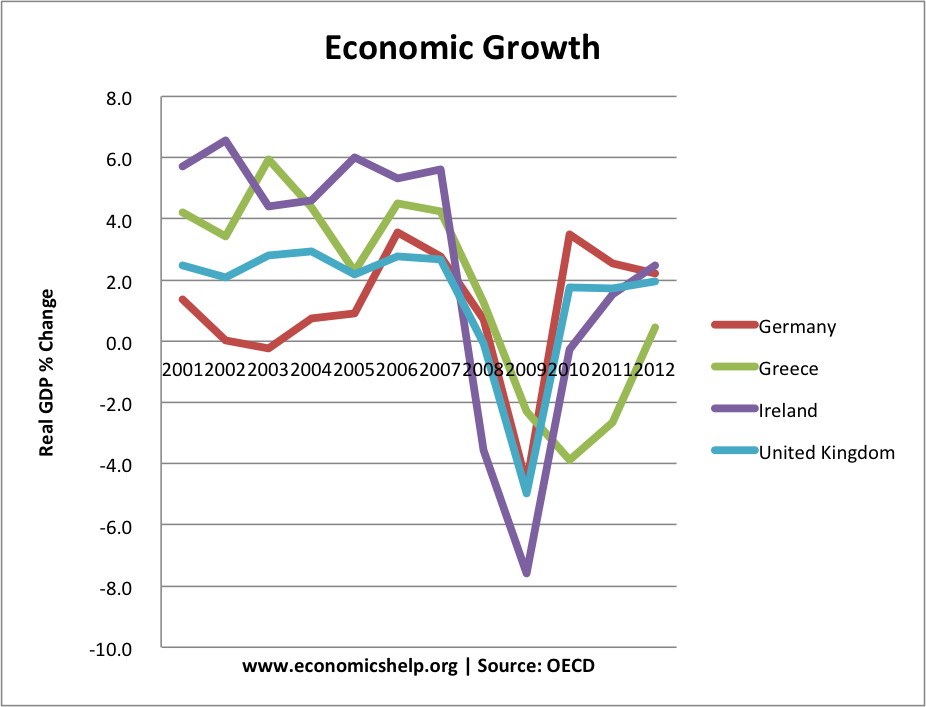

Example of boom countries and declining competitiveness

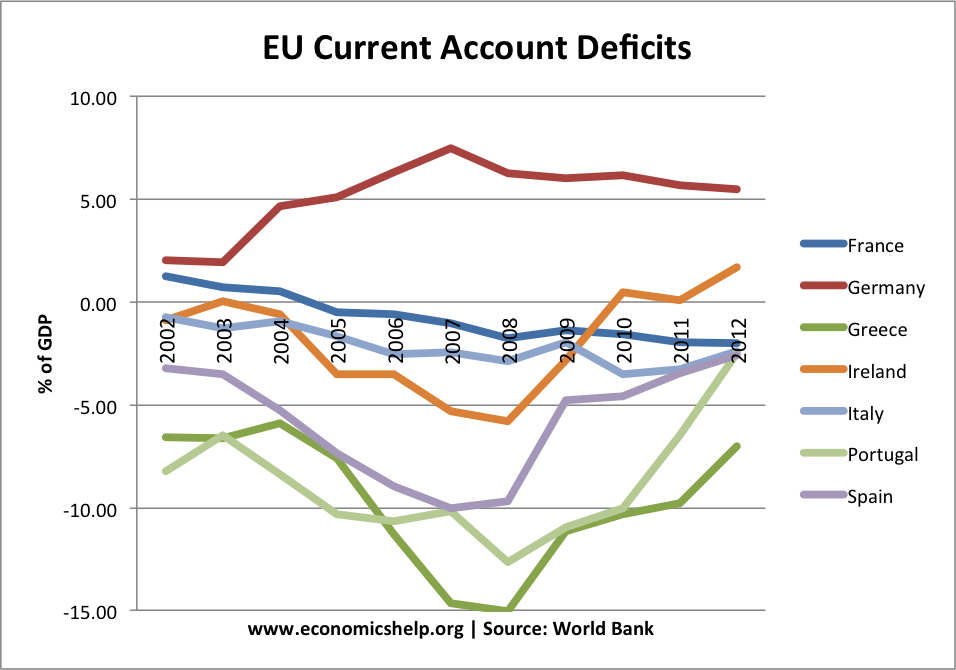

In the Euro, between 2001-2007, several southern European countries experienced strong growth, but also declining competitiveness. Because their exchange rates were fixed in the Euro, this resulted in large current account deficits – reflecting the loss of competitiveness. For example, Ireland and Spain both had strong economic growth leading up to 2007, but the boom contributed to rising labour costs and a decline in relative competitiveness.

Economic growth and impact on current account deficits.

Current account deficits an indicator of declining competitiveness.

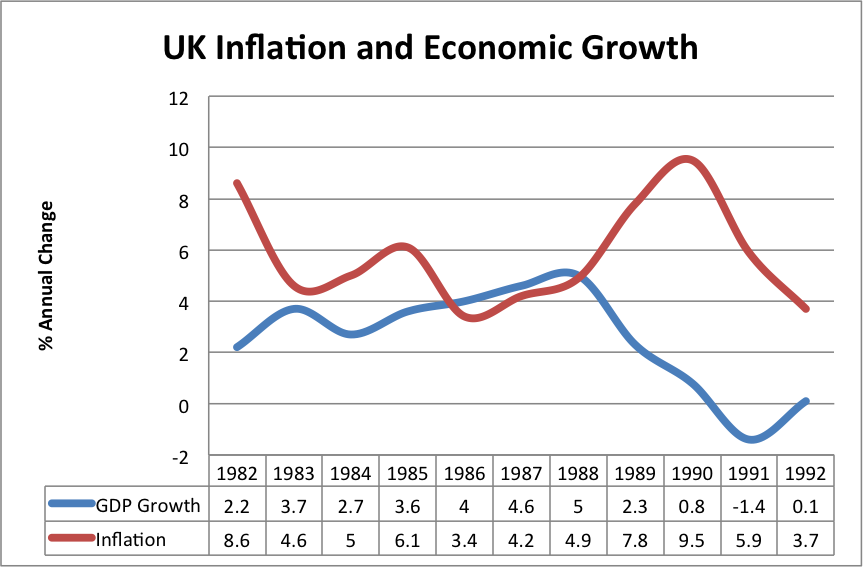

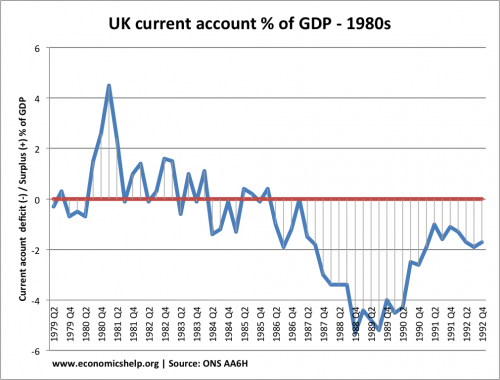

UK boom of late 1980s.

After economic growth reached 5% in 1988, we saw a sharp rise in inflation to nearly 10%.

This led to a decline in competitiveness. The UK current account deficit increased in this period due to two factors

- Rising import demand

- Declining export competitiveness

Evaluation of booms and competitiveness

It depends on the nature of the economic boom. If the boom is fuelled by higher consumer spending and rising asset prices, then we are more likely to see demand outstripping supply resulting in higher inflation. However, if we have a boom in investment and rising productivity, then a country may not see a decline in competitiveness. For example, China has been able to maintain high rates of economic growth without losing competitiveness. This is because the growth has been export led and consistent with low wage growth.

Also, countries can lose competitiveness due to supply side factors. Even countries with low economic growth will become uncompetitive if costs rise. For example, before 2007, Portugal and Greece had relatively modest rates of growth, but they experienced rising unit labour costs.

When measuring competitiveness, the current account only shows part of the picture. It is also necessary to look at wage costs, inflation to get a better picture, e.g. wage competitiveness

Related