Readers Question: I am currently researching the impact of the global economy on inflation in the UK. I have come across economic policy uncertainty but am unsure what effect policy uncertainty in the EU and USA will have on the UK.

UK inflation is primarily due to domestic factors. For example, if you look at the inflation of the early 1990s, it was due to an economic boom and rapid growth in aggregate demand. This level of inflation wasn’t experienced by our main international competitors.

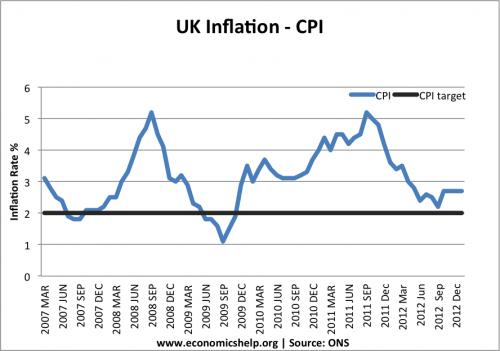

In 2011, the UK experienced higher rates of inflation than the Eurozone and the US. The reason inflation was higher in the UK than the Eurozone was due to factors such as:

- Impact of devaluation causing imported inflation.

- Rise in taxes. CPIY (a measure of inflation excluding taxes) was much lower than the headline CPI rate

- Rise in commodity prices having a greater impact in the UK.

Global factors affecting UK inflation

There are still global factors affecting UK inflation. Firstly, the price of commodities, such as oil, metals, food will affect UK inflation. The rise in oil prices in 2008 and later in 2011/12 was a factor in causing UK inflation.

Global trends in inflation. Since the 1970s, inflation in advanced industrial countries has fallen. This global trend towards lower inflation has helped the UK also experience lower inflation. Lower inflation across the globe is due to several factors, such as:

- Rising productivity and cheap manufactured goods from China / Asia.

- Improved technology and working practices which have helped reduce costs.

- Perhaps inflation targeting. e.g. Monetary policy geared towards keeping inflation low.

- Decreased inflation expectations making it easier to keep inflation low.

The UK has definitely benefited from these global inflationary trends. But, at the same time, domestic factors have been influential in affecting UK inflation. Currently, Eurozone inflation has fallen to 1.1% but UK inflation is higher at 2.7%

What will be the effect of policy uncertainty in the USA on the UK?

There is significant policy uncertainty in the US, with the government shut down. A prolonged debate about US government spending could risk precipitating a downturn in the US economy and an end to the US economies reasonable recovery. This would be highly damaging to the global economy. If the US economy falters, it will definitely have a negative impact on economic growth elsewhere in the world. There is also the risk of adversely affecting confidence in countries like UK and Europe.i

If the US economy did falter this would reduce inflationary pressures. Export demand would be weaker and commodity prices less likely to rise. However, given inflation is already very low in Europe, the impact on inflation would be marginal.

However, if the US can muddle through and avoid steep spending cuts and a fall in confidence, the US economy could maintain a steady recovery. However, there are no signs that any recovery will be strong enough to cause a rise in demand induced inflation.

Overall, I think the policy uncertainty will have a very limited impact on UK inflation. There is a greater danger that a US downturn would make it harder for the global economy to achieve economic growth.

Effect of policy uncertainty of the EU on UK.

I don’t think the EU has ‘policy uncertainty’ I would say the problem with EU policy is that it is depressingly predictable. Recent news that EU inflation has fallen to 1.1% and unemployment continues to rise – should have precipitated great attempts to stimulate demand and try and overcome the deflationary pressures in the Eurozone. But, the EU is unlikely to change from its course of policy which is geared towards tolerating high unemployment, and a depressed economy.

Related