To what extent can the government help boost domestic industry and manufacturing?

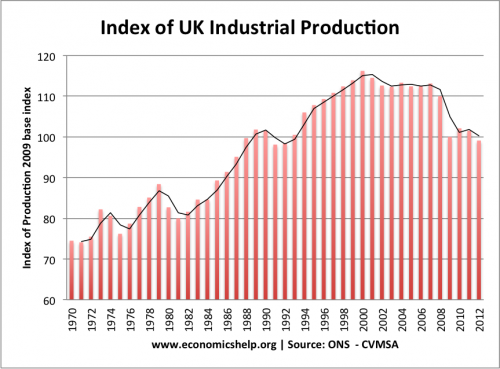

In recent weeks, several politicians have talked about their desire to help UK manufacturing and boost industrial production. It may be a noble endeavour to try and boost UK industry and rebalance the economy away from financial services to manufacturing. But, how practical is it for the government to actually boost manufacturing output?

The main ways governments might be able to help industry could include:

- Stable macro economic environment – low inflation, sustained positive economic growth

- Satisfactory availability of credit – A working banking sector willing to lend to firms

- Investment in infrastructure – better transport links to reduce firms costs

- Improved labour productivity – through better education and training of workers

- Increased geographical mobility – easy for firms and workers to move

- Removal of unnecessary red tape and regulations

- Environment which promotes research & development

- Subsidy to help develop certain technologies.

- Stable exchange rate – avoiding over-valuation of the exchange rate.

- Low tax rates.

1. Macro economic environment

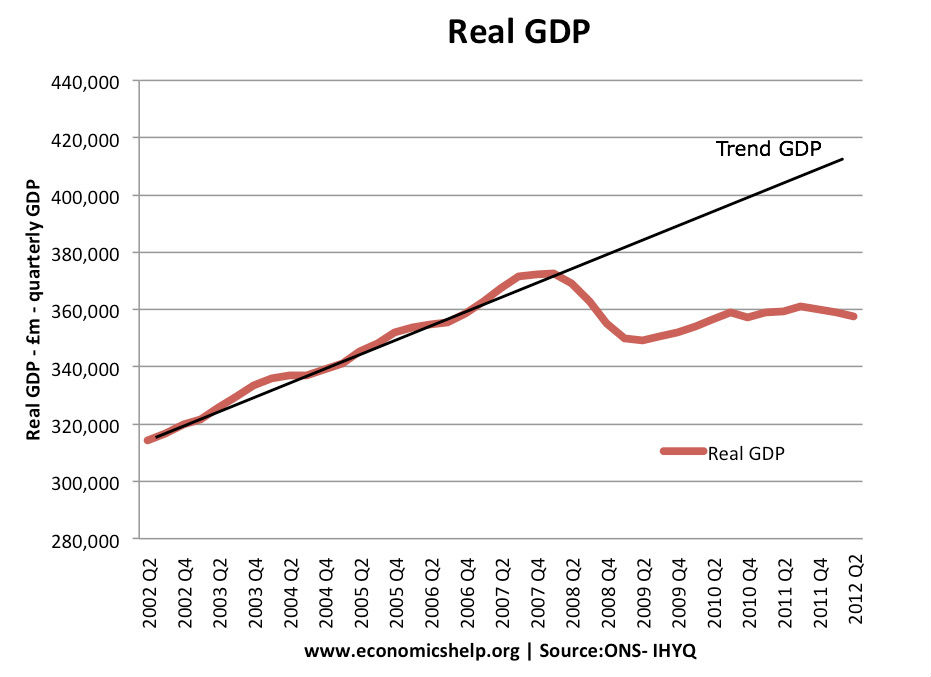

Since 2007, the UK economy has fallen way behind its long term trend rate of growth. We have been experiencing the longest decline in real GDP on record. Inflation has generally been low; but, with weak demand, firms have been reluctant to invest. On coming to power in 2010, the current government prioritised debt reduction over growth. Many economist feel this lengthened the recession and prolonged the short-term difficulties of industry. The government claim signs of recovery in 2013 is evidence that industry will be able to benefit from the future economic growth. However, better management of fiscal policy could have enabled an earlier recovery and reduced the short-term difficulties of industry.

- But, the success of UK manufacturing also depends on demand from Europe, there is little government can do about a European recession. Also, the Bank of England and monetary policy play an important role in determining economic growth. Also, macro economic instability cannot explain the relative decline in manufacturing in the past few decades.

2. Availability of credit

A big complaint of business since 2007 has been the difficulty in accessing credit. The credit crunch has made banks unwilling to lend. Despite low interest rates, credit has been scarce – holding back business investment. Business investment is important for the growth of industry. This is not easy for a government to resolve. By intervening in the banking sector and bailing out banks like Northern Rock and Bradford & Bingley, the government helped prevent a serious loss of confidence in the banking industry – which could have been disastrous. But, it wasn’t enough to actually increase lending.

The government’s publicised right to buy scheme – offering homeowners help to get a mortgage, might be more productive if they used for business. Rather than propping up a bloated property market. The government could offer the same principle of helping firms to get loans for business investment. Arguably, business investment would help create a more balanced economy than helping consumers take on more debt.

However, there is always a reluctance of the government to be involved in lending to firms. The argument is that this could risk distorting the market, helping inefficient firms gain finance and invest in unproductive schemes. The Bank of England’s funding for lending scheme may be a more practical scheme for helping improve lending than direct government intervention in business loans.

3. Improved infrastructure

This is one area where government intervention is needed. Road and rail links have positive externalities and tend to be under-provided in a free market. The result is the economy tends to experience high levels of congestion, which increase costs for firms. Public sector investment in better transport links can play a role in helping firms, e.g. a third runway at Heathrow or a second channel tunnel could help export goods to Europe and beyond. Improved infrastructure will definitely help business and many business say the government is holding back on key decisions, e.g. Heathrow expansion. However, better transport on its own doesn’t transform business – it is just a factor which helps.

4. Improved labour productivity / labour skills

Business has frequently raised concerns at the lack of basic education and training qualifications, and this is holding back business expansion. This is particularly a problem in manufacturing where there is a lack of trained mechanics and scientists. The government could, in theory, try improve basic literacy and give more importance to vocational skills needed by industry. This is a significant factor to remain competitive in high tech industries.

- However, these policies would take time, and there is the problem of potential government failure – does the government know which vocational qualifications are needed?

5. Low tax rates and removed regulations

Countries like Ireland have attracted business investment through offering low corporation taxes. However, tax competition could prove self-defeating and only attract firms who then send back profit to original country. It is easy to argue regulations should be removed, but often they are needed for safety or environmental factors. In theory, we should have same regulations as our European partners. Red tape doesn’t explain why UK business is less productive than German firms.

6. Subsidy for business

When I ask students for suggestions, this is always a popular idea. The UK did try subsidising key industries in 1960s and 1970s, but the results were not promising. A blank government check rarely helps to turn around an industry (though temporary US support of GM is a positive case study) Subsidies of firms needed to be highly targeted to areas where there is market failure, e.g. green technology with positive externalities, or certain types of training.

7. Labour markets

Government intervention in the labour markets could help. For example reducing minimum wages and labour market regulation to reduce labour costs. But this would be at cost of increased inequality. Also, other countries like Germany are successful not because they try to match China on labour costs, but because they try and increase value added. Another policy is to allow more selective immigration; the UK labour market often experiences labour shortages in certain areas (e.g. Maths teachers, nurses, engineers) making it easier to allow immigration would help labour markets become more flexible.

Limits of Government intervention

The success of manufacturing depends to a large extent on the ability of entrepreneurs and successful R&D. The most successful business, such as Dyson, achieved success with little, if any, intervention from the government. It is hard to think of a policy to encourage greater innovation, better labour relations and an ethos of hard work.

There is another school of thought that says trying to improve the growth UK manufacturing is to fight a losing battle. Whether we like it or not, our comparative advantage does lie in retail, insurance and financial industries. These industries do earn export revenue. Trying to make Britain a nation of producers and manufacturers may be unsuccessful because our comparative advantage no longer lies there.

However, there are definitely factors that the government can implement which help industry. The most important is a healthy macro economy. Policies which hold back economic growth will hold back industrial recovery. On the supply side, there are areas where government intervention can help create marginal gains – notably infrastructure, education and flexible labour markets.

Related

- UK industrial production

- What does the UK produce?

- Decline of the UK coal industry – a lesson in deindustrialisation

- Balance of payments

- Supply side policies

needed to get straight to the point but still very helpful