Recently, the US Treasury criticised German economic policy. They argue that German’s export led growth model and anaemic pace of domestic demand is damaging to European and global growth.

“Germany’s anaemic pace of domestic demand growth and dependence on exports have hampered rebalancing at a time when many other euro-area countries have been under severe pressure to curb demand and compress imports in order to promote adjustment,”

“The net result has been a deflationary bias for the euro area as well as for the world economy.” (BBC link)

It might seem a bit of a paradox for the US to criticise other countries economic policies, when their own arguments about the debt ceiling threatened to push the US and global economy back into recession. But, why is the US criticising German economic policy and is it justified?

Criticism of German economic policy

Single Currency. The big issue with the German economy is that membership of the Euro means their actions have a significant impact on other countries in the Eurozone.

Essentially countries in the south of the Eurozone are being forced into pursuing austerity and deflationary policies. This involves cutting government spending to try and meet budget deficit reduction targets. This is reducing domestic demand and causing recession in southern Europe. Southern European countries are also trying to restore unit cost competitiveness. This involves trying to reduce wage costs, so that their exports will be more competitive. However, because southern states are in the Euro, they cannot devalue to help boost competitiveness. Reducing wage costs through deflation and austerity is proving quite damaging to their economy. They are facing serious recession, and very high rates of unemployment. Their big problem is insufficient demand. Cutting wages and supply side reforms are proving insufficient to create sufficient demand in the economy to reduce unemployment.

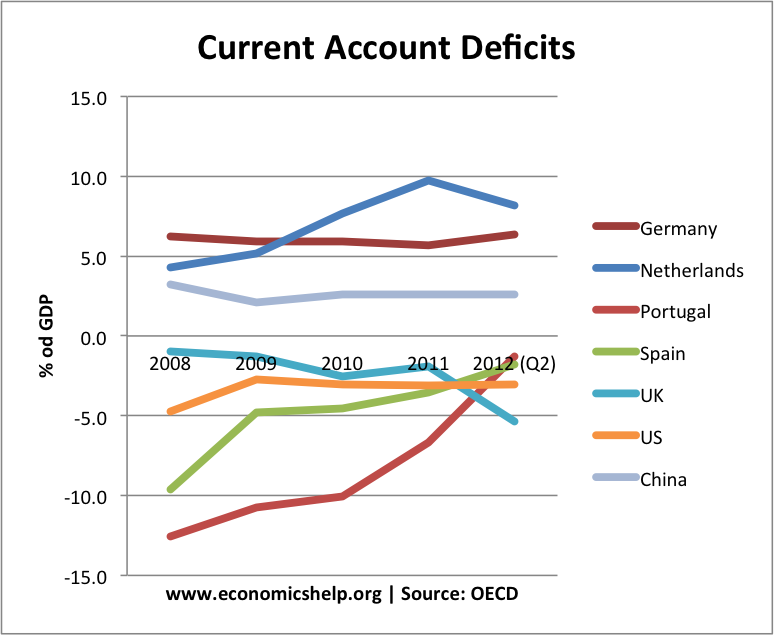

On the other hand Germany are benefiting from their exports being very competitive in the Eurozone. German exports are very strong. But, German domestic demand is weak. This means that Germany is running a very large current account surplus. Germany is now running a larger current account surplus than China (FT)

Without the Euro, the result would be an appreciation in the German currency, reducing German exports and increasing import demand. But, this is not happening contributing to the large current account surplus and imbalance between north and south Europe.

Many economists argue that if southern European countries are facing deflationary pressure and recession, Germany and the ECB should be doing more to help increase demand in the Eurozone.

For example, if Germany adopted looser fiscal policy and the ECB adopted looser monetary policy. This would increase demand and make it easier for southern Europe to sell exports. More demand from northern Europe would help reduce the extent of their recessions.

The other criticism is that not everyone can be Germany – relying on export led growth and a current account surplus. The current EU policy involves hoping that southern Europe will increase demand through structural reform, greater competitiveness and lower wages. But, without higher demand from somewhere, economies will be stagnant. Not everyone can replicate the German model of running a large current account surplus. One persons surplus and export demand is someone else’s current account deficit and lower demand.

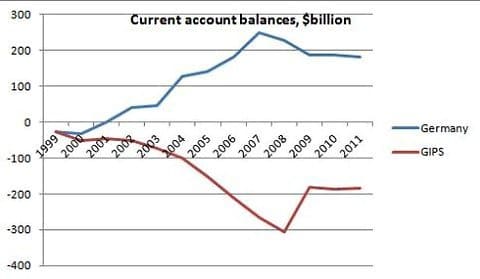

Current account Germany and GIPS

The German Current account has mirrored the current account deficit in Greece, Ireland Portugal and Spain. (Link)

Germany has responded arguing that they do have robust wage growth and their export led economy is a significant driver of global economic growth. This is true to some extent. But, the size of the German current account surplus is evidence that they could do a lot more to increase demand. This would help Europe recover and reduce the pressure of austerity policies. Recovery in southern Europe is in the interests of Germany and the Eurozone, but the current policies of relying on austerity and wage cuts are not working and southern Europe is paying a very high cost of unemployment.

Related