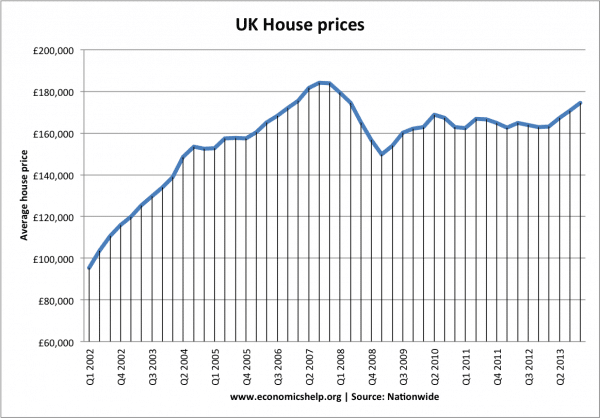

Just five years after the start of global credit crunch and the UK housing crash, it seems incongruous to be talking about another UK property bubble. It is a paradox that the UK has experienced five long years of recession – the worst decline in living standards in recent times, and yet, property prices still continue to go through the roof.

It’s symbolic of the UK’s unbalanced economy that on the one hand, we have falling real incomes, but on the other hand, property prices continue to outstrip expectations.

But, firstly, does the UK really have a property bubble?

Prices in many parts of the country are still below the pre-crisis peak. London is the main property trouble spot.

The Office for National Statistics show average prices in London increased by 11% in the year to November 2013. The performance of the London housing market dragged the national house price inflation up from 3.5% to 5.4%. Also, it is luxury houses that are seeing the price rise fastest. ‘Prime’ houses worth over £1,000 per sq ft are now 27% higher than 2007. (London property market needs to be cooled, Guardian)

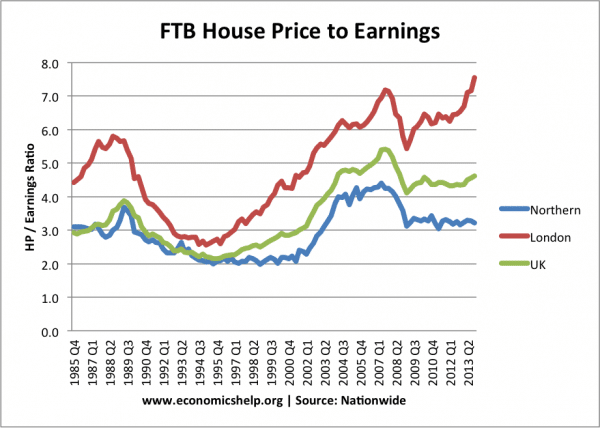

The UK’s geographical property bubble

Source: Nationwide | House price to income

London property prices have reached a record 7.5 times average earnings for first time buyers. But, in the north, the ratio is only 3.1. By 2018, a forecast by the ‘Item Club’ predict the average London home will cost more than £600,000. That would be 3.5 times the average in Northern Ireland and 3.3 times the average in the north-east of England.

The UK property bubble is highly geographical. It is in London, the South East and other selected hotspots that house prices have risen significantly. In other areas of the country, house prices remain depressed. There is no coherent movement in national house prices. The old adage of ‘location’ remains the key issue to explain the property mystery.

Why is parts of the UK experiencing a property bubble?

- Supply. The number of households in the UK is rising significantly faster than the supply of housing. You don’t have to be a student of economics, to know that if the demand for housing is rising 250,000 a year, and the supply is increasing by just 100,000 – this is creating a strong underlying upward pressure on prices. Supply is often cited for explaining the difference between the fate of the US housing market and the UK. The US saw a collapse in prices after the global credit crunch because there was a large stock of unsold houses. But, the UK doesn’t have that. See also – more on UK Housing supply

- Demand from buy to let investors. Housing is still seen as a good investment. London is particularly attractive to foreign investors, looking to buy houses.

- Inelastic demand. The housing shortage means that either options of renting or buying are financially unattractive. But, despite the record house prices, many first time buyers would like to try buying – even if it means borrowing from parents, taking out a large mortgage or getting on the governments ‘Help to buy scheme’.

- Governments Help to buy scheme. Some analysts have criticised the governments Help to Buy scheme, which is giving help for first time buyers to get a mortgage. Essentially it is propping up unsustainable demand by enabling people to pay higher prices. It does nothing to tackle the underlying reason for the high house prices. It also reflects the piecemeal approach of the government to the housing market. Building 150,000 extra houses a year is a real political headache. Helping people borrow more is easier, but only a temporary fix.

- See also: Why are UK prices so high?

Problems of the UK property bubble

- Geographical inequality. Young workers living in property hotspots are facing difficulty in getting a place to live. A high percentage of disposable income is going on renting or mortgage.

- Geographical immobility. Many workers are discouraged from moving to property hotspots because of the price and cost of moving. This can mean firms struggle to attract sufficient skilled labour. The problem is acute in the public sector with teachers and nurses becoming reluctant to stay in London.

- Monetary policy offers no easy fix. The property bubble cannot be resolved by a quick change of monetary policy. The MPC have an even greater concern of high unemployment and a depressed economy. Also the regional nature of the property market means that raising rates to cool London property prices may be damaging for the housing market in the north.

- High debt economy. One consequence of the property bubble is that young people are having to take on more debt. This leaves them vulnerable to any change in interest rates because a high percentage of their income is going on mortgage payments – leaving them vulnerable to rising rates.

Solutions to UK property bubble

- Tackling the supply shortage. Easier said than done. But, the supply shortage is not going to disappear by wishful thinking. Given the political and environmental difficulties of building on green belt land, there needs to be a rethink of how to build high density housing on ‘brown field’ sites.

- Public housing. Since the 1980s, ‘council housing’ has gained an unwelcome tag and association of somehow being undesirable. But, the acute housing shortage is unlikely to be dealt with by the private sector alone. Public sector housing could help build affordable housing where they are needed most.

- Restrictions on foreign buying and second property homes. In many areas, such as London, property prices are being fuelled by overseas buyers and people buying second homes. This is pricing low income workers out of the property market. Higher taxes and restrictions on overseas buyers might help to cool London property prices.

Related

Another fundamental factor is as follows. The economically illiterate buffoons that inhabit Westminster think that boosting the economy via more deficit leads to a larger public debt. (In fact, as Keynes pointed out, deficits can easily be funded by new base money rather than extra debt.) And more public debt is bad in the eyes of the above buffoons.

Thus they opt to expand private debt rather than public debt: i.e. they try to induce private banks to lend more.

the real estate market is the first to get affected by the changes in economy. if the economy is good then the effects are positive and for bad economy the effects are negative. the economy have been bad since 2010 and it continued to be for most of 2013. but now it has started to recover.

The last bullet point for the solutions is spot on. Overseas investments in London, especially Central London has been the main cause of the property market bubble in London. Where those who can not afford to live in London any more, are moving to the outskirts of London in fairly commutable distance. Which in fact is cheaper including the travel costs for work etc.

real estate is belonging on economics.if economical condition is down is the same to real estate