Readers Question: how does a current account surplus affect domestic employment?

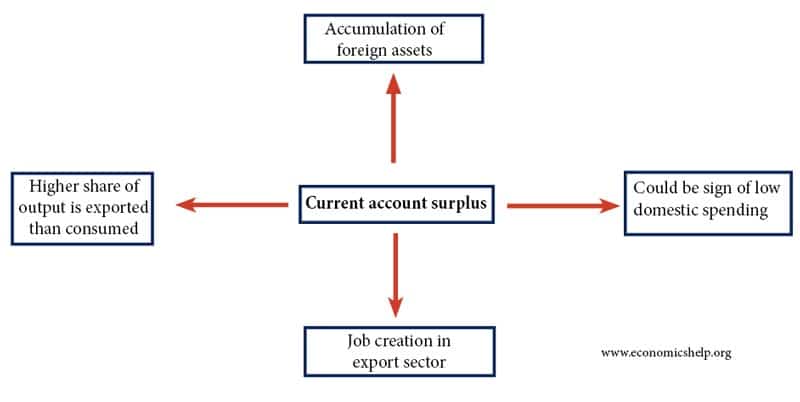

A current account surplus means an economy is exporting a greater value of goods and services than it is importing. A country with a current account surplus will have a deficit on the financial/capital account. i.e. a country with a current account surplus will have surplus foreign exchange it can use to invest in other countries.

There is no hard and fast rule about what will happen if a country has a current account surplus. It depends on the size of the current account and the reasons for the current account surplus.

In theory, you could expect a current account surplus (X-M) to boost employment because it is indicative of higher domestic demand.

- High exports (X) leads to increased employment in the export sector.

- Lower import spending may mean people are spending more on domestic goods rather than buying foreign goods. Greater demand for domestic goods helps domestic employment.

Some potential effects of a current account surplus

Current account surplus in fixed exchange rate

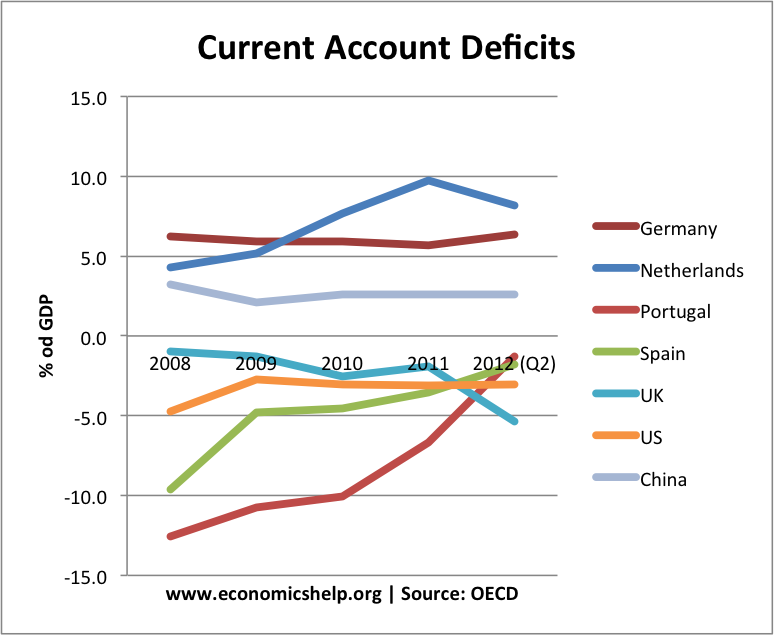

One reason for a current account surplus is when a country has a relatively undervalued exchange rate. This may be a country in a fixed exchange rate. For example, Germany is in the Euro but due to better German competitiveness than its European neighbours, Germany has had more competitive exports. The German export sector has helped strengthen the German economy.

Ceteris paribus, this current account surplus is helping to boost domestic employment. Because German exports are competitive, Germany is selling a lot of exports and this is leading to higher domestic employment in the exporting sector. Without the strong export demand, the German economy would be weaker and we would be liable to have higher unemployment.

If you compare it to countries with a large current account deficit in the Euro, the German economy has done relatively better regarding economic growth and employment.

For example, in the mid-2000s, Euro member countries like Greece, Spain and Portugal were uncompetitive in the Euro, this was one factor leading to lower economic growth and lower employment in these countries. These countries had very high current account deficits.

Economists have often argued that Germany should boost consumer spending (and reduce their current account surplus) to help economic growth in other Euro countries.

Current account surplus and domestic demand

A current account surplus is partly due to high exports, but the other side of the equation is imports and domestic demand.

A country may have a large current account surplus because of relatively weak domestic demand. This weak demand leads to lower consumer spending and lower spending on imports. Therefore, in this case, domestic employment will suffer from a weak economy.

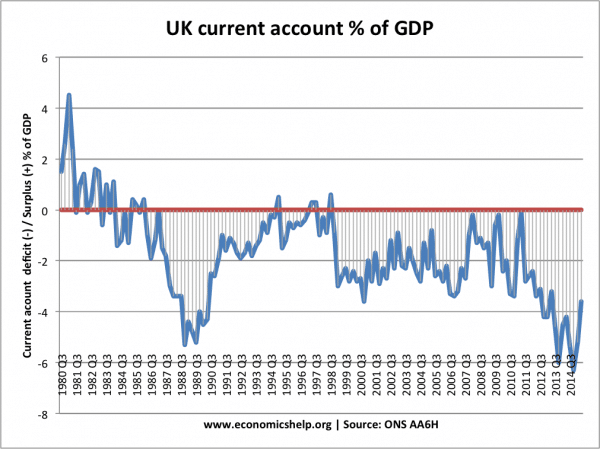

The current account is often cyclical. In a boom, we see a rise in the current account deficit because consumer spending rises, leading to an increase in imports. During a boom, unemployment falls and inflation rises.

But, in a recession, consumer spending falls leading to lower imports, lower inflation, and an improvement in the current account. The deficit may convert to a surplus, but this is due to the recession, and therefore leads to higher unemployment

In the UK’s example, periods of a current account surplus – 1980-82, 1994 and around 2007-10 followed recessions of the 1980s, 1991/21 and the recession of 2008.

Examples of current account surplus – China, Japan

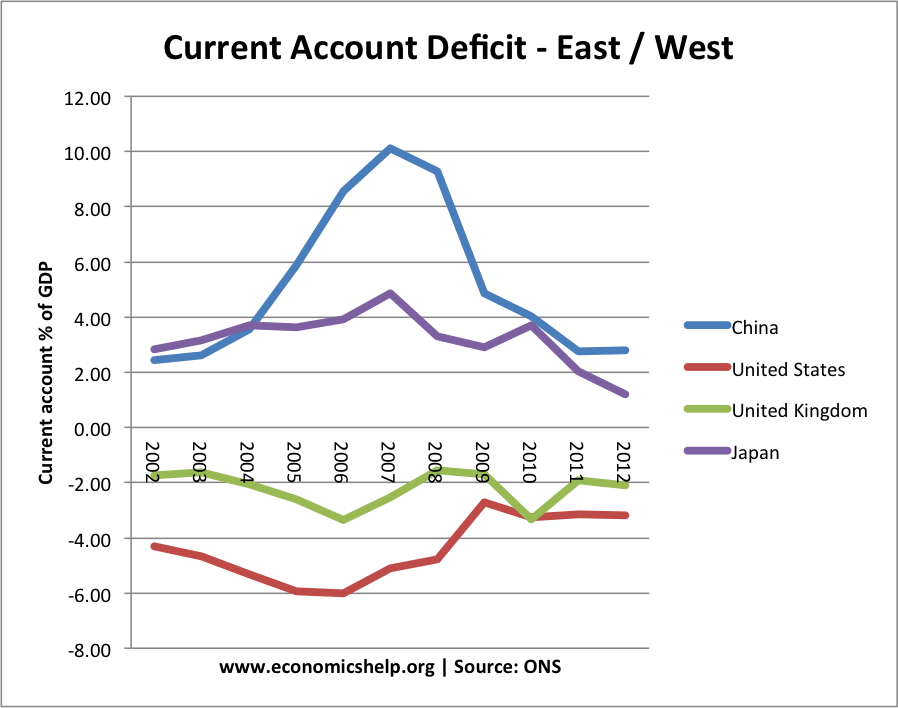

China had a record current account surplus in the mid-2000s, this was mainly due to greater competitiveness, helped by an undervalued Yuan. This was a factor in China’s record economic growth, and it led to higher employment.

Japan’s current account surplus was due to weak domestic demand, and a reluctance to buy imports. Japan’s export sector was still one of strongest sectors of the economy, but this period of a current account surplus was a period of low growth and weak employment growth.

A current account surplus will tend to boost domestic employment if:

- It is due to an improvement in competitiveness, leading to higher demand for exports.

- If domestic demand is still relatively strong, but consumers are buying domestic goods, rather than importing.

A current account surplus could lead to lower domestic employment if:

- The surplus is caused by a recession which has hit domestic demand and led to a fall in import spending.

- In a global recession where a surplus is caused by falling exports and an even bigger fall in imports

Impact of current account surplus on foreign assets

Another element of a current account surplus is that the country will be accumulating foreign assets. With large current account surplus (and inflow of foreign currency), China has been purchasing assets around the world – including US bonds and investment in Africa.

In the first half of the Twentieth Century, US was the dominant manufacturing nation. It ran large current account surpluses; during this period it was a net exporter of capital. US firms and government investing abroad and accumulating foreign assets which can earn profit, dividends and rent.

In the last quarter of the Twentieth Century, Japan ran a large current account surplus, enabling Japan to build its net wealth abroad. This could prove useful to help pay towards its ageing population when demographic changes cause an increased percentage of retired people.

Political controversy of current account surplus

A large current account surplus can be a controversial political issue – especially if other countries feel the surplus is a result of an undervalued exchange rate. Some economists have argued the excess current account surplus of Germany and China have directly caused less output and jobs in deficit countries.

On the other hand, a country running a current account deficit is able to have a higher level of consumption than otherwise with a current account surplus.

Related

How a nation with a current account surplus is suitable to conduct policy of currency revaluation.

Your analysis of Japan’s current account surplus is incorrect. It is not down to the goods trade (the goods balance has averaged close to zero over the past decade), it is down to the income balance. Japan’s income from foreign assets is far higher than are foreigners’ earnings from Japanese assets. Down to weak demand maybe, but not weak demand for imported goods.