Readers Question: how does a current account surplus affect domestic employment?

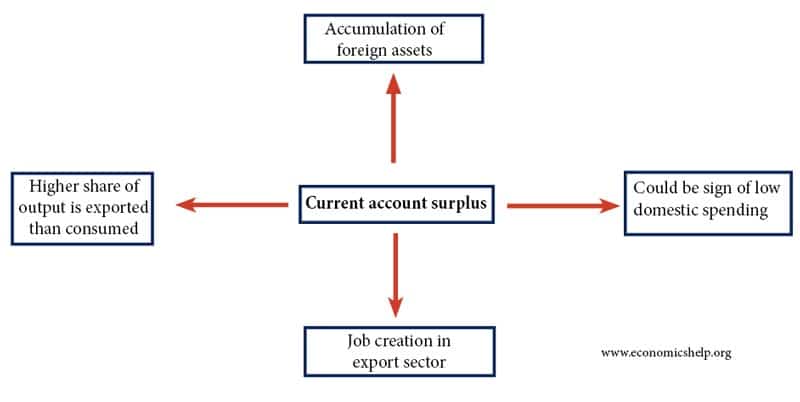

A current account surplus means an economy is exporting a greater value of goods and services than it is importing. A country with a current account surplus will have a deficit on the financial/capital account. i.e. a country with a current account surplus will have surplus foreign exchange it can use to invest in other countries.

There is no hard and fast rule about what will happen if a country has a current account surplus. It depends on the size of the current account and the reasons for the current account surplus.

In theory, you could expect a current account surplus (X-M) to boost employment because it is indicative of higher domestic demand.

- High exports (X) leads to increased employment in the export sector.

- Lower import spending may mean people are spending more on domestic goods rather than buying foreign goods. Greater demand for domestic goods helps domestic employment.

Some potential effects of a current account surplus

Current account surplus in fixed exchange rate

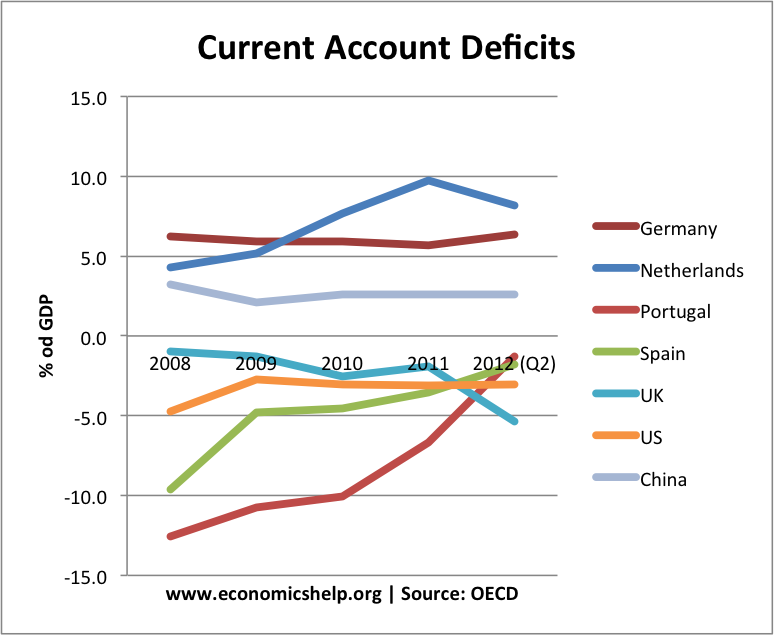

One reason for a current account surplus is when a country has a relatively undervalued exchange rate. This may be a country in a fixed exchange rate. For example, Germany is in the Euro but due to better German competitiveness than its European neighbours, Germany has had more competitive exports. The German export sector has helped strengthen the German economy.

Ceteris paribus, this current account surplus is helping to boost domestic employment. Because German exports are competitive, Germany is selling a lot of exports and this is leading to higher domestic employment in the exporting sector. Without the strong export demand, the German economy would be weaker and we would be liable to have higher unemployment.

If you compare it to countries with a large current account deficit in the Euro, the German economy has done relatively better regarding economic growth and employment.

For example, in the mid-2000s, Euro member countries like Greece, Spain and Portugal were uncompetitive in the Euro, this was one factor leading to lower economic growth and lower employment in these countries. These countries had very high current account deficits.

Economists have often argued that Germany should boost consumer spending (and reduce their current account surplus) to help economic growth in other Euro countries.

Current account surplus and domestic demand

A current account surplus is partly due to high exports, but the other side of the equation is imports and domestic demand.

A country may have a large current account surplus because of relatively weak domestic demand. This weak demand leads to lower consumer spending and lower spending on imports. Therefore, in this case, domestic employment will suffer from a weak economy.

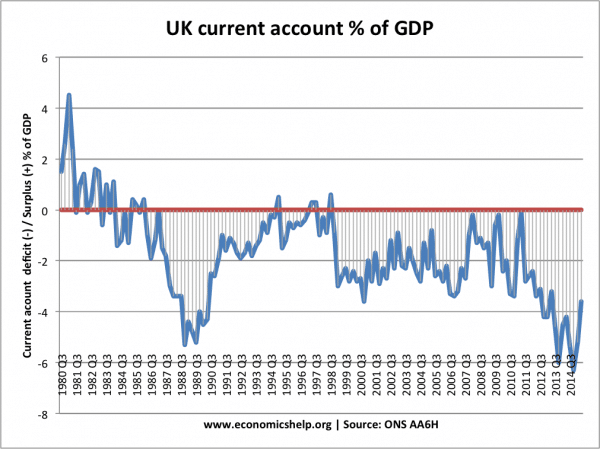

The current account is often cyclical. In a boom, we see a rise in the current account deficit because consumer spending rises, leading to an increase in imports. During a boom, unemployment falls and inflation rises.

But, in a recession, consumer spending falls leading to lower imports, lower inflation, and an improvement in the current account. The deficit may convert to a surplus, but this is due to the recession, and therefore leads to higher unemployment

In the UK’s example, periods of a current account surplus – 1980-82, 1994 and around 2007-10 followed recessions of the 1980s, 1991/21 and the recession of 2008.

Examples of current account surplus – China, Japan

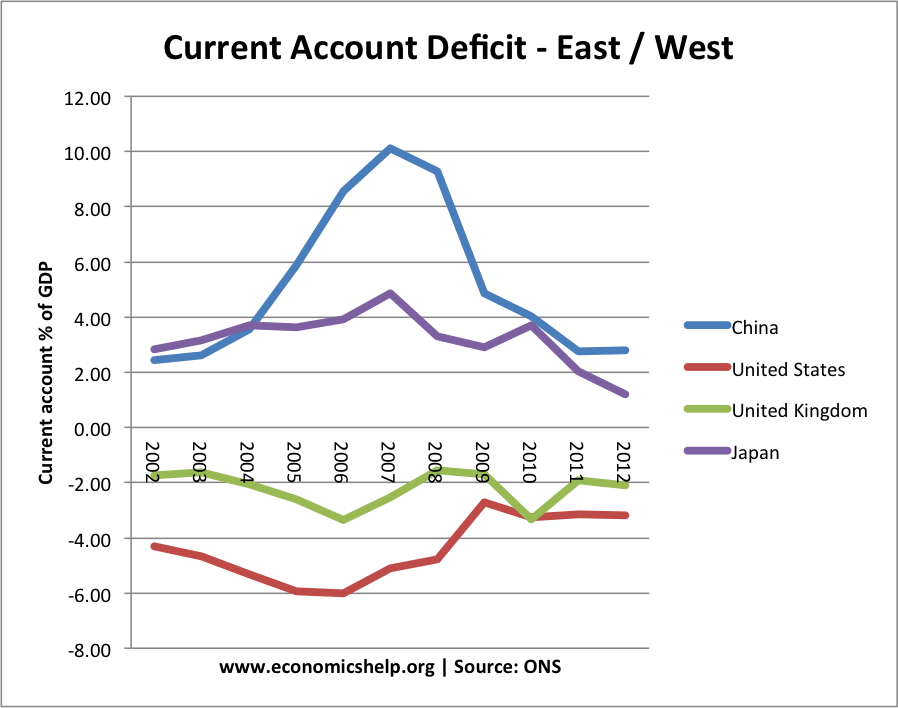

China had a record current account surplus in the mid-2000s, this was mainly due to greater competitiveness, helped by an undervalued Yuan. This was a factor in China’s record economic growth, and it led to higher employment.

Japan’s current account surplus was due to weak domestic demand, and a reluctance to buy imports. Japan’s export sector was still one of strongest sectors of the economy, but this period of a current account surplus was a period of low growth and weak employment growth.

A current account surplus will tend to boost domestic employment if:

- It is due to an improvement in competitiveness, leading to higher demand for exports.

- If domestic demand is still relatively strong, but consumers are buying domestic goods, rather than importing.

A current account surplus could lead to lower domestic employment if:

- The surplus is caused by a recession which has hit domestic demand and led to a fall in import spending.

- In a global recession where a surplus is caused by falling exports and an even bigger fall in imports

Impact of current account surplus on foreign assets

Another element of a current account surplus is that the country will be accumulating foreign assets. With large current account surplus (and inflow of foreign currency), China has been purchasing assets around the world – including US bonds and investment in Africa.

In the first half of the Twentieth Century, US was the dominant manufacturing nation. It ran large current account surpluses; during this period it was a net exporter of capital. US firms and government investing abroad and accumulating foreign assets which can earn profit, dividends and rent.

In the last quarter of the Twentieth Century, Japan ran a large current account surplus, enabling Japan to build its net wealth abroad. This could prove useful to help pay towards its ageing population when demographic changes cause an increased percentage of retired people.

Political controversy of current account surplus

A large current account surplus can be a controversial political issue – especially if other countries feel the surplus is a result of an undervalued exchange rate. Some economists have argued the excess current account surplus of Germany and China have directly caused less output and jobs in deficit countries.

On the other hand, a country running a current account deficit is able to have a higher level of consumption than otherwise with a current account surplus.

Related

Please help me, I need to know what effect will the increase in export have on the current account balance?

If we increase our exports it will improve our current account balance. Simple. The key area of difficulty for the UK government is how we achieve this. Some countries such as China manipulate their currency to keep it artificially weak, this ensures that it’s exports are price competitive.

Hey, can you explain how an economy may face a deficit in trade of goods yet have a surplus on its current account of the balance of payment.

The other components in current account might have large surplus to be compared with the deficit account in trade of goods. The trade in services, current transfers and income might be surplus which enable the current account to be surplus.

Hi, to understand this lets take the example of India, India has always more of import expenditure than it makes from export but still in 1960

It had current account surplus due to the income it abstained from abroad by Indians residing in abroad was substantially greater than the trade deficit caused due to high imports.

If there is direct inward investment from overseas firms, does the BOP improve, or stay the same? Does it stay the same because current account is in deficit and financial account is in surplus?

Direct investment from abroad is a credit item in the financial a/c of the balance of payments. It has the potential for bringing in investment capital into the domestic economy, but the domestic consumers lose out on significant income on the current a/c. For instance, a debit item in the financial a/c, investment abroad could be offset by credit income in the current a/c deficit.

Hi can you explain the the drawbacks of a BOP surplus ?? Emphasized a bit more on the drawbacks please !!!

What are the possible impacts and effects the current inflow of imports could have on job creation

the presentation is well explained but what are the long run and short run effects of economic growth

what about the negetive effects an clear evauation

how does the countries with trade surplus cause less jobs in countries with trade deficits

A country with trade surplus(country A) means that the country’s export is higher than its exports and the contrary is true for the country with trade deficit(country B).

So people are demanding more goods from country A and less from country B. So this will create jobs in country A while it might increase unemployment in country B.

hi how would lowering inflation reduce a current account surplus

A reduction in inflation would lead to the domestic country’s goods being cheaper as average price level has fallen. This would cause foreign demand for domestic goods to rise as they are cheaper in relative terms. Causing an increase in exports for the domestic country leading to a current account surplus.

please i wanna know why all the countries who has a surplus use it buying foreign assets

why not use’s it in other sectures like helth, education…..

to improve their people’s life

you say that “In theory, you could expect a current account surplus (X-M) to boost employment because it is indicative of higher domestic demand.”

But then go on to say “A country may have a large current account surplus because of relatively weak domestic demand.”

How can these both be true?? does a surplus mean there is strong or weak domestic demand??

A large (X-M) is a net contributor to AD. So in theory, a current account surplus is increasing domestic demand. But, there are other components of AD. Consumption accounts for 2/3s if import spending is low, it maybe because consumer spending is low and so domestic demand weak. You cannot categorically say whether a surplus means strong or weak demand – it depends on too many variables.

There are 2 different causes for a surplus, it can iether be because of a weak domestic demand or if there is no recession seen yet there is a surplus it can indicate a strong domestic demand

Hi can you explain the the drawbacks of a BOP surplus ?? Emphasized a bit more on the drawbacks please !!!

I want to know how a country could have a deficit on its primary income but a current account surplus

Why would a government wish to eliminate a current account surplus