Readers Question: What have been the drivers of the mortgage default rate in the 2008 recession compared to the late 1980s/ 1990s?

Despite the depth of the recession in 2008, the mortgage default rate in the UK has been lower in the current recession than in the early 1990s.

The peak for home repossessions occurred in 1991, when over 70,000 homes were repossessed or 0.77% of outstanding mortgages.

The peak in the current recession was 46,000 home repossessions in 2009. (0.4%) (more mortgage default rates in UK)

1. Interest Rates

One factor that clearly explains different mortgage default rates is the base interest rate.

One factor that clearly explains different mortgage default rates is the base interest rate.

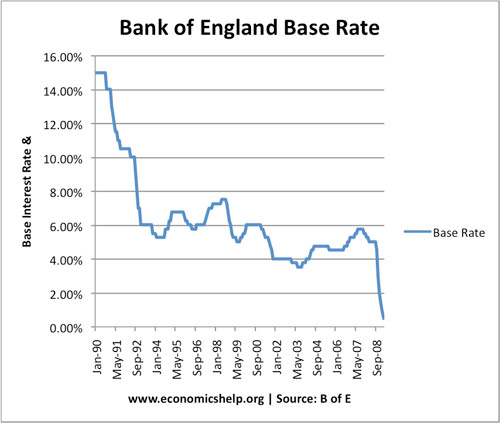

In the early 1990s UK interest rates were very high, reaching a peak of 15%. Interest rates were so high because:

- The government tried to reduce inflation caused by the Lawson boom

- The government had joined the Exchange Rate Mechanism and were trying to keep the value of the pound at a fixed level against the D-Mark.

The high interest rates were one of the main causes of the recession. The high interest rates caused tremendous difficulties for homeowners. The sharp rise in interest rates saw the cost of mortgages almost double. This meant many couldn’t afford the repayments and so they went into default.

The current recession was caused by the credit crunch (not high interest rates). In fact the Bank of England cut interest rates to 0.5% (an historic low) to try and boost the economy. This meant many people on tracker and variable mortgages saw their monthly mortgage payments fall. Therefore, although there was a rise in unemployment and low income growth, at least interest rates were low.

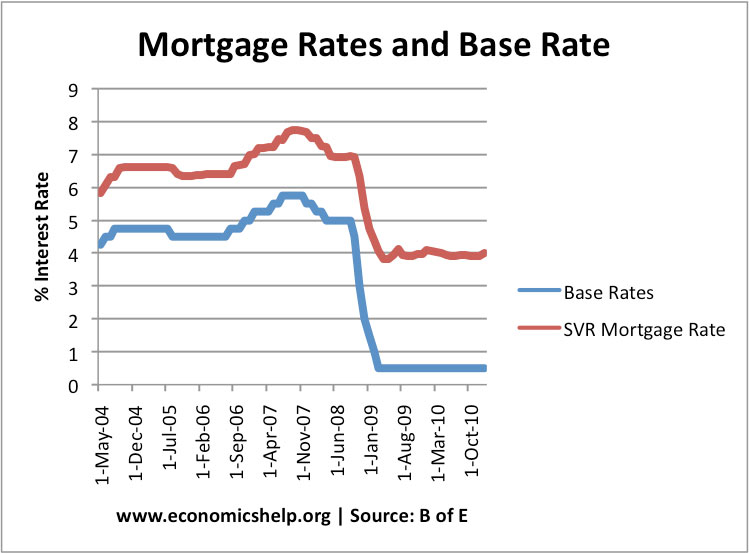

One factor about interest rates is that not every mortgage holder saw their mortgage rate fall by as much as base rates. Many banks took the opportunity of keeping mortgage rates high and not passing the base rate cut on to consumers. Therefore, mortgage rates were still high. But, quite significantly lower than in 1991.

Graph showing the standard variable mortgage rates didn’t fall as much as base interest rates.

Graph showing the standard variable mortgage rates didn’t fall as much as base interest rates.

What were main cause of Default in 2008-10

2. Unemployment.

In this period, UK unemployment rose significantly. Unemployment is the biggest cause of mortgage defaults as people receiving job seekers allowance see a fall in disposable income and may no longer be able to afford repayments. (UK unemployment)

3. Debt

In 2008, the UK saving rate had fallen close to 0% (UK Saving ratio) as many had borrowed more. Therefore many homeowners had not only mortgage to pay but also credit card and store card debts. Combined with falling incomes the pressure of various debt repayments meant that some defaulted on mortgage.

4. Falling real incomes.

The 2008-10 economic slowdown was a period of stagnant or falling real incomes (falling real wages). For one of the first times, people in work saw negative real wage growth. Inflation was higher than nominal wage growth leading to squeeze on living standards. This squeeze in real incomes makes it more difficult for people to meet mortgage repayments.

5. Size of Mortgages

During the boom years of 2001-2007, banks had lent unorthodox mortgages such as four or five times income multiples and self-certification mortgages. This meant many homeowners were paying a large % of their income on their very high mortgages.

Related

Thanks for answering my question!