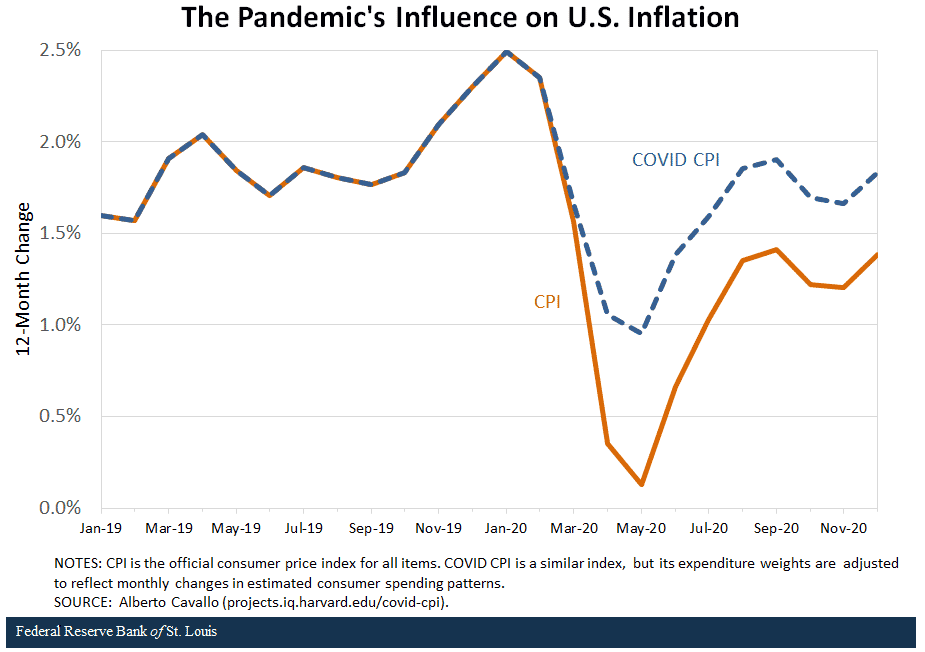

Return of Covid-Style Shortages and Inflation?

Do you remember when Covid led to empty shelves, panic buying of toilet paper and then when it all ended – a surge in inflation? It was only 3 years ago, though it feels longer. However, US stores could soon see looming shortages as 145% tariffs on China caused a sharp drop in US imports …