Readers Question: What would happen if a major currency, such as the dollar gets backed by gold again?

If a major currency was backed by gold it means the government must hold sufficient gold to convert representative money into gold at the promised exchange rate.

- It means that the country would not be able to increase the money supply (without an increasing the supply of gold)

- It means that the exchange rate should be fixed against other countries (unless the government decide to devalue or change the exchange rate.)

Outcome of A Major Currency Backed by Gold

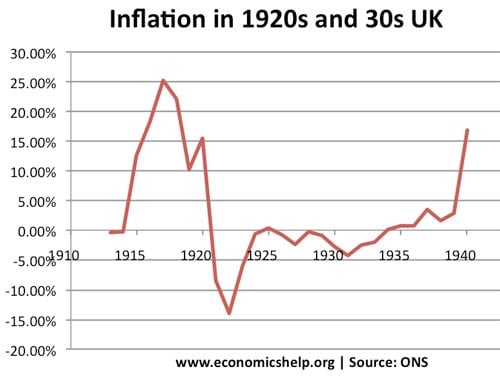

Lower Inflation. Without the ability to print money and expand the money supply, inflation is likely to be lower. Low inflation is often put forward as the main virtue of the gold standard. It is argued this can give greater stability in the economy encouraging investment and growth.

Deflation. The problem is that if there is limited expansion in the money supply and an overvalued exchange rate, an economy could easily end up with deflation. Most modern economies see significant growth in the money supply during a period of economic expansion. Without the expansion of the money supply, growth is likely to be curtailed.