Readers Question: Hello I recently saw a programme How China Fooled the World – with Robert Peston and I was wondering what threats and opportunities does the growth of economies like China and India provide to the UK economy?

According to the IMF, in 2010, the Chinese economy was $5,878 billion – second only to the US economy. If we use GDP at purchasing power parity (PPP), the size of the Chinese economy is estimated to be even larger, at around $10,119 billion.

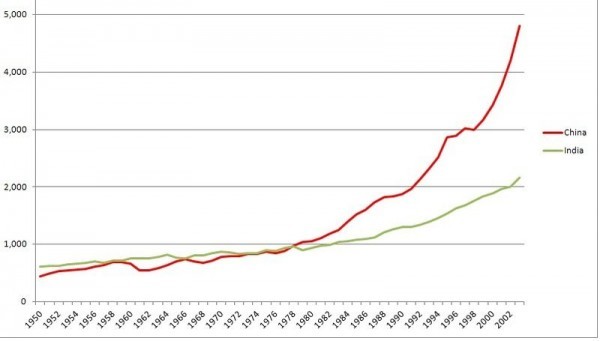

China also has a growth rate, averaging close to 10% a year. Even if there is a slowdown in this record rate of economic growth, China is forecast to become the dominant world economy within 10 or 20 years. India is another sleeping giant. Although India’s growth rate is slower than China it is the second most populous country and is still catching up with the rest of the world.

Opportunities of Chinese / Indian growth on UK economy

Low cost of manufactured goods. One major consequence of economic growth in China is that the UK has benefited from lower prices of many manufactured goods, imported from China. If you have ever wondered how Pound shops can sell so many goods for £1 – the answer is directly importing from China. China’s success in keeping costs low has created a downward pressure on prices. This helps to keep inflation in the UK low and improve living standards for UK consumers.

Growing consumer class. So far China’s growth has mostly concentrated on export led growth, leading to a large current account surplus. However, the next stage of Chinese economic development will likely see a growing consumer class who wish to purchase more luxury goods and services. This provides a significant opportunity for UK exporters of goods and services. Because of the size of the Chinese economy, there is strong latent demand. This could benefit UK exporters of high value added goods, such as nuclear technology, chemicals, cars (see: what UK exports). Also, there will be growing demand for UK services, such as university education / learning English. So far China’s growth has been somewhat one-sided – we have seen UK manufacturing firms squeezed out of business, but the other side of the equation is that British firms will have a strong growing market in China.

Lower costs of production. Another big advantage of the development of the Chinese and Indian economy is that it provides UK firms with potential lower costs of production. For example, many UK service centres have been shifted to English speaking centres in India. This dramatically reduces labour costs, leading to lower costs for telephones e.t.c. Also, an English firm which innovates a new product can use the low cost manufactured process of China to bring the product to the market at a competitive price. This is speeding up the globalisation of production. Increasingly we see a product produced in different sections of the world. e.g. the most famous is probably ‘Apple – designed in California, produced in China.’

Alternative to US / Europe. Traditionally, the UK economy has been reliant on exports to the EU and US. With the EU and US economy relatively stagnant, growth in exports to non-EU countries suggests the economy will become more diversified and less reliant on the EU trading block. (see: UK exports to non-EU countries)

Threats of Chinese growth

Increased competition for raw materials. Chinese growth has come at a cost of seeing rising price of raw materials. For example, during the recession of 2008-13, we saw periods of rising oil prices. This is unusual – usually during a recession in the West, oil prices fall. But, due to the growing demand from China and Asia, oil prices have been rising. This has squeezed living standards in the West. We faced both recession and rising prices. As the China and India economy grows, the pressure on raw materials is likely to exacerbate.