Readers Question: What are the effects of the exchange rate on UK businesses?

The exchange rate will play an important role for firms who export goods and import raw materials. Essentially:

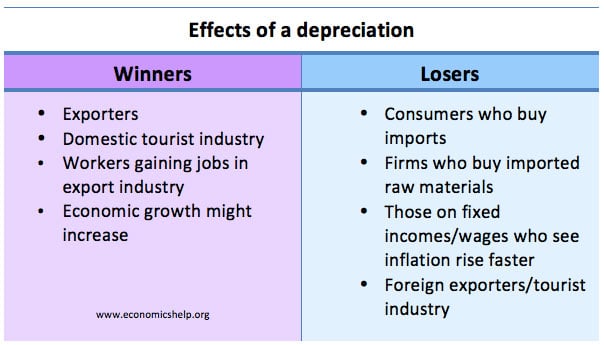

- A depreciation (devaluation) will make exports cheaper and exporting firms will benefit.

- However, firms importing raw materials will face higher costs of imports.

- An appreciation makes exports more expensive and reduces the competitiveness of exporting firms.

- However, at least raw materials (e.g. oil) will be cheaper following an appreciation.

Effect of depreciation in the exchange rate

If there is a depreciation in the value of the Pound, it will make UK exports cheaper, and it will make imports into the UK more expensive.

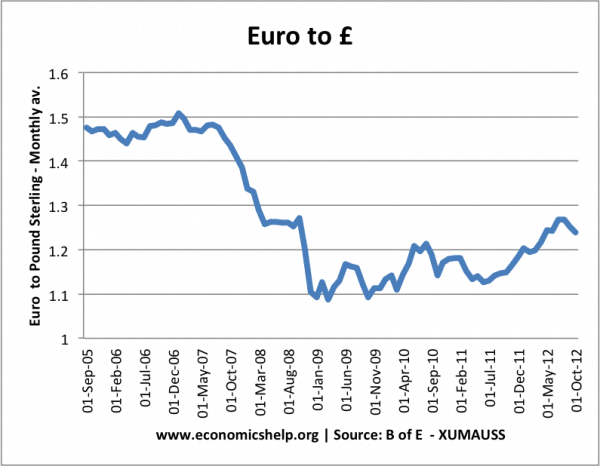

In this example:

- At the start of 2007, the exchange rate was £1 = €1.50.

- By Jan, 2009, the Pound had fallen in value so £1 was now only worth €1.10 (a depreciation of 26%)

Impact on British exporters

Suppose a British car costs £4,000 to build and sells for £5,000 in the UK.

- In 2007, the European price of this car would be €7,500 (5,000 *1.5)

- In 2008, the European price of this car would be €5,500 (5,000 *1.1)

The 26% depreciation means that European consumers now find British goods much cheaper. The cost of producing the car stays the same (assuming parts are not imported), but the effective market price in Europe has fallen. This should increase demand for British goods.

Increase profit margin or reduce the foreign price?

A British firm has a choice, it can reduce the European price from €7,500 to €5,500; this should lead to an increase in the quantity sold, and increase UK exports.

Alternatively, the firm could keep the price at €7,500 and just make a bigger profit margin. It is a good choice for exporters to have – reduce European price and sell more or keep price the same and make a bigger profit margin.

Impact on importers of raw materials

The downside of a depreciation is that British firms who import raw materials will see an increase in the cost of buying raw materials. If the British car company imports engines from Germany to make the car, it will have to pay more to buy the engines. This will reduce its profit margin.

Suppose an engine costs €1000 to import from Germany. In 2007, this costs £666 (1,000/1.5). In 2009, with the fall in the value of the Pound, they will have to spend £909 (1,000/1.1) to buy the same German engine.

Impact on incentives

In the long term, it is argued that a depreciation may reduce the incentives for exports to cut costs. The depreciation enables an ‘easy’ increase in their profit margin. As a result, there may be less incentive to cut costs and boost productivity. If a firm is facing an appreciation, then they may face a greater incentive to cut costs.