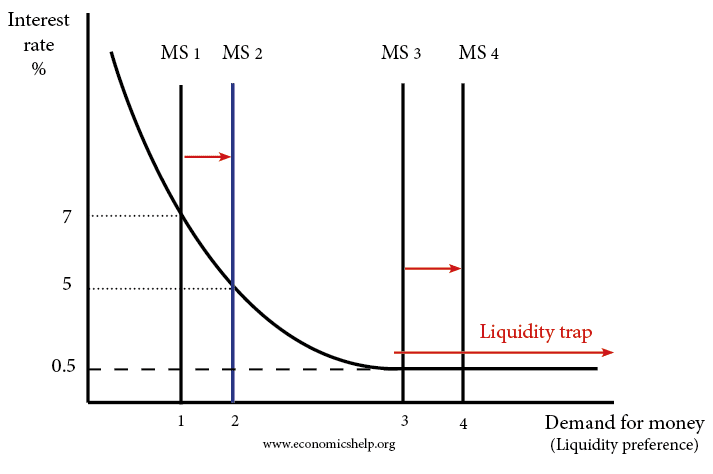

Liquidity refers to the ease at which assets can be converted into cash.

- An asset is said to be liquid if it is easy to buy and sell; for example, short-date government gilts are a highly liquid market because it is easy to sell on the bond markets.

- As asset is said to be illiquid if it is difficult to buy and sell. For example, a house is a very illiquid asset because to sell a house requires considerable time and expense. By the time you have found a buyer, the price of a house may have changed considerably – especially during boom and busts.

The importance of liquidity

An investor may need both liquid and illiquid assets. You need liquid assets to deal with any unexpected short-term crisis. But, illiquid assets may offer a greater chance for capital gains and higher yield.

For example, if you put money in a current account, you have instantaneous access, but interest rates tend to be low. If you put money in a time deposit account, you have to give the bank a seven day or 30-day advance warning you need the money. This makes your savings more illiquid, but the bank compensates by paying a higher interest rate.

Liquidity ratio

A liquidity ratio refers to the number of liquid assets to overall assets. If a firm is highly liquid – it has a high proportion of assets that can easily be converted to cash to pay off any obligations.

A low liquidity ratio means a firm has a shortage of liquid assets and may struggle to meet short-term debt obligations.

Cash reserve ratio

A bank may be required to keep a certain percentage of its assets in the form of liquid assets. It is the fraction of customer deposits held in cash reserves.

Cash reserves are not profitable. If a bank lends deposits to other customers, it can charge interest and make more profit. But bank loans are highly illiquid because the bank cannot immediately ask for the loan back.

A problem of the credit crisis is that banks had a very low cash-reserve ratio. This led to a liquidity crisis when banks couldn’t raise sufficient funds on short-term money markets.