- Total revenue (TR): This is the total income a firm receives. This will equal price × quantity

- Average revenue (AR) = TR / Q

- Marginal revenue (MR) = the extra revenue gained from selling an extra unit of a good

- Profit = Total revenue (TR) – total costs (TC) or (AR – AC) × Q

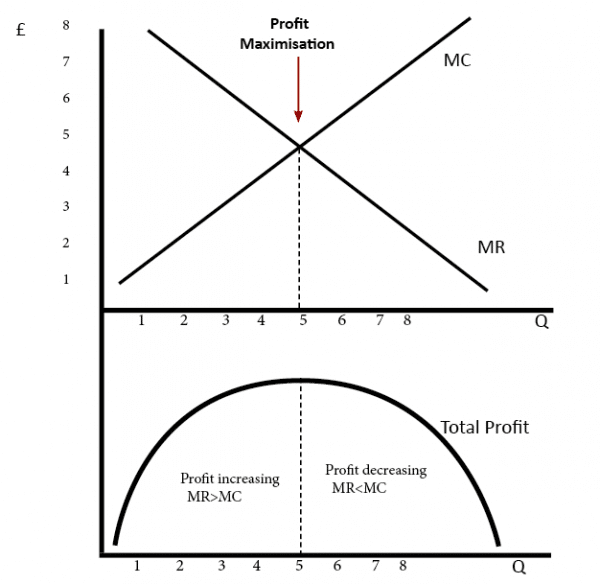

Profit maximisation

- In classical economics, it is assumed that firms will seek to maximise their profits. This occurs when the difference between TR – TC is the greatest.

- Profit maximisation will also occur at an output where MR = MC

- When MR> MC the firms is increasing its profits and Total Profit is increasing.

- When MR< MC total profit starts to fall

- Therefore profit is maximised where MR = MC

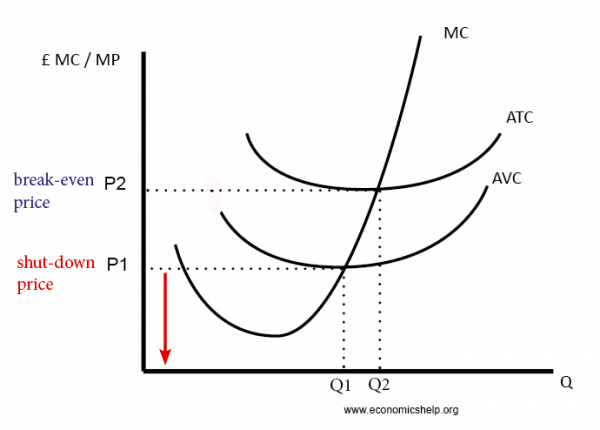

Definition normal profit

This occurs when TR = TC. This is the break-even point for a firm (P2). It is the minimum profit level to keep the firm in the industry in the long run. See more on normal profit.

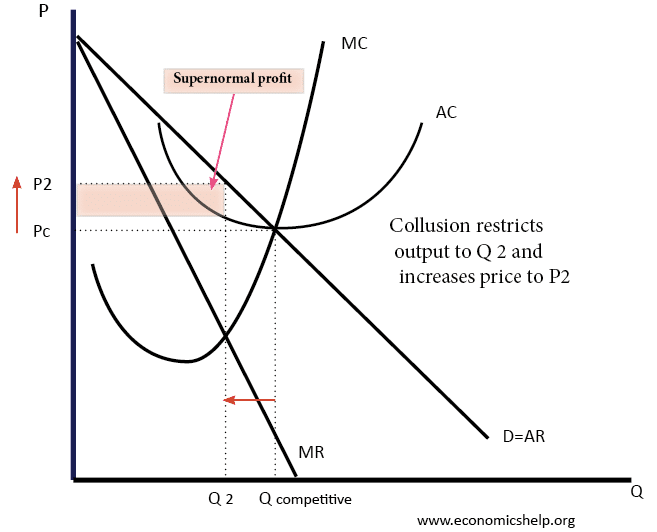

Definition supernormal profit

Supernormal profit is any profit above and beyond the level of normal profit (min. profit needed to keep firm in business. Supernormal profit occurs when total revenue > total cost.

Supernormal profit also occurs when average revenue (AR) is greater than average costs (ATC)

This diagram shows how collusion enables firms to make supernormal profit.

Whether to produce at all

- If AR > ATC The firm is making supernormal profits

- If AR= ATC The firm is making normal profits. This is the ‘break-even’ price.

- If AR< ATC but AR > AVC. it is making an operating profit and is covering its variable costs. However, it is making an economic loss because it can not cover its fixed costs as well. At this level (P1-P2) In the short run, it is best to keep producing because it has already paid for its fixed costs. It is at least making a contribution to its fixed costs

- If AR < AVC The firm is likely to shut down in the short run.

Evaluation

- In the real world, it is more difficult for firms to maximise profits because they do not have access to costs and marginal revenue data easily, it is difficult to predict.

- The firm may not close down at price of less than P1 – if they expect the fall in demand to be temporary and they are hopeful that they can cut costs. A firm will try to avoid shutting down because it will lose market share and long-term customers.

Factors that affect profitability

- Costs of production

- Can firm benefit from economies of scale?

- Are workers motivated and maximising labour productivity

- Exchange rate – appreciation makes exports expensive, but imported raw materials cheaper

- Economic cycle – Recession reduces demand for normal goods

- Competitiveness. A firm with monopoly power can make supernormal profit

- Investment in more efficient business.

- More detail – factors that affect profit

Related