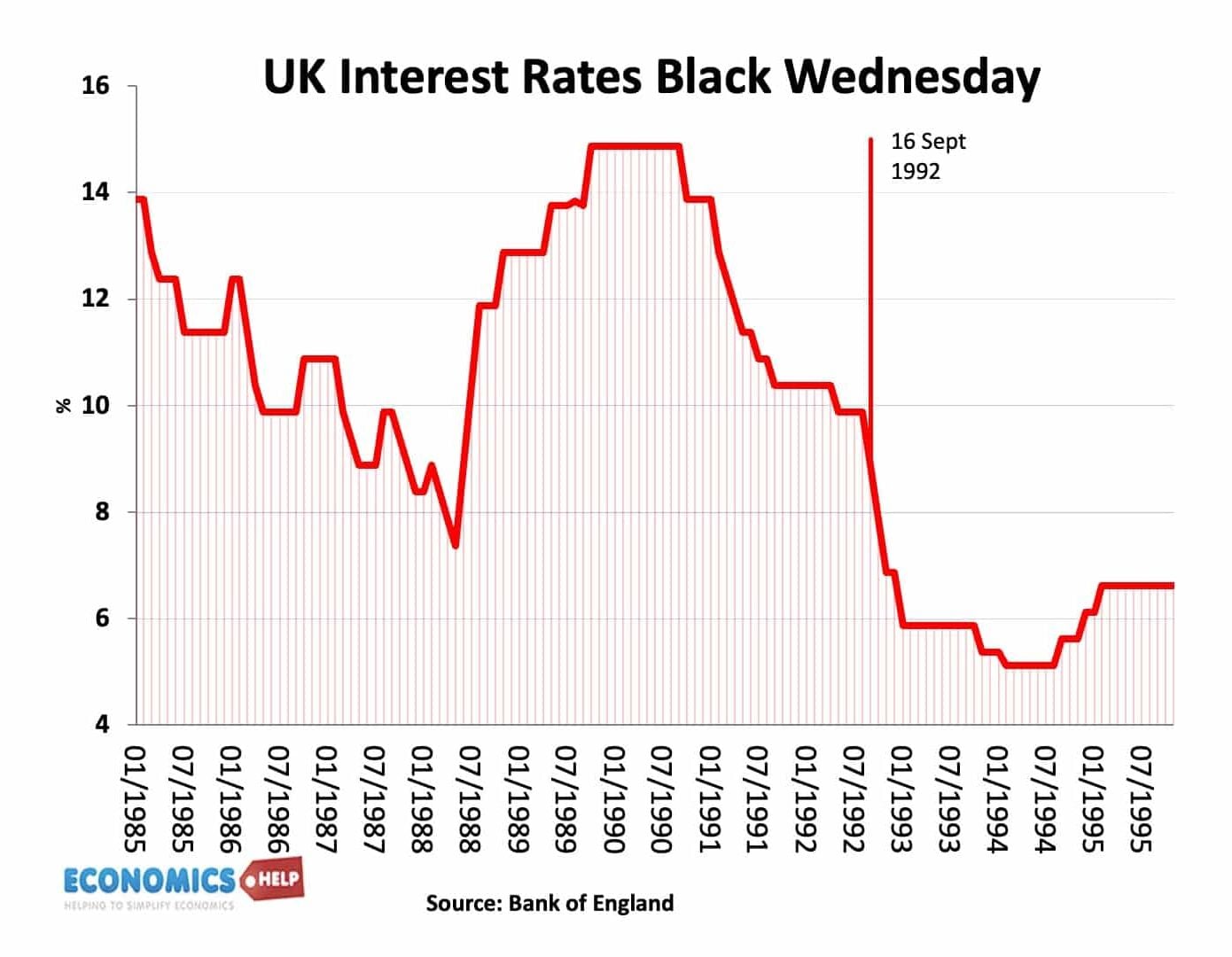

Bank of England Interest Rates

The Bank of England has the task of setting base interest rates to try and meet the government’s inflation target of 2%. The base rate is the rate at which the commercial banks have to borrow from the Bank of England. The Bank manages the money supply so that commercial banks usually end up having …