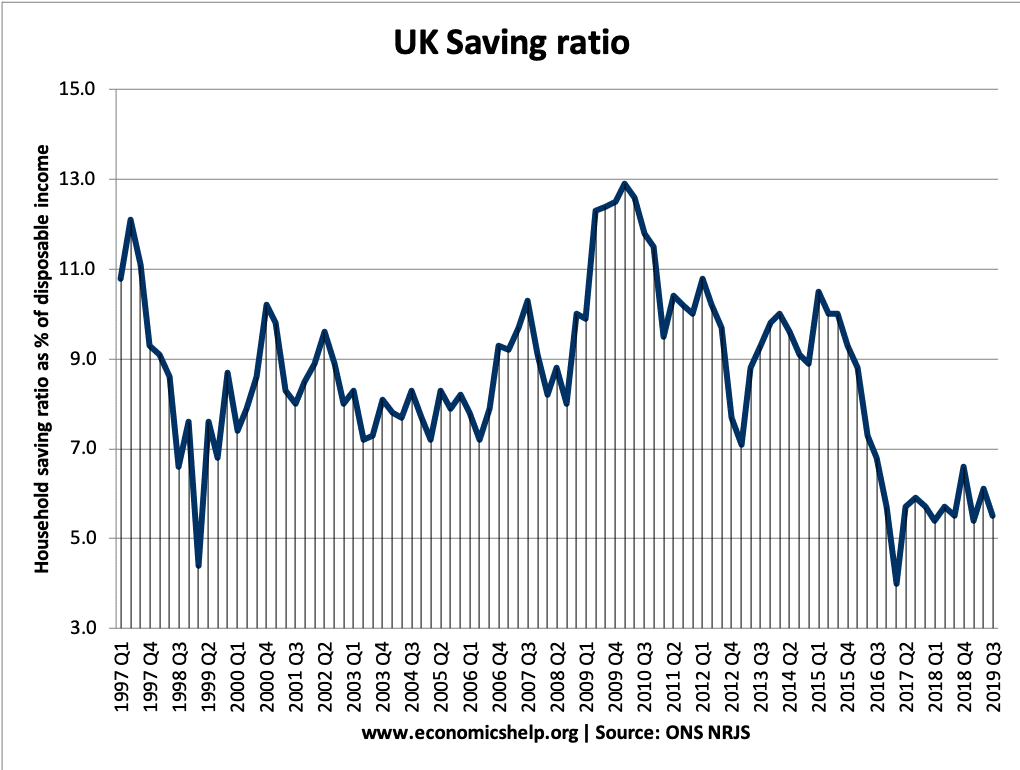

Should we be concerned about a falling savings ratio?

In the Bank of England’s latest forecast for the UK, they predict reasonably good economic growth in term of real GDP. At the same time, forecasts for average real incomes are more pessimistic. The Bank of England suggests UK economic growth will be maintained by consumer spending – spending which will partly be funded by …