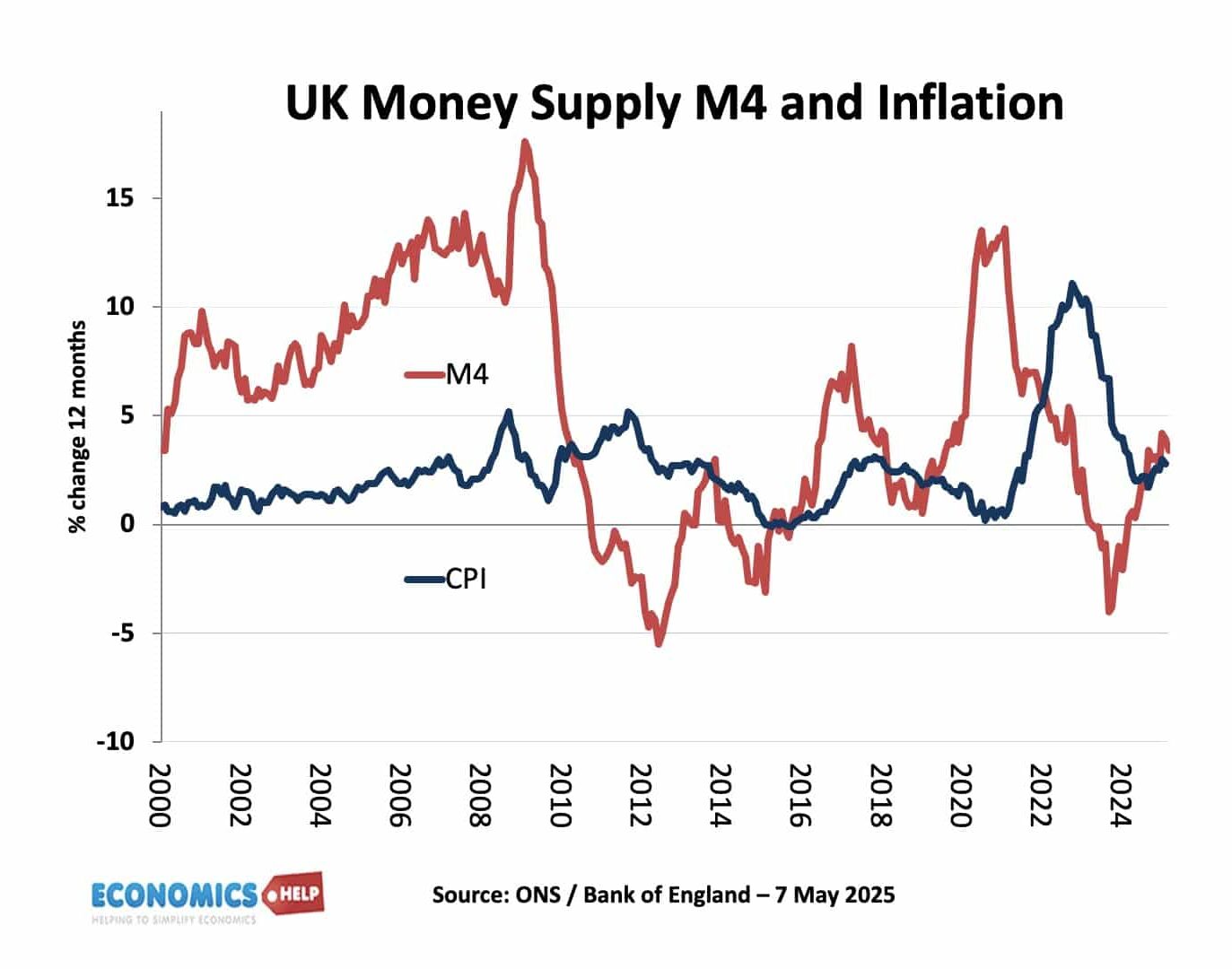

CPIY and Inflation

CPIY = CPI – indirect taxes such as VAT, stamp duty and excise duty. This gives a guide to underlying inflation, stripping away the distortionary impact of indirect taxes. This suggests underlying inflation is lower than the headline rate.(CPIY statistics.gov) A big issue for the UK economy is the existence of inflation when theoretically, there …