Interest Rate Predictions 2015

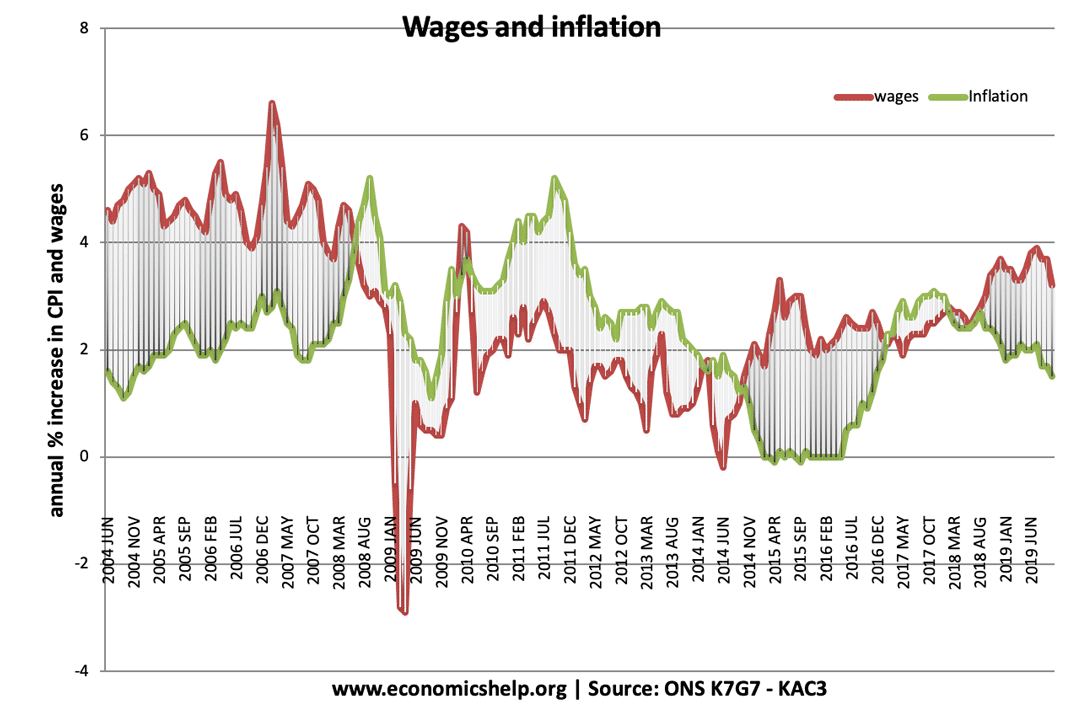

Bank of England base interest rates are currently 0.5%. Economists are divided about when interest rates will rise. Some point to the evidence of a strong economic recovery to suggest interest rates could rise by mid 2015. Others argue that the strong global deflationary pressures mean that UK inflation is likely to stay very low …