How Overvalued are UK House Prices?

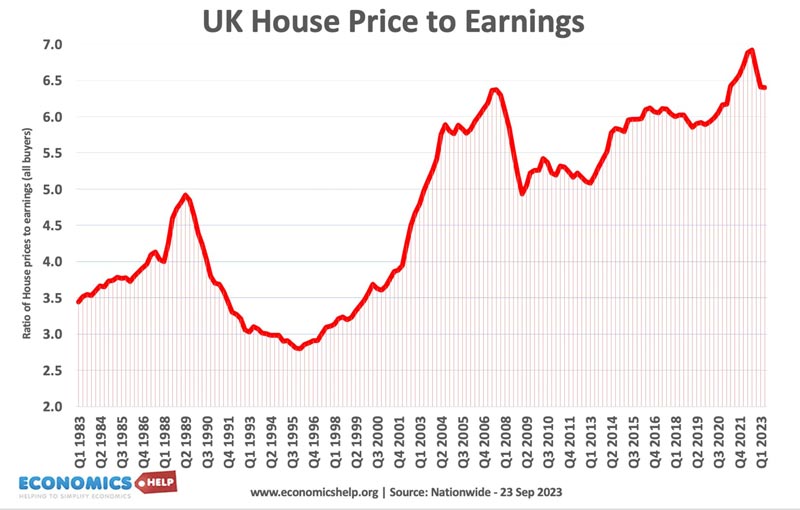

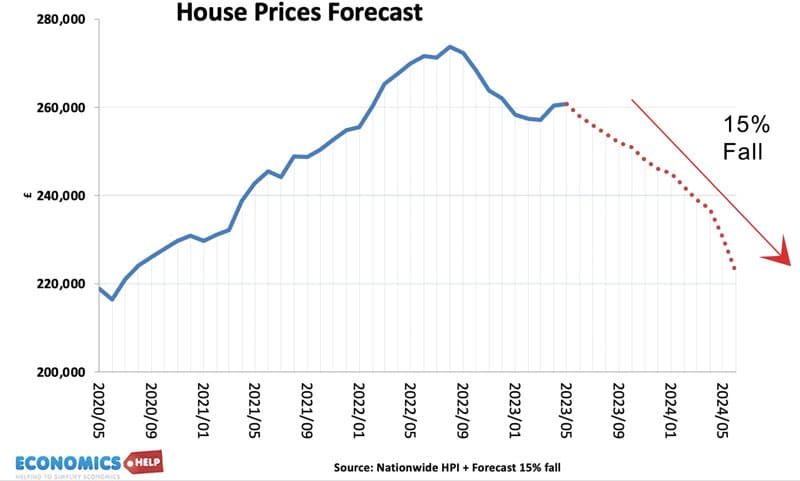

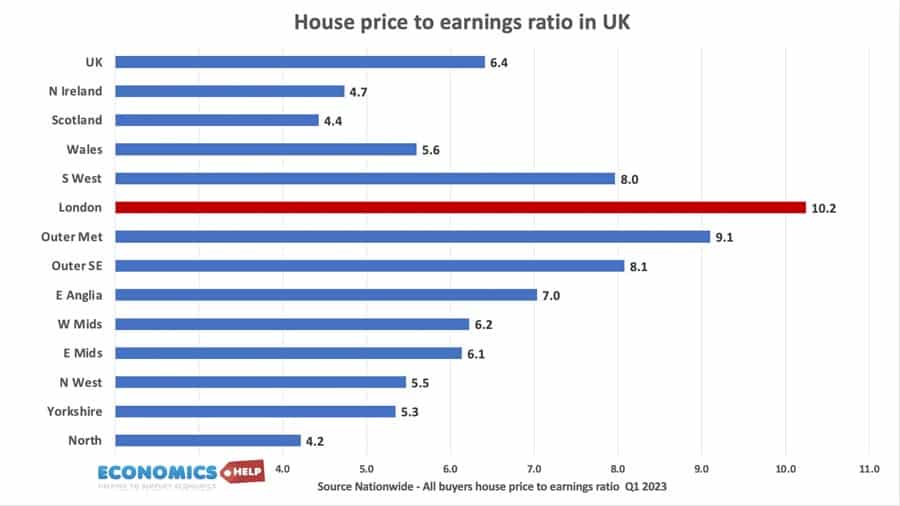

UK house prices are overvalued, which is why prices have started falling in most regions across the country. But, the big question is how far do prices need to fall? And where are prices most overvalued? How OVERVALUED are UK House Prices?Watch this video on YouTube In the aftermath of the 1990s recession, UK …