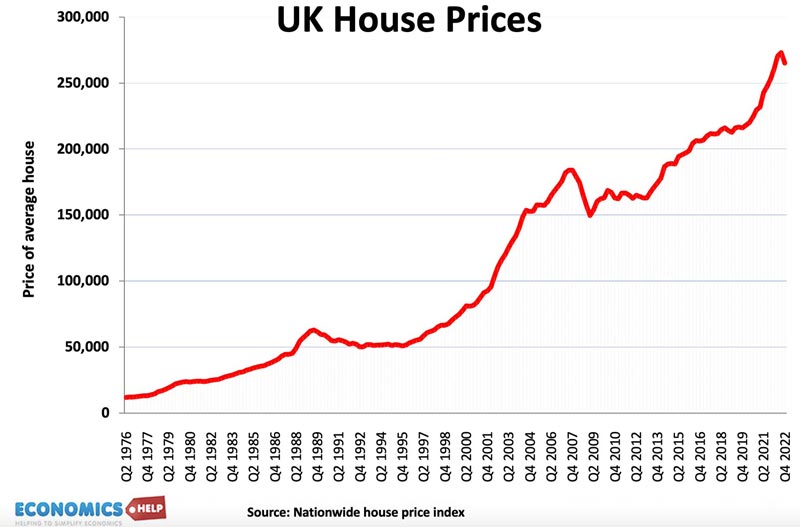

With mortgage rates soaring, and with the most pessimistic forecasts that house prices could fall by up to 35%, does it make sense to wait until after the current housing crisis has eased before buying? There’s no simple answer because it depends why you are buying and where you live. But, the housing market is definitely looking vulnerable because of high inflation and higher interest rates.

Is it worth waiting for prices to fall?

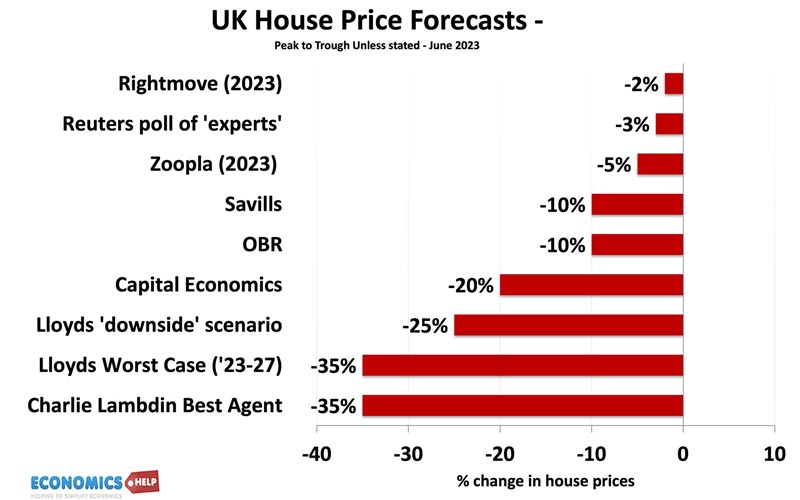

Firstly, is it worth waiting to benefit from potential price falls? House price predictions range from marginal declines of 2% all the way up to a 35% drop over a few years. Reuters claim the average house price forecast of ‘21 industry experts’ is just a 3% fall in 2023. Yet in May, Lloyds forecast a 35% decline in a worst case scenario. A 35% fall over a few years is also similar to the forecast made by Charlie Lamdin of BestAgent. The OBR predicted a 10% fall from peak to trough, but that was before the recent mortgage rate rises.

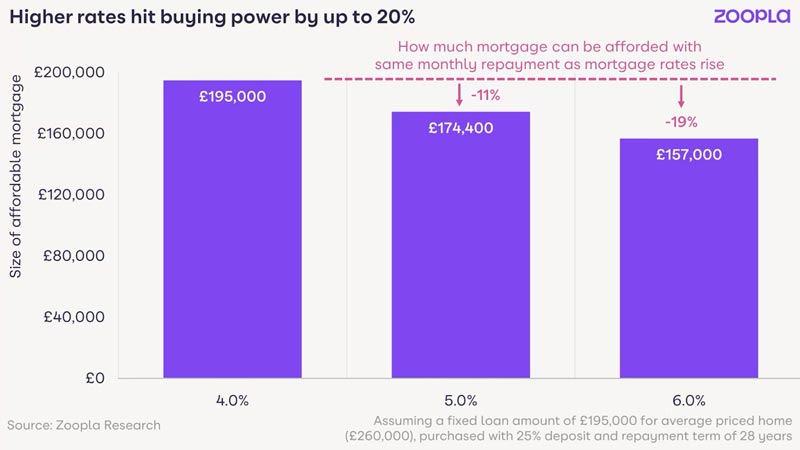

The huge variation in house price forecasts, doesn’t make it easy and a reminder any forecast requires a degree of guesswork. If people are 100% confident in their predictions, I tend to be wary. But, the recent rise in mortgage rates, have really tilted the balance against people being able to purchase. This Zoopla graph

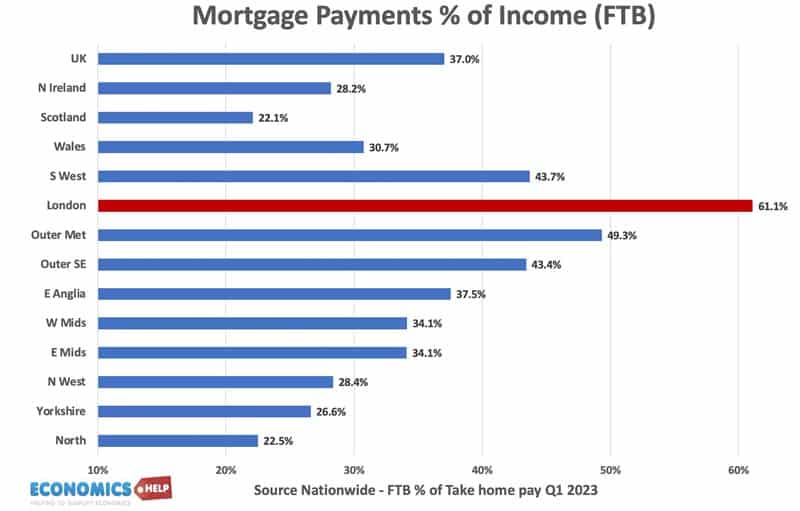

shows a rise in interest rates from 4-5% reduces buying power 11%. If rates rose to 6%, it would reduce buying power 20%. It is not surprising that there has been a sharp rise in the number of selling accepting a discount on the asking price. As interest rates rise, the cost of mortgage payments as a share of income is rising close to past crash levels. It is not helped by the fact real wages have been stagnant and even falling, another factor reducing affordability.

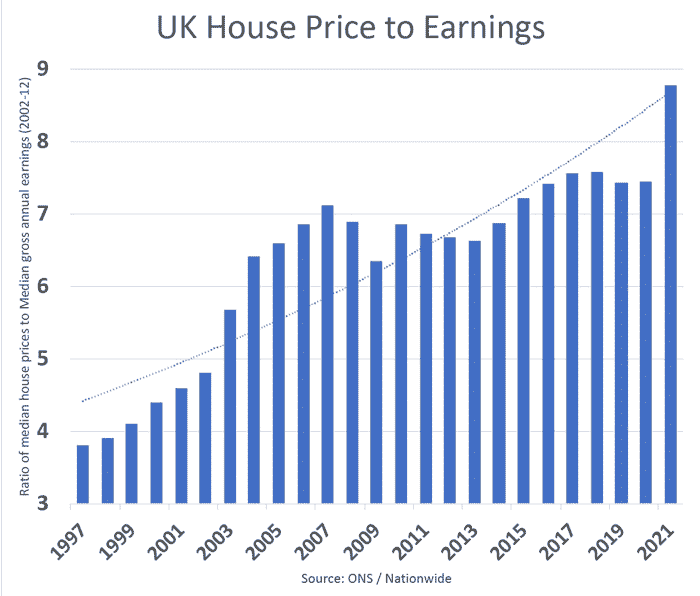

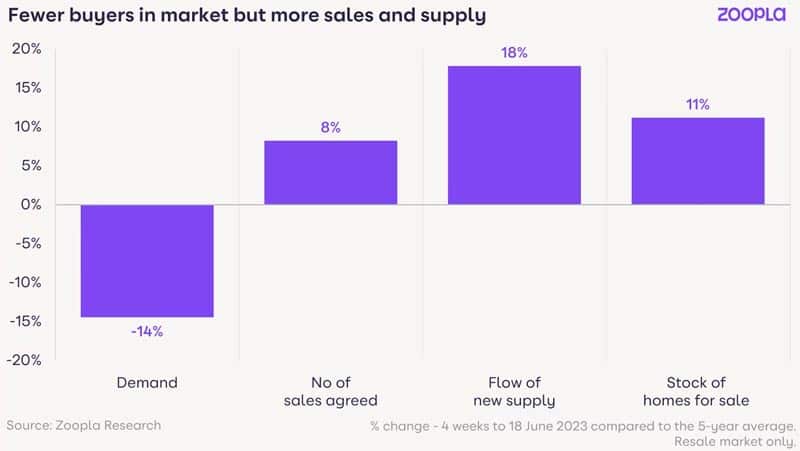

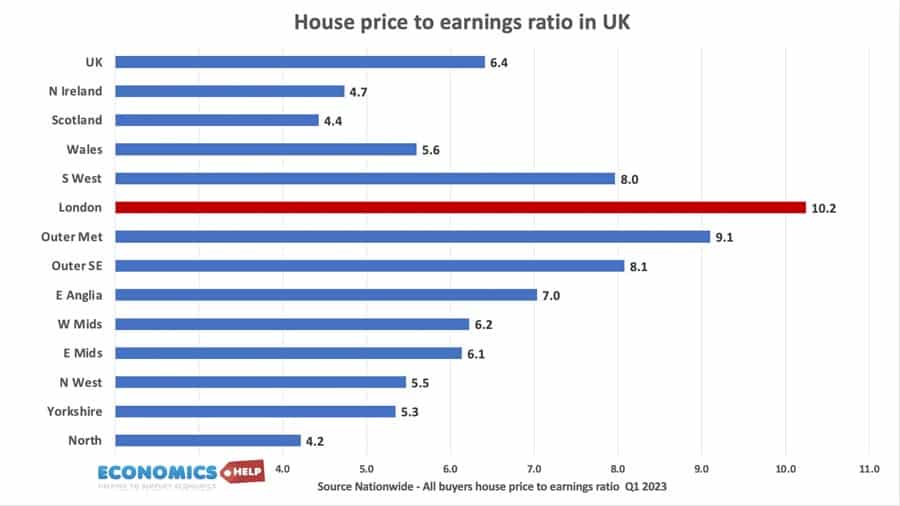

If we look at the average house price to income ratios, they are now at unsustainable levels. With substantially higher interest rates, the market can no longer support this kind of income multiple. Some point to the fact we have only had very modest house falls, despite large interest rate increases, but, with around 80% on a fixed rate mortgage, there is a time lag effect, with an increasing number of homeowners facing higher remortgage costs over the coming year. Although repossession rates are very low compared to the 1990s, the full effect of higher rates has not been fully felt. If the supply of houses on the market continues to increase as people sell, it would further reduce prices. The latest data from Zoopla shows both falling demand and rising supply.

When we talk about UK house prices we have to bear in mind, the housing market is highly regional. If we look at house price to income multiples, it varies enormously depending on the region.

As usual, London and the south-east are the most overvalued. This area is also most affected by rising interest rates with first time buyers paying 61% of take-home pay according to Nationwide.

It is London which will be most affected by higher interest rates and is likely to see the biggest house price drops. Yet, the UK still has many areas which are not so badly overvalued. If you have flexibility in where to live, there are good bargains to be had, such as this 3-bed house in Doncaster for £150,000.

Rent vs Mortgage

However, house price falls are not the only calculation. If you are paying very high market rents and can afford a mortgage, you may prefer to start investing in buying a house and paying off a mortgage, rather than rent, which is understandably known as dead money. I bought a house in 2005, shortly before the house price crash of 2008/09, but it didn’t really bother me when prices fell. Ironically, it was a boon because the rapid drop in house prices and financial crash led to lower interest rates and a cheaper mortgage.

In 2020, some predicted a house price crash because Covid was going to devastate the global economy. These predictions may have put people off buying – hoping prices would fall. But, despite a deep recession, house prices soared. Those who delayed hoping prices fall made a really expensive mistake. Earlier this year I was on talk talk tv with Russell Quirk who said house prices were going to rise and we even made a bet of £100. His point was that people predict crashes that never materialise. But, 2023 is almost the complete opposite of 2020.

In 2020, interest rates were cut to 0.1%, making mortgages very cheap and households saw a surge in savings, which encouraged purchases. Then working from home caused a dash for space. On top of this the Bank of England added an extra £400bn of quantitative easing into the banking sector. It is unsurprising that house prices soared. By contrast, in 2023, we have seen mortgage rates soar to over 6%. The Bank are slowly beginning to reverse quantitative easing. The covid surge in savings is going into reverse as households deal with a cost of living crisis and finally, some investors are seeking to cash in on the record house prices, by selling. It can be difficult to make house price predictions, but all the economic and financial data point to weaker house prices. And, it is not true UK house prices always rise, we do se big drops in house prices, like 1989-94 and 2009. Japan is an example of a country which saw house price falls last for over a decade.

Gradual readjustments

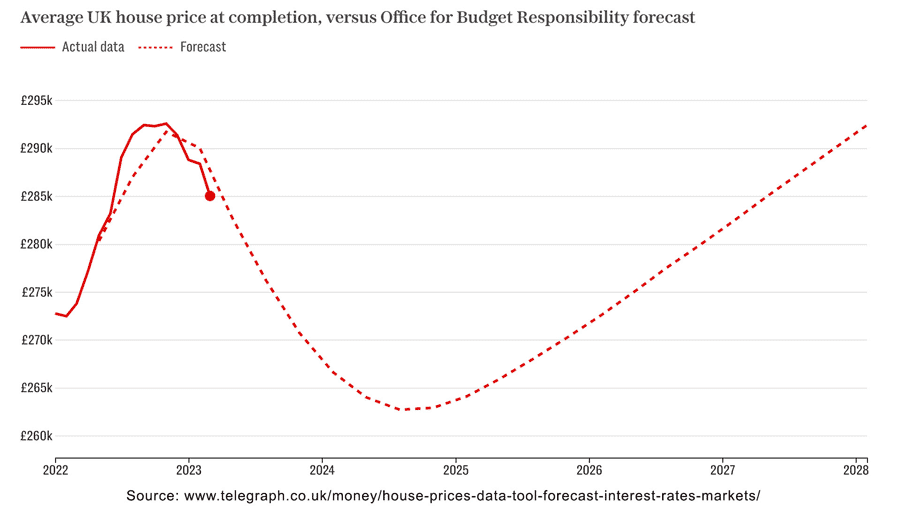

But if you are waiting for house prices to fall, the adjustment in prices can take a couple of years. It is important that even most pessimistic forecasts say house prices will fall 35% over a time period of 2-3 years. The Youtube algorithm and google search tend to prefer words like crash, but a more accurate description would be steady decline, gradual slide, slow readjustment. Also, bear in mind house price statistics can lag behind current events.

The housing market has a lot of rigidity as homeowners and estate agents cling to past valuations. Also, to some extent, homeowners may try to compensate for falling affordability by choosing longer mortgage terms (e.g. 40 years) and increasing deposits. We also can’t rule out some kind of government intervention in the market given an election in 2024. By most metrics, the UK housing market is overvalued, but it could be a slow process of readjustment.

The IMF state that as a rough rule of thumb, for every 1% rise in base rates, house prices fall 2%. This would mean that if UK rates were to rise from 0.1% to 6%, this is potentially a 12% fall in prices. However, this rough rule of thumb needs further explanation. UK house prices are so expensive, even small rate rises have a big effect. This is why analysts say that interest rates of 6% have the equivalent effect of around 13% two decades ago. In theory, the UK housing market should react more to interest rate rises than in the past. This is why there are so many horror stories of people remortgaging and facing an extra £200+ a month. When people say interest rates are still low by historical standards, it is not the whole story.

Prospect for interest rates

As important as house prices are what about interest rates? Fixed-rate mortgages have exceeded 6%, and some analysts predict interest rates could continue to rise. This is because UK inflation has become much more stubborn than predicted, with core inflation rising to 7%. The UK has the highest inflation rate in the G7. This begs the question, is the era of ultra-low interest rates over?

But, do current fixed rate mortgage rates offer good value? Firstly, banks have pushed up mortgage rates faster than the base rates, bank profitability has increased with higher base rates been priced into mortgage rates. Secondly, the current interest rate shock is probably unsustainable for the UK economy, and likely to push the economy into recession. Therefore, in 2024 and 2025, the upward pressure on interest rates may have to ease. The economist recently pointed out that Central Banks may have to accept a higher inflation rate than the target of 2% because the cost of high interest rates is likely to be too much for economies.

I plumped for a tracker mortgage a few weeks ago, shortly before a bad inflation report sent interest rates rising. So my record is not great in the short-term, but I would personally be reluctant to lock in a five year fixed rate mortgage at 5%, – not forgetting that it is the equivalent of 10% a few decades ago.

Buy to Let is in the doldrums

If you are an investor wondering whether to take out a buy to let mortgage the calculation is much more straightforward, despite rising rents, the yield on letting in current climate is an all time low, not helped by the increased cost of more regulations. Furthermore, with the likelihood of falling prices and negative equity. It is hard to see any incentive for new buy to let at the moment. If you don’t need to buy, then there is no harm in waiting.

What about if you are renting and worried, they will keep rising? In the last housing crash of 2009, falling house prices also contributed to falling rents. However, in 2023 it is not so clear that if house prices fall, rents will fall too. The problem here is shortage of properties. Some buy to let investors are selling, and new landlords are not coming into the market. Yet, demand for renting is growing with rising numbers of households and more renters not eligible for getting a mortgage.

Inflation prospects?

Another big question for the housing market is what will happen to inflation? With falling energy prices and food inflation coming down, inflation is forecast to fall considerably by 2024. This could ease pressure on the housing market and interest rates. The first caveat to this is that past forecasts of falling inflation have frequently been proved wrong. The second caveat is that it may only take another geopolitical shock, such as a coup in Russia to send oil prices rising and another potential inflationary shock.

Questions for first time buyers

What are the questions to ask, if you are thinking of buying in 2023? Firstly can you afford the mortgage? Banks have really tightened their lending criteria in recent weeks, so if you can pass their stress tests, then it means the bank has confidence in your ability to repay. Secondly, how does a mortgage compare to your current rent? Many renters will find the relative cost is quite similar, even at these high interest rates. But, if you are living very cheaply at your parent’s house, this is a great opportunity to save for a bigger deposit and look for better value over the next few years. The bigger the deposit, the lower the loan to value of the house and the more protected you are from negative equity should house prices fall. Also, with bigger deposits, you will get relatively better mortgage deals. The turmoil of the housing market is potentially good news for those who felt they could never buy a house in the UK. If you take the opportunity to save for a deposit in the next few years, there is a really good chance for much better affordability in the future.

Risk of Recession

Another question for potential buyers is what about the risk of recession and unemployment? The worst case scenario is rapidly rising unemployment and higher interest rates. This is what caused a surge in home repossession in the early 1990s, and that long period of falling prices. 2023 is unusual, in that we have very low economic growth, but quite high levels of job vacancies. If we enter recession, the rise in unemployment will probably be muted compared to say 1991 or 2009, but could still be devastating for many An economic downturn it is another real concern for potential homebuyers, but then so is renting.

Conclusion

Whether you buy a house or wait is very much a personal decision. But, the housing market looks more at risk of significant falls than for the past 15 years. It is a buyers market. Asking prices have become detached from the reality of what people are willing to pay. So if you want to buy, be willing to put in big discount from asking price, and if it doesn’t get accepted be patient. If you liked this video, this is more on why the UK is heading into recession and what it could mean for the housing market.

Hello Tejvan,

I am Israel Ajao

I just recently found your YouTube channel and your contents are quite compelling, fascinating and intellectual. Your analysis are extensive and great. I find your argument about house prices downside to be instructive in particular with the new interest rate by the Bank of England.

Given the extensive analysis you have done on residential houses, I am more interested in commercial real estate property (hotel purchase prices) in London. Could it also be facing a downward spiral? I hope to hear back from you.