A look at why the Venezuela economy is dependent on oil, why it did not do more to diversify, and the problems of relying on a primary product like oil.

Readers Question: First, why are more than 90% of their exports based on oil? Under Hofstede’s “Uncertainty and Avoidance of Risk”, Venezuela is ranked as a country that goes to great lengths to avoid risk. But basing an entire economy on the prosperity of one commodity seems like the definition of risk. Your thoughts on that are much appreciated.

Firstly a few quick statistics on Venezuela economy. According to Wikipedia

- Venezuela is an oil-dependent economy. Revenue from petroleum exports accounts for more than 50% of the country’s GDP and roughly 95% of total exports.

- Manufacturing contributed 17% of GDP in 2006

- Agriculture in Venezuela accounts for approximately 3% of GDP, 10% of the labour force.

Why does an economy base its prosperity around one commodity?

Firstly, Venezuela is not unique. Many countries specialise in oil and then later come to regret this specialisation. I have a Russian student who is asking exactly the same question – Why did Russia not take the opportunity to diversify away from gas and oil. (see: Russian economic crisis)

The problem is that when oil prices are high, it’s tempting to take advantage of the high revenues. Anything else seems much less profitable. Secondly, people may make the assumption oil prices will remain high – so they have plenty of time before needing to diversify the economy.

If you have vast reserves, then in the short term, oil production offers the quickest way to promote economic prosperity, higher tax revenues and higher government spending. By comparison, at the time, manufacturing and agriculture will offer much smaller returns and potential for exports.

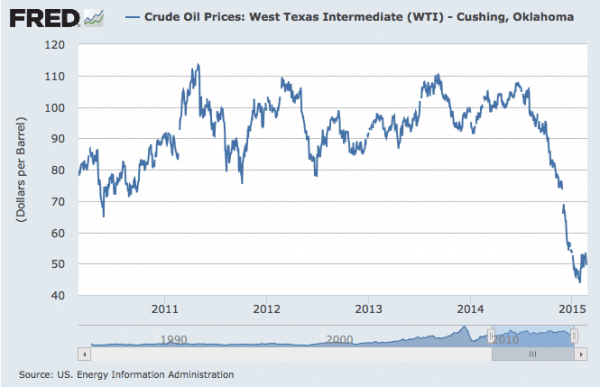

In 2007, when oil prices were rising, the Venezuela economy was growing rapidly – 7% a year. With oil revenues, the government was able to begin ambitious spending programmes. Many in 2007/08 may have felt that high oil prices were likely to stay high. (I remember reading articles which predicted oil prices of $200 a barrel. Very few were predicting a collapse in prices to $40.

Why not diversify the economy?

It is easy to say than do. If you have an economy that has a highly profitable oil industry, it is difficult to develop new manufacturing industries. This is for a few reasons.

- The profitable oil industry will be attracting most investment and skilled labour.

- Entrepreneurs will be reluctant to create new industries, where Venezuela doesn’t seem to have a comparative advantage; the prospect of profit is low and there is no guarantee they will be able to create new industries. Trying to work in the oil industry may seem more appealing and profitable.

- The government, in theory, could try to diversify the economy. They could tax the oil industry and use the proceeds to subsidise the creation of new manufacturing industry. However, around the world, governments don’t have a great track record of ‘setting up new industries’ – The government is not expert in manufacturing and so it may struggle to decide which industries to create and where to spend money. There is no guarantee the government efforts to subsidise new industries will bear any fruit. Many governments would prefer to take the easier option of benefiting from the boom in the oil industry and hope the oil price stays high.

- Governments are not noted for long-term vision and acting on the possibility of changing economic situations. The political process also encourages a short-termism. You don’t tend to win many elections by promising lower income now, and investment which may bear fruit 5-10 years in the future.

Readers Question: And second, why don’t they specialise in anything else? Do they really not have any other comparative advantage in producing any other type of good?

In the short term, with oil prices over $100 – Venezuela’s comparative advantage will be in oil. No other industries will be as profitable. With a decline in oil prices, the benefit of the oil industry falls and Venezuela’s comparative advantage will shift. That is the difficulty, you can have a short-term comparative advantage in the production of a commodity like oil, but in the long-term, your comparative advantage may be different (depending on what happens to the price of oil.) The difficulty is looking at the high price of oil in 2008 and deciding this high price is unlikely to stay high, therefore, we need to take account of this.

Problems of relying on oil industry

Many countries have got into difficulties because of relying on oil. For example, Netherlands had a boom in the oil industry, which led to its manufacturing industries falling behind. This became known as the “Dutch Disease” – or “Resource Curse” A recognition that suddenly discovering a lot of new natural resources can be a real problem because you get a temporary boost in income but, this can damage other areas of the economy, leading to a more commodity-dependent economy.

But, can a government not do more?

Yes, a government could do more. It can set up an oil fund (like Norway), where tax revenues are saved and invested and not spent on current income. A problem of Venezuela was wanting to pursue very optimistic spending programmes – raising expectations, which depend on very high oil prices. Now expectations have been missed and there are no savings to use.

Secondly, the government can do more to benefit the economy in the long-term. I am very doubtful the government can set up industries. But, the government can invest in education, training, infrastructure – supply-side policies which will help small and medium-sized business do well in the long-term and make the economy more diversified.

Related

Venezuela had a stabilization fund. But it was gutted by Chavez, who was very poor at governance and placed incompetent people in the oil ministry as well as PDVSA. Venezuela had tried to diversify, they had a steel and aluminum industry, but it was nationalized and its production capacity was cut considerably. The same happened to agriculture, and other economic activity. Thus, as we saw oil prices climb from 1999 to 2014 the Chavez/Maduro regime destroyed both the oil industry’s as well as other sectors’s capacities to produce goods for internal needs and export.

The problem was compounded by extreme corruption, theft from national accounts by the ruling clique, a drain of resources used to provide oil and cash to Cuba, a surge in murder and other crimes, and flight of the professional and educated class.

What happened in Venezuela was truly surreal. It has been destroyed by a combination of Marxist dogma, corruption, incompetence, nepotism, and Chavez’s megalomania.

There is some misinformation about Venezuela’s economy worldwise. In fact, Venezuela prior to Chavez- had a more diversified economy. Venezuela indeed used to export agricultural machinery, leather, cars, trucks, 5% of its exports were steel and other minerals, petrochemicals, medicines, textiles, clothing, corn, soybean.

Venezuela used to supply most of its internal needs and exported a good amount of goods. The seizure of different industries and constant attacks from the regime of Hugo Chavez, then Maduro (Cuban intelligence behind then) to all the sectors of the economy is what led to the current state of the economy. We got to see periods where oil prices were pretty low and while we saw slow growth in the economy, we still could keep up with the economy apparatus.

There is so much misinformation since the Internet era. Authoritarian governments and other private entities (social media owners, market investors, etc) with obscure interests invest a great deal in putting a blind in people’s eyes. The myth of a “Venezuela going to the abyss by relying exclusively on oil” has been successful propaganda to conceal the wrongdoings of a regime through corruption and subcolonization that have benefit countries such as Turkey, Cuba, Russia, China, Iran, and companies such as Chevron, Goldman Sachs, Rofnet.