Readers question: Will a sustained recovery in the UK lead to inflation?

A sustained economic recovery could lead to inflation. If economic growth is above the long run trend rate for a prolonged period, if demand grows faster than productivity, then in that scenario we are likely to see rising inflation (rise in the cost of living). However, if the economic recovery is sustainable, if demand grows at a similar rate to productivity, then inflation will remain low.

Previous experiences of economic recovery and inflation

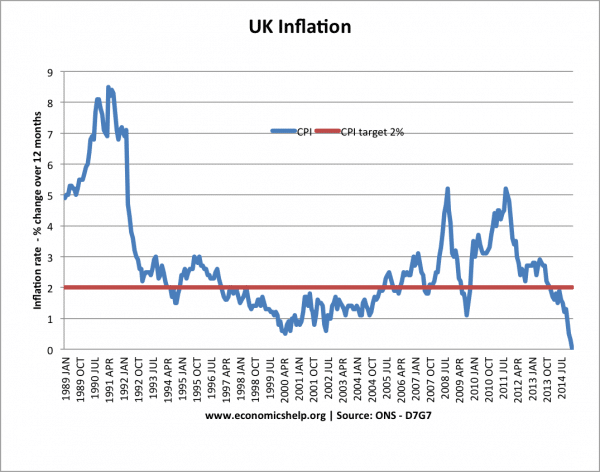

In the 1980s, the economic recovery from the 1982 led to an economic boom of the late 1980s (with growth of over 4% a year), and this kind of recovery did cause inflation to rise to over 9%. (Lawson boom)

However, after the 1991/92 recession, the economic recovery was consistent with a low rate of inflation. This was due to lower global inflation, a more sustained rate of economic growth and the independence of the Bank of England willing to target low inflation. (Great moderation)

What are the prospects for inflationary growth in the UK?

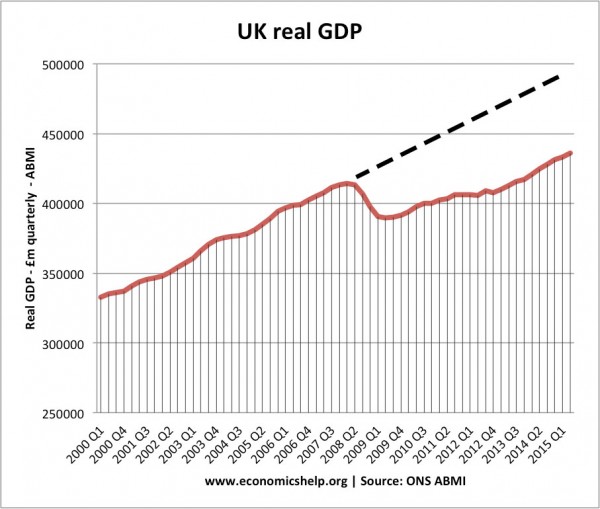

At the moment, it is difficult to forecast any significant inflation. The recovery has been muted since 2010, real GDP per capita has grown at a slow rate – if we look at the past trend rate of growth, the economy is still below the previous trend rate.

Interest rates have a long way to rise. Interest rates have been at 0.5% since March 2009. This gives the Bank of England ample opportunity to respond to any rise in inflationary pressures. If growth does start to boom, then the Bank of England can increase interest rates to moderate the rise in economic growth.

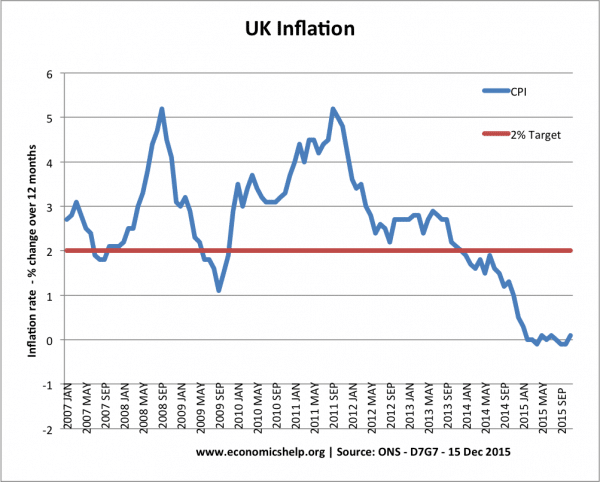

Inflation is at near historic lows. UK inflation is close to 0%, inflation expectations have fallen and it is hard to envisage a quick change in this. With low inflation expectations, it becomes much easier to keep inflation low because workers have got used to accepting minimal (if any) nominal wage increases.

Low global inflation. It is not just the UK which is experiencing low inflation. We are also seeing very low inflation in Europe and other countries. This is partly caused by falling oil and commodity prices, but also a reflection we are in a new era of low growth.

Reasons for possible inflation in the future

- Poor productivity growth. The UK has seen continued poor growth in productivity. This means the UK is more likely to experience supply bottlenecks. Even small rises in demand could cause inflation, if productivity continues to stagnate or grow slowly.

- Low-interest rates could cause an asset bubble, e.g. rising house prices, which cause rising consumer demand.

- Delayed impact of quantitative easing. The increase in the money supply from the Bank of England’s quantitative easing has largely stayed in commercial banks and not filtered through into the wider economy. An economic recovery could encourage the banks to restart lending, and fuel a future economic boom.

- Rising house prices could lead to inflationary pressures. In the late 1980s, rising house prices were a factor behind high inflation; rising house prices encourage consumer confidence and encourages banks to lend. However, the rising house prices in the 2010’s are also discouraging many young consumers who feel need to save for a large deposit or have little disposable income after paying rent.

- Unbalanced economic recovery. The UK’s strongest recovery is in consumer spending, with a growing current account deficit. With domestic production not showing much recovery, this could increase the chance of inflationary pressures.

- Unemployment falling to 5% and likely to keep falling. Even at this stage of the economic cycle, firms report difficulty in employing skilled labour. If migration fell significantly, we could see rising wages due to labour shortages. However, one reason for low unemployment is the fact many low paid, temporary jobs are being created. Firms are employing more, by keeping wages low.

Conclusion

At the moment, it is hard to see any imminent prospect of real inflation. When looking at reasons to be concerned about inflation in the future, it is clutching at straws to try to try and see inflationary pressures. For a UK recovery to lead to inflation, we would need to see a real change in the nature of the economic recovery.

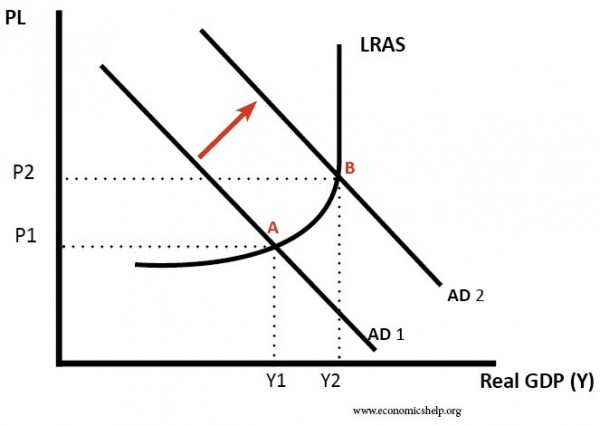

AD/AS diagrams

Diagram of Demand Pull Inflation

Recovery causing inflation due to AD rising faster than AS.

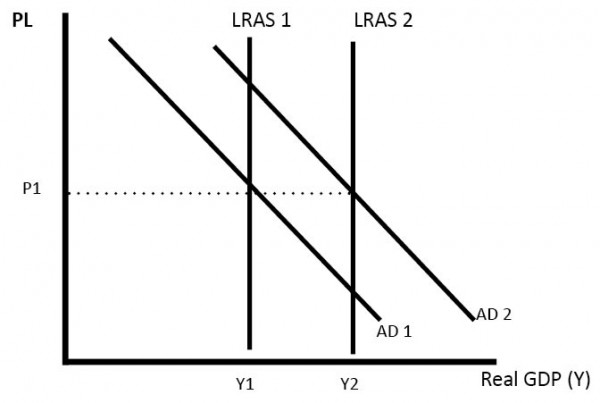

Diagram showing low inflationary growth

AD increases at same rate as LRAS – keeping inflation low.

Related