Readers Question: what are the advantages and disadvantages of inflation?

Inflation occurs when there is a sustained increase in the general price level. Traditionally high inflation rates are considered to be damaging to an economy. High inflation creates uncertainty and can wipe away the value of savings. However, most Central Banks target an inflation rate of 2%, suggesting that low inflation can have various advantages to the economy. Some economists even argue we should target a higher inflation rate during periods of economic stagnation.

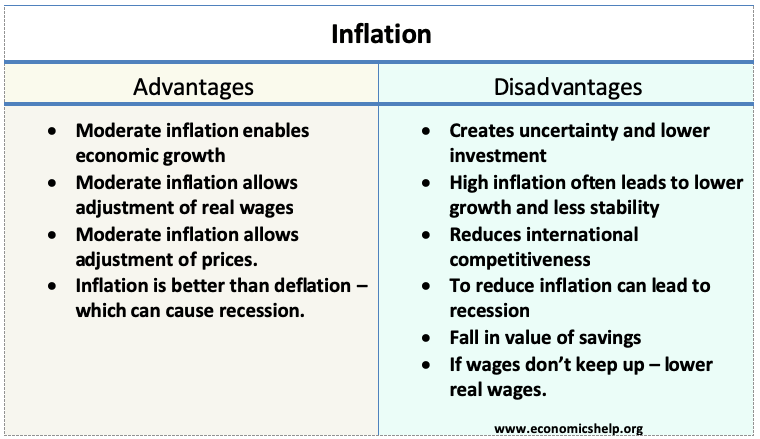

The advantages of inflation

1. Deflation (a fall in prices – negative inflation) is very harmful. When prices are falling, people are reluctant to spend money because they feel that goods will be cheaper in the future; therefore they keep delaying purchases. Also, deflation increases the real value of debt and reduces the disposable income of individuals who are struggling to pay off their debt. When people take on a debt like a mortgage, they generally expect an inflation rate of 2% to help erode the value of debt over time. If this inflation rate of 2% fails to materialise, their debt burden will be greater than expected. Periods of deflation caused serious problems for the UK in 1920s, Japan in 1990s and 2000s and Eurozone in 2010s.

See more Costs of deflation

2. Moderate inflation enables adjustment of wages. It is argued a moderate rate of inflation makes it easier to adjust relative wages. For example, it may be difficult to cut nominal wages (workers resent and resist a nominal wage cut). But, if average wages are rising due to moderate inflation, it is easier to increase the wages of productive workers; unproductive workers can have their wages frozen – which is effectively a real wage cut. If we had zero inflation, we could end up with more real wage unemployment, with firms unable to cut wages to attract workers.

3. Inflation enables adjustment of relative prices. Similar to the last point, moderate inflation makes it easier to adjust relative prices. This is particularly important for a single currency like the Eurozone. Southern European countries like Italy, Spain and Greece became uncompetitive, leading to large current account deficit. Because Spain and Greece cannot devalue in the Single Currency, they have to cut relative prices to regain competitiveness. With very low inflation in Europe, this means they have to cut prices and cut wages which cause lower growth (due to the effects of deflation). If the Eurozone had moderate inflation, it would be easier for southern Europe to adjust and regain competitive without resorting to deflation.

4. Inflation can boost growth. At times of very low inflation, the economy may be stuck in a recession. Arguably targeting a higher rate of inflation can enable a boost in economic growth. This view is controversial. Not all economists would support targeting a higher inflation rate. However, some would target higher inflation, if the economy was stuck in a prolonged recession. See: Optimal inflation rate

For example, the Eurozone has had a very low inflation rate in 2013-14, and this has corresponded to very weak economic growth and very high unemployment. If the ECB had been willing to target higher inflation, then we could have seen a rise in Eurozone GDP.

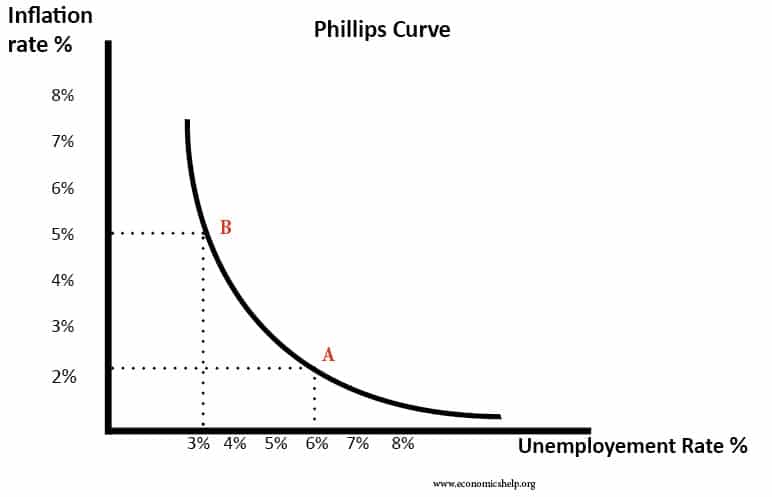

The Phillips Curve suggests there is a trade-off between inflation and unemployment. Higher inflation leads to lower unemployment (at least in the short-term) there is a debate about how meaningful this trade off is.

5. Inflation is better than deflation. The only thing worse than inflation, joke economists, is deflation. A fall in prices can cause an increase in the real debt burden and discourage spending and investment. Deflation was a factor in the Great Depression of the 1930s..

Disadvantages of inflation

Inflation is usually considered to be a problem when the inflation rate rises above 2%. The higher the inflation, the more serious the problem is. In extreme circumstances, hyperinflation can wipe away people’s savings and cause great instability, e.g. Germany 1920s, Hungary 1940s, Zimbabwe 2000s. However, in a modern economy, this kind of hyperinflation is rare. Usually, inflation is accompanied with higher interest rates, so savers do not see their savings wiped away. However, inflation can still cause problems.

- Inflationary growth tends to be unsustainable leading to a damaging period of boom and bust economic cycles. For example, the UK saw high inflation in the late 1980s, but this economic boom was unsustainable, and when the government tried to reduce inflation, it led to the recession of 1990-92.

- Inflation tends to discourage investment and long-term economic growth. This is because of the uncertainty and confusion that is more likely to occur during periods of high inflation. Low inflation is said to encourage greater stability and encourage firms to take risks and invest.

- Inflation can make an economy uncompetitive. For example, a relatively higher rate of inflation in Italy can make Italian exports uncompetitive, leading to lower AD, a current account deficit and lower economic growth. This is particularly important for countries in the Euro-zone because they can’t devalue to restore competitiveness.

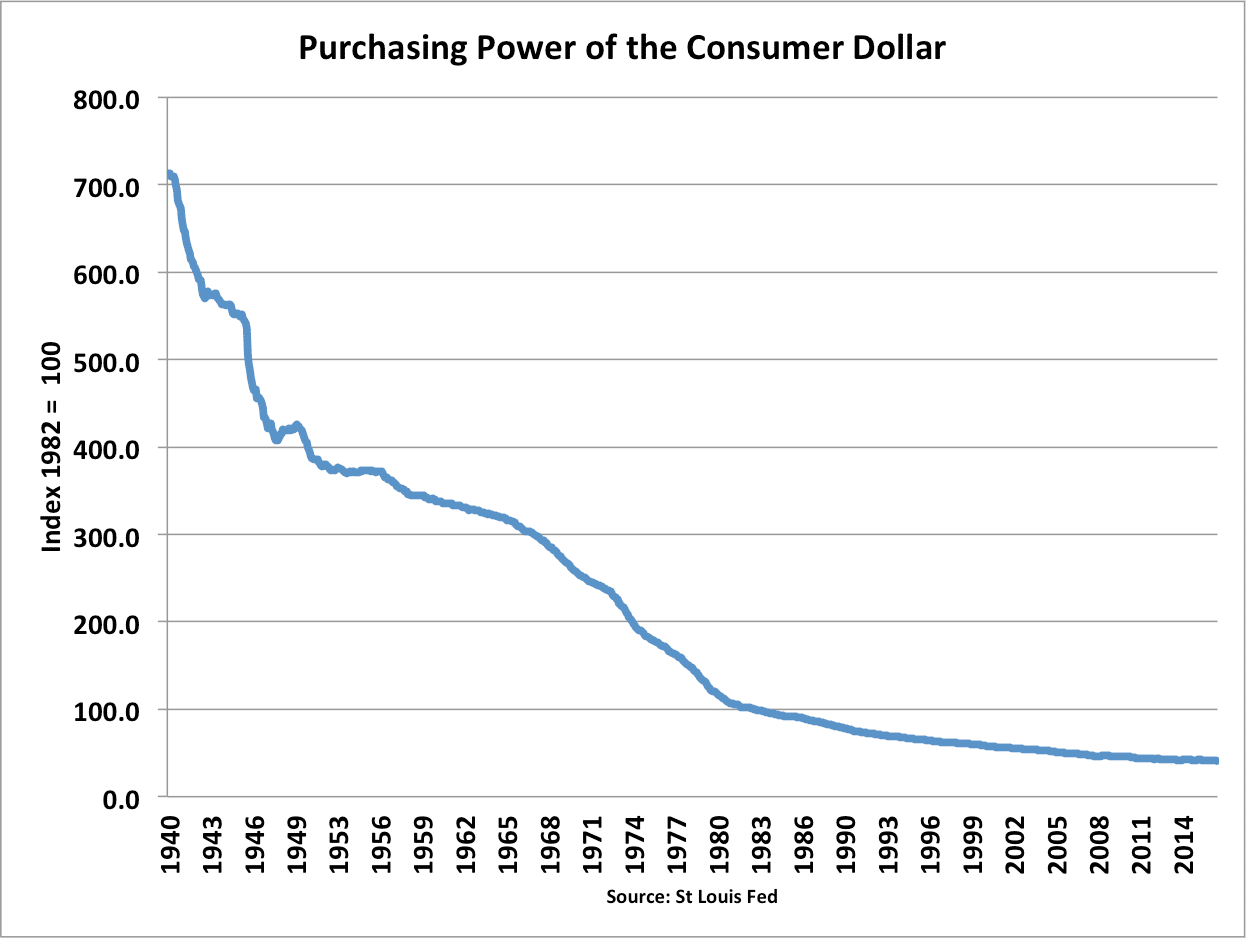

- Reduce the value of savings. Inflation leads to a fall in the value of money. This makes savers worse off – if inflation is higher than interest rates. High inflation can lead to a redistribution of income in society. Often it is pensioners who lose out most from inflation. This is particularly a problem if inflation is high and interest rates low.

- Menu costs – the cost of changing prices lists becomes more frequent during high inflation. Not so significant with modern technology.

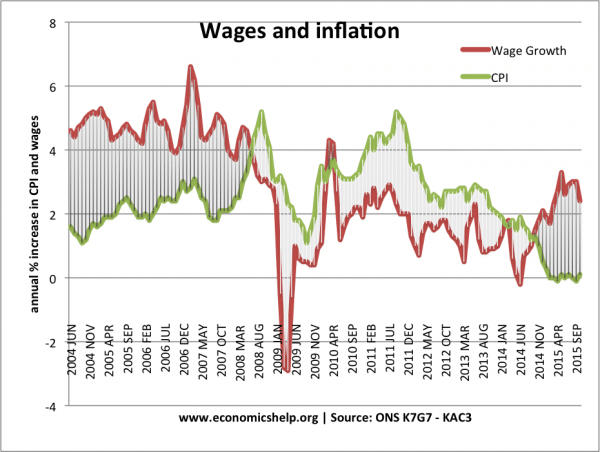

- Fall in real wages. In some circumstances, high inflation can lead to a fall in real wages. If inflation is higher than nominal wages, then real incomes fall. This was a problem in the great recession of 2008-16, with prices rising faster than incomes.

Inflation (CPI) above wage growth 2008-14, caused a decline in living standards – especially for workers in low-wage, zero-hour contract jobs.

Related

For me, an inflation higher than 2% is a disaster to class D family or the family that belongs to a poor family.

how to control inflation

Does consumer choice on imported goods affects its inflation?

Inflation can highly influence the import and export level of a country. Higher inflation rate may raise the chances of having an increased level of imports as it makes domestic people more competitive to buy imported products and services. … It will lead to a high level of import trade.

a very summative piece of work which is very useful in research

One would imagine that rising prices generally encourage production. Isnt this good for investment and therefore for economic growth?

A certain country in Africa recently increased the salaries of its secondary school science teachers by over 400%. What are some of the pros and cons of such a macroeconomic intervention?

Nice info on the advantages and disadvantages of inflation

I can’t believe this was a labour decision. I always thought that labour were a common man party, but CPI only hurts those on lower income.

thanks for that labour