Readers Question: What is the relationship between inflation & economic growth?

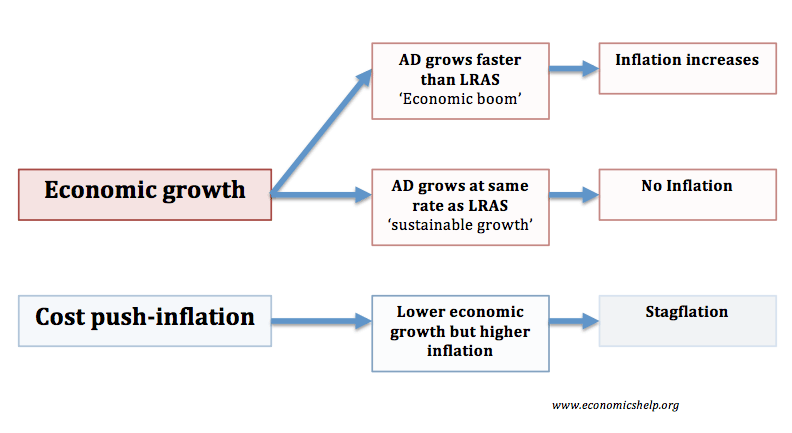

- If economic growth is caused by aggregate demand (AD) increasing faster than productive capacity (LRAS) – if economic growth is above the ‘long-run trend rate‘ then economic growth is likely to cause inflation.

- If economic growth is caused by increased productivity (LRAS), then the growth can be sustainable and not cause inflation.

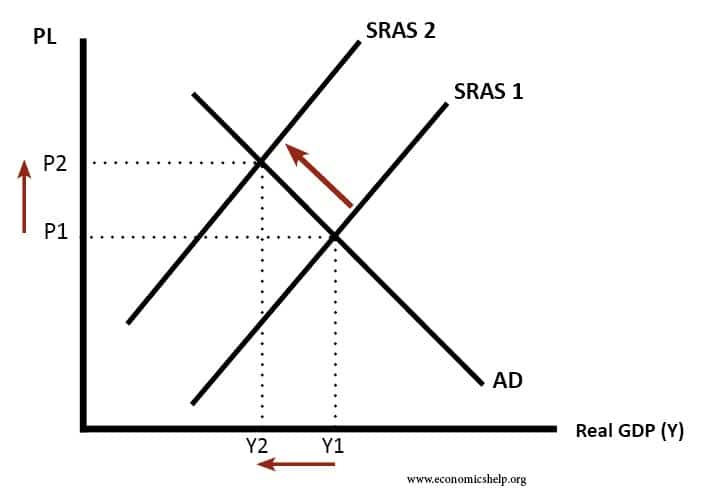

- With cost-push inflation, it is possible to get both negative economic growth and inflation at the same time (Stagflation).

Why can economic growth lead to inflation?

- If demand rises faster than firms can increase supply, firms will respond to the excess demand and supply constraints by putting up prices.

- In a period of rapid growth, firms will employ more workers and unemployment will fall. As unemployment falls, firms may find it harder to fill job vacancies; this shortage of labour will cause wages to rise.

- If wages rise, firms costs increase and therefore firms pass these cost increases on to consumers.

- Also, with rising wages, workers have more disposable income to spend – causing a further rise in aggregate demand (AD)

- With higher economic growth, people may start to expect inflation – and this expectation of rising prices can become self-fulfilling.

- Therefore, rapid economic growth tends to cause upward pressure on prices and wages – leading to a higher inflation rate.

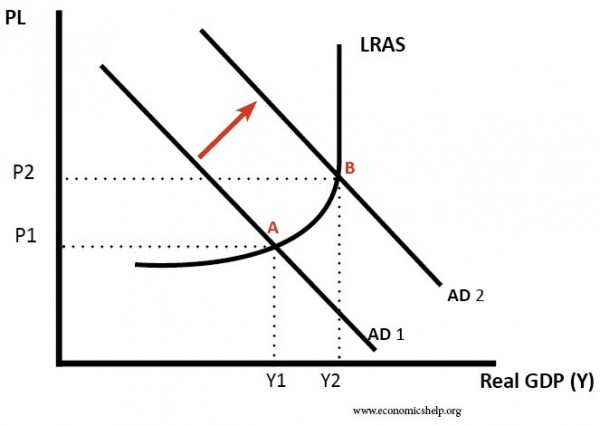

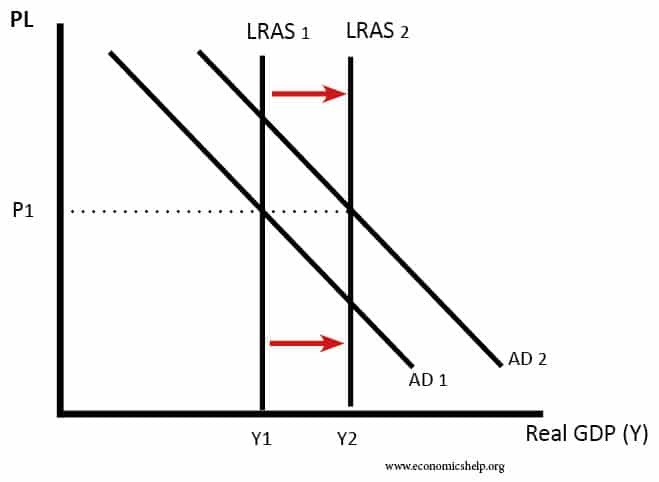

Diagram of Demand Pull Inflation

- Basically, If economic growth is above the long run trend rate (average sustainable rate of growth over a period of time) then inflation is likely to occur.

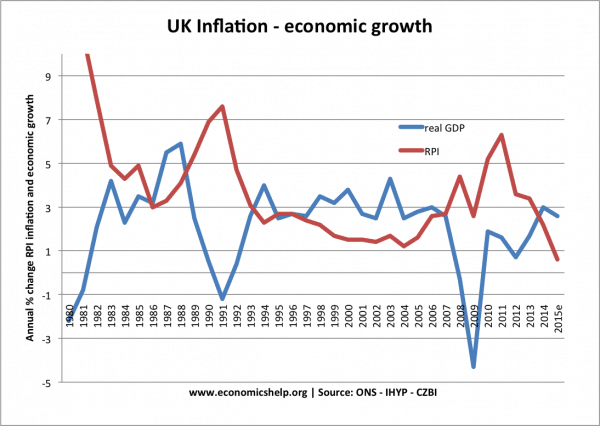

Lawson Boom – late 1980s

An example of high growth causing inflation was the Lawson boom of the 1980s. In this period, economic growth reached an annualised rate of up to 5%. This was much higher than the UK’s long-run trend rate of growth (of around 2.5%) and this rapid growth caused inflation to increase to 11% for some months.

High economic growth in the late 1980s – led to high inflation. The recession of 1991, brought inflation down.

Economic growth and low inflation

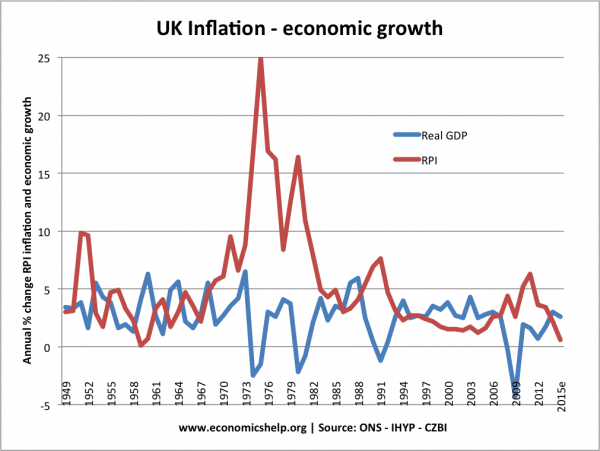

It is possible that we can have economic growth without causing inflation. If growth is caused by increased productivity and investment, then the productive capacity of the economy can increase at the same rate as aggregate demand (AD). This enables economic growth without inflation. For example, between 1993 and 2007, the UK experienced low inflationary growth. This is partly due to economic growth being sustainable i.e. close to the 2.5% average; it was also due to productivity improvements such as privatisation and more flexible labour markets.

Diagram showing low inflationary growth

Increase in both LRAS and AD enables growth without inflation.

Low inflation causes long-term economic growth

It is also argued that low inflation can contribute to a higher rate of economic growth in the long term. This is because low inflation helps promote stability, confidence, security and therefore encourages investment. This investment helps promote long-term economic growth. If an economy has periods of high and volatile inflation rates, then rates of economic growth tend to be lower.

The cost-push inflation of 1973 (rising oil prices) led to recession because the higher prices lead to declining disposable income.

High Inflation and Low Growth

It is possible that an economy can experience low growth and high inflation (e.g. in 2009, 2011, 2017)

This can occur if there is cost-push inflation. Cost-push inflation could be caused by rising oil prices. It increases costs for firms and reduces disposable income. Therefore, there is lower growth, whilst high inflation. This is sometimes known as stagflation.

In 2011, the UK is experienced a fall in the rate of economic growth and relatively high inflation.

The inflation was caused by

- Rising food prices/oil prices

- Devaluation of the pound – causing rising import prices.

- Rising taxes

Therefore, despite low growth, inflation was high.

Conclusion

There can be a conflict between economic growth and inflation. In periods of rapid economic growth, inflation is likely to rise. However, it is possible to have both low inflation and positive economic growth – so long as the growth is sustainable and productive capacity increases at a similar rate to AD.

Related

what are conflictin relationships between inflation and employment