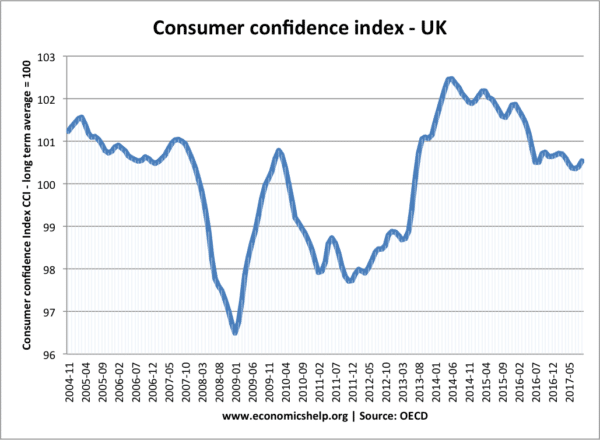

Consumer confidence is the outlook that consumers have towards the economy and their own personal financial situation. This outlook can be optimistic (high consumer confidence) or pessimistic (low consumer confidence)

The level of consumer confidence will be an important factor that determines the willingness of consumers to spend, borrow and save. A high level of consumer confidence will encourage a higher marginal propensity to consume. A fall in levels of consumer confidence is often an indicator of an economic downturn.

This measure uses 100 as the long-term average for confidence. Therefore, a stat above 100 indicates consumer confidence is higher than average. A value below 100 indicates below average confidence.

Consumer confidence often mirrors the state of the economy

Factors that affect consumer confidence

- House prices – Housing is the largest form of household wealth Falling prices reduce wealth and confidence. Rising house prices enable households to ‘re-mortgage’ and gain equity withdrawal.

- Economic news – Depressing statistics about the global and national economy will reduce confidence and encourage saving rather than spending.

- Uncertainty – a major political/economic change can lead to uncertainty which reduces confidence. For example, major terrorist attack, uncertainty over Brexit deal.

- Unemployment – The fear of rising unemployment will discourage consumers.

- Inflation and real wages. High inflation will reduce confidence. Stagnant and falling real wages will make people pessimistic.

- Personal debt levels. Rising debt levels will be a source of concern – especially if interest rates rise or the economy slows down.

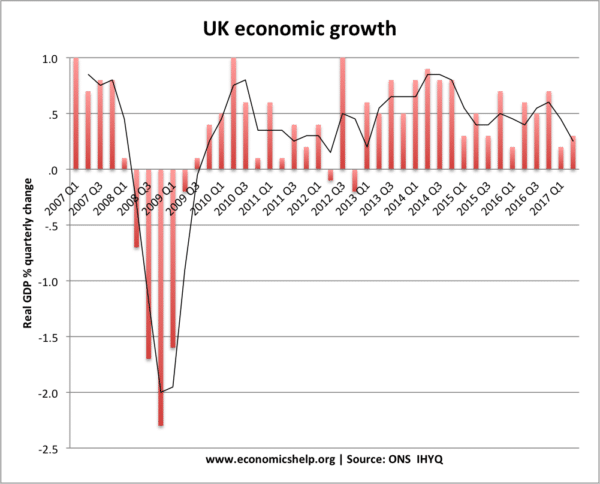

- Economic growth – A recession will invariably be associated with a fall in consumer confidence; positive economic growth tends to improve consumer confidence.

- Current economic situation. Expectations are largely based on the current economic situation and reported the news. News of job losses and falling house prices are amongst the key factors which influence consumer confidence.

Outlook for future UK consumer confidence

If I were a betting man, I would expect consumer confidence to deteriorate over the next 18 months.

- Squeeze in real wages is reducing spending power.

- Growing personal debt levels will make consumers vulnerable to higher interest rates or economic slowdown.

- Prospect of Brexit related uncertainty.

- Fall in unemployment but growing uncertainty of new jobs in the flexible labour market.

Measuring consumer confidence

Consumer confidence is based on qualitative surveys, where people carrying out research ask a sample of the population questions, such as:

- Do you feel confident about the general economic situation for next year?

- Do you feel confident about your personal economic situation for next year?

- Expectations regarding employment conditions six months hence

- Expectations regarding their total family income six months hence

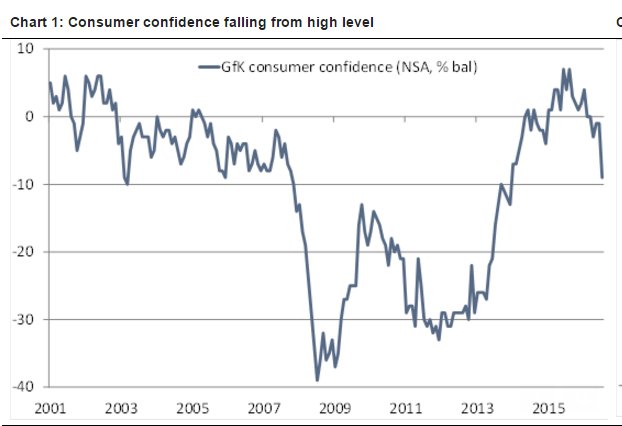

- Confidence indexes are often measured in terms of +/-. With a + of 10 meaning, there are a greater number of people optimistic than pessimistic about the future.

Importance of consumer confidence

- Consumer spending is a major component of aggregate demand (60%) and economic growth. If confidence falls, this will tend to cause lower spending and reduce the rate of economic growth.

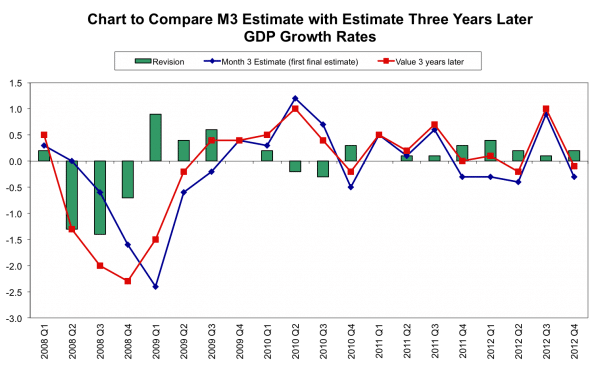

- Consumer confidence is a leading indicator. This means consumer confidence can give a good indication of future economic downturns. For example, in 2008, real GDP stats took time before they indicated the economic situation, but the fall in confidence was a very good predictor of the sharp recession. See: How do we know we are in a recession?

- Confidence can become self-fulfilling. If confidence falls because of uncertainty, this can have a significant impact on other economic variables and become self-fulfilling, i.e. if confidence and spending falls, firms will react by delaying investment too.

- Consumer confidence can influence the effectiveness of economic policy. Suppose the Bank of England cut interest rates from 5% to 0.5% – in theory, this gives consumers more disposable income to spend. However, if consumer confidence is very low, they are much more likely to save this extra income. Therefore, the interest rate cut may be ineffective in boosting spending. This is what happened in 2009. On the other hand, if consumer confidence is very high, consumer spending is likely to rise despite higher rates.

- In theory, it is possible for consumers to ‘talk themselves into a recession‘. If people expect a recession, confidence drops, spending drops, creating a negative multiplier effect of lower growth and higher unemployment. This, in turn, causes more falls in consumer spending. Though in reality, consumers don’t expect a recession without some good reason. Recessions have more causes than an unexplained fall in confidence. However, the drop in confidence strengthens the underlying negative factors.

Evaluation of consumer confidence

- Consumer confidence is only a survey and people may become pessimistic for reasons not related to a change in economic fundamentals.

- Sometimes confidence can be influenced by non-economic factors and prove temporary, e.g. a major sporting success may improve confidence, but this could be very short lived.

- Falls in confidence may not be as important as the changing factors behind them. In 2008, we saw a sharp fall in confidence because of the financial crisis. But, some may argue it was this financial crisis and decline in bank lending which was a more important factor in causing the recession. In other words, falling confidence is a symptom rather than the cause of the recession.

- A fall in consumer confidence can lead to a rise in savings. When confidence returns, consumers may spend these savings on items they have delayed buying.

- Delayed investment. Similarly, a decline in confidence may cause firms to hold back on investment. But, in the future, this could lead to a mini-boom in investment as all the delayed investment comes back into the economy.

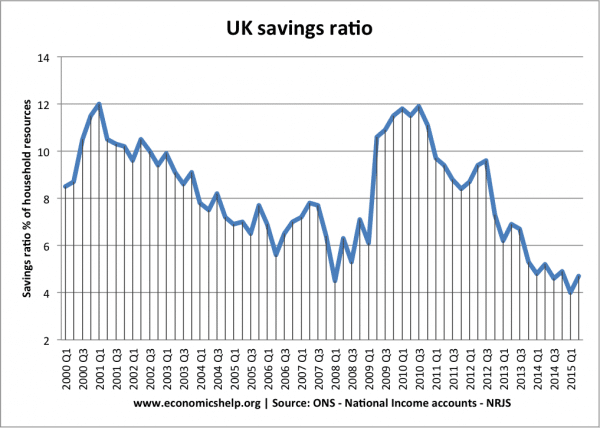

Consumer confidence and saving rates

There is an inverse relationship between saving rates and consumer confidence. When confidence falls the immediate reaction is for households to increase savings and reduce borrowing. This makes sense if you fear unemployment, it is not the time to engage in a borrowing spree.

The sharp fall in consumer confidence of 2008/09, led to a sharp rise in savings ratio.

US Consumer confidence

Unsurprisingly after the 2008 credit crunch, consumer confidence plunged in the US. The US had a stronger recovery than the UK and consumer confidence recovered more quickly.

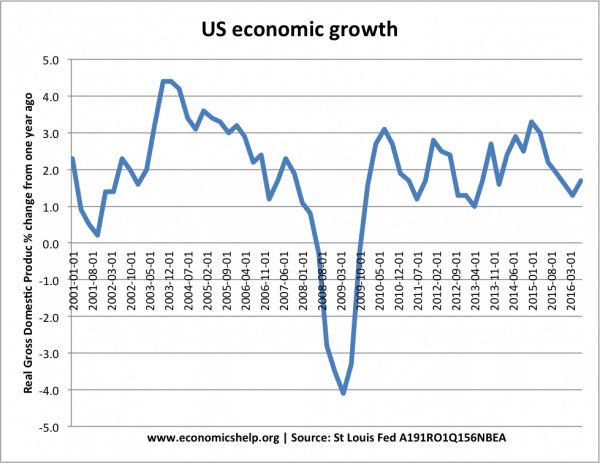

US economic growth

Related