This week I wrote a post about escape velocity – the idea an economy stuck in recession needs a decisive burst to escape a liquidity trap, low spending and low confidence. If an economy can return to this normal trend rate of economic growth, we can end the period of ultra low interest rates and engage in fiscal consolidation without harming economic growth. Unfortunately, when you’re in a liquidity trap to achieve this escape velocity requires a certain decisiveness, political courage plus understanding of basic macroeconomic theory.

Unsurprisingly, this year’s budget gives not so much a decisive burst, as more an attempt to use a few plastic bands to try and patch up a leaking ship.

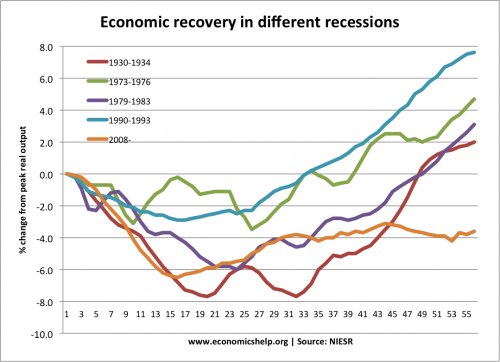

In the past five years, the UK economy has shrunk 3% – making the recession longer lasting than even the 1930s. The past three years have seen stagnant economic growth, with no sign of falling unemployment or rising living standards. What the past three years have shown is that in a liquidity trap (interest rates or 0%) tight fiscal policy is contractionary – no matter how much you try to engage in unconventional monetary policy. The chancellor is still hoping that the Bank of England can work miracles, whilst he reduces government spending. The evidence of the past three years is not encouraging.

Yet, despite clear evidence of the damage done by premature fiscal tightening, the chancellor ploughs on with his plan A – seeming to spend most of his time blaming what a mess we are in. In Europe, EU policy makers have, in the past, attempted to appeal to the confidence fairies. The idea that cutting the budget deficit will restore confidence in the economy and lead to a miraculous economic recovery. The current government also tried to go along with this. The only problem is that it miserably back-fired – with confidence slumping after the 2010 election. The confidence trick of austerity has become one of the great jokes of the past few years – except it’s a joke without much humour.

The current coalition is proving strangely reminiscent of the vision-less 1931 national coalition. Another coalition which exacerbated the great depression through a misplaced obsession with trying to reduce the deficit. The tragedy of history is that we keep repeating it.

The greatest tragedy of the UK economy is not the growing national debt, but the economic stagnation and mass unemployment. There are 2.52 million unemployed – and it’s no comfort that unemployment rates in Europe are even higher – it’s 2.52 million unemployed who have little optimism from an economy that is stuck in a deflationary spiral.

In 2010, when Osborne enthusiastically embraced a vision of austerity for the UK, he forecast a budget deficit of this year of £60bn. Instead, we will have a deficit of £120bn. Basically, austerity has proved self-defeating in reducing the deficit. We’ve had the worst of all world – pain and no gain. No deficit reduction, no economic recovery – just lower expectations and lower living standards.

The problem is that austerity always has a certain political appeal. It’s easy to post graphs of rising public debt – Panic! It’s harder to place graphs of rising public debt next to rising private sector savings and explain the government needs to offset the swing in private sector spending.

The UK is not the only economy to be entering a double dip recession. It is true that the whole European economy is struggling. Though to place all the blame on Europe – conveniently ignores the fact exports to Europe have risen in the past three years. A bigger problem is the desperate state of the finance sector, with banks hoarding cash and being unwilling to lend. But, when the government is so overwhelmingly negative and depressive about the state of the economy, it’s not really a surprise banks have some reluctance to lend.